The state of B2B monetization in 2025

Introducing new data from 240 software and AI companies

The appetite for new, disruptive pricing models is higher than ever before. Software companies are realizing they can't solely rely on flat-rate or seat-based subscriptions in an age of AI, automation and APIs where value is disconnected with how many people are logging in.

But interest in disruptive pricing models doesn't always translate into adoption. And interest doesn't mean folks will accept new ways of buying. That left me wondering: what’s really going on with software monetization?

With your help, I've spent the past three months investigating the latest in SaaS and AI monetization. And I've collected data from more than 240 software companies. This wouldn’t be possible without the help of Growth Unhinged readers — THANK YOU!

Premium subscribers can read the full 35 page State of B2B Monetization report. In today’s newsletter, I’ll unpack the six biggest takeaways that stood out to me:

Seats and flat-rate pricing are increasingly under threat.

As AI continues to gain traction, hybrid has become the ‘it’ pricing model.

There are a seemingly infinite number of ways to structure hybrid pricing. Choose wisely (or support multiple models).

Outcome-based pricing is seen as the 'holy grail'. It’s still out of reach for 95% of the market.

The shift toward pricing transparency seemed inevitable. This isn’t playing out.

Pricing models keep evolving. Most of the market is unprepared to keep up.

Who participated in the survey

Before we dive into the data, I wanted to share more information about who participated in the research. The State of B2B Monetization survey was run from April to May 2025. A typical respondent was between $1-20M ARR, headquartered in the US and selling a product that’s a hybrid of SaaS and AI.

There was a fairly healthy mix of survey participants by company size, geography and product types.

Annual recurring revenue (ARR): 26% were <$1M ARR, 22% were $1-5M ARR, 15% were $5-20M ARR and the remaining 37% were above $20M ARR.

Geography: 57% were based in the US. 24% were in Europe or Israel. The remainder were in the UK (5%) or elsewhere (14%).

Product type: 50% described their product as mostly SaaS. 14% said they’re AI-native. The remaining 36% were a hybrid of SaaS and AI.

Takeaway 1: Seats and flat-rate pricing are increasingly under threat.

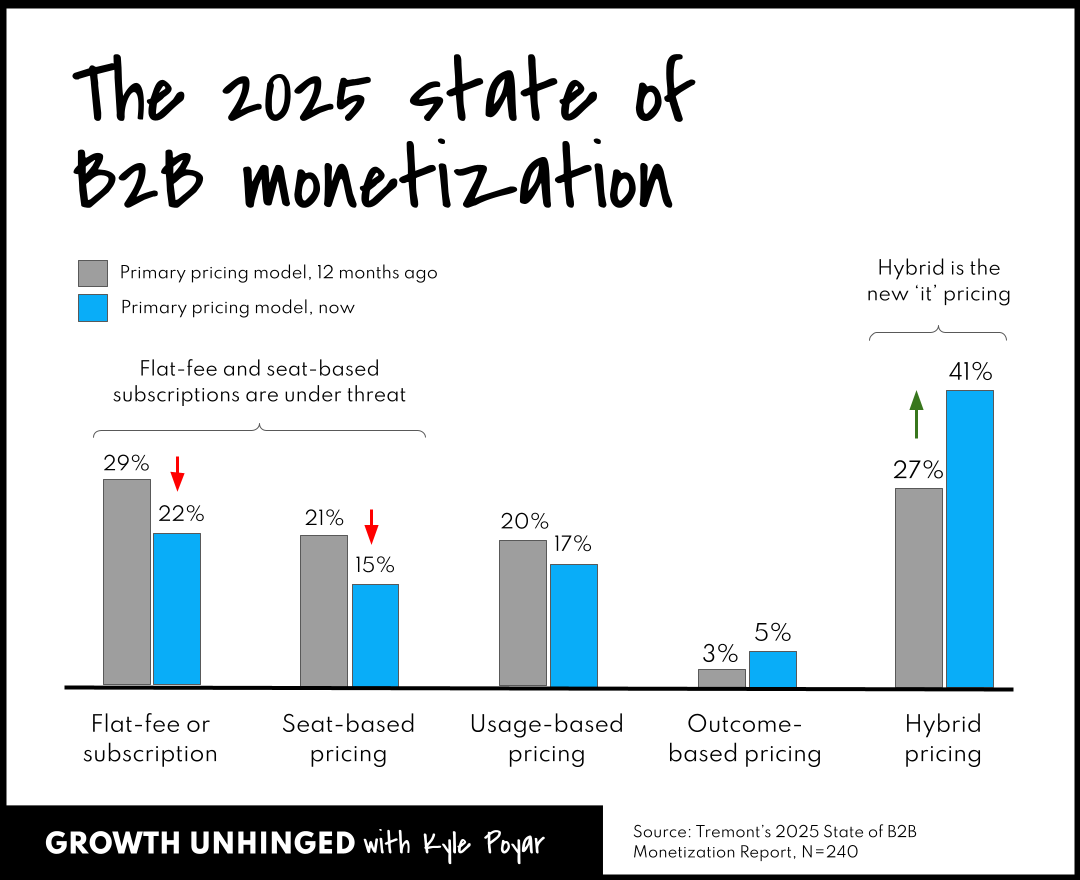

As recently as 12 months ago, software pricing was mostly seat-based pricing and flat-rate subscriptions. These models offered pricing predictability and the promise of durable recurring revenue (ARR). And they’re increasingly under threat, particularly for AI-native products, due to value misalignment and cost pressure.

Flat-fee and seat-based pricing are being replaced by hybrid pricing, i.e. combinations of subscriptions and usage (more on that later).

Flat-fee subscriptions are down from 29% to 22% over the past 12 months.

Seat-based pricing is down from 21% to 15%.

Hybrid pricing is up from 27% to 41%.

What’s happening is that software and AI are becoming inseparable. More than half of survey respondents (53%) said they include AI capabilities as part of their core software offering. A mere 20% said that they don’t offer any AI capabilities. Even fewer (16%) said that AI is largely sold as a standalone product or add-on.

The rise of AI, and AI agents in particular, results in value being decoupled from customers needing to buy more seats. In fact, if the AI works as intended, customers likely need fewer people and more AI.

Alphabet says that AI now generates more than 30% of their code.

Microsoft’s CTO expects 95% of all code to be AI-generated by 2030.

Cursor grew to $200M ARR with 60 people, more than $3M per employee.

Klarna says their ARR per employee soared from $575k to $1M as a result of an AI efficiency push.

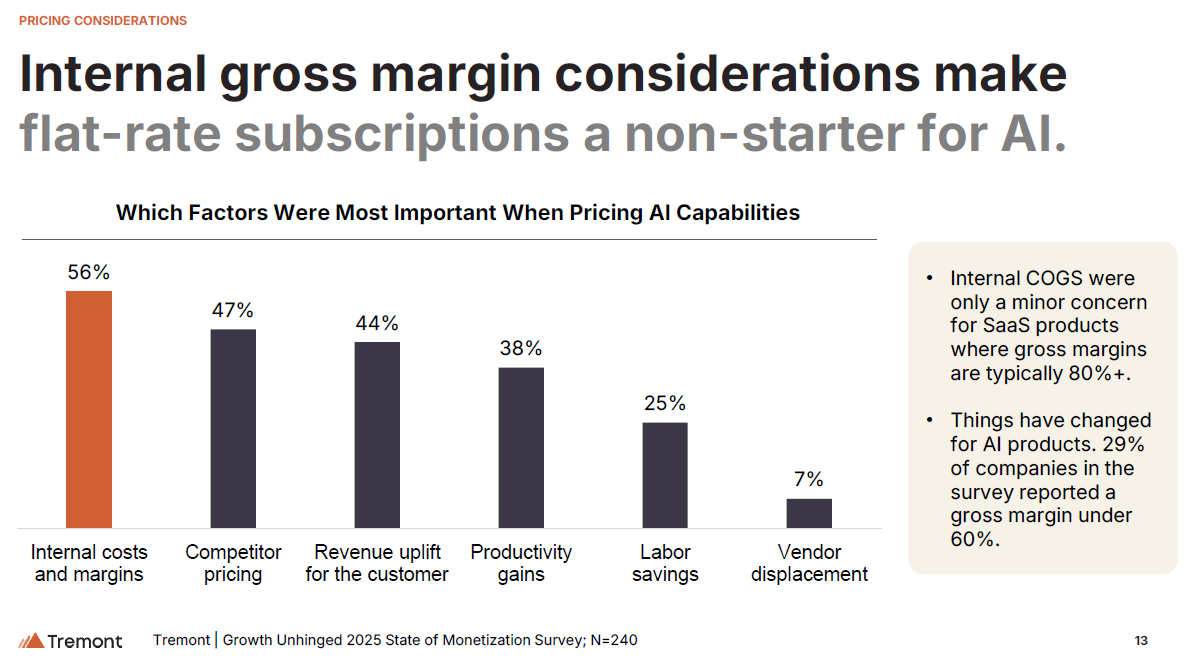

Meanwhile, the costs of delivering AI capabilities are real, and they’re becoming a key input into pricing. Survey participants cited internal costs and margins as the most important factor when pricing their AI capabilities.

Takeaway 2: As AI continues to gain traction, hybrid has become the ‘it’ pricing model.

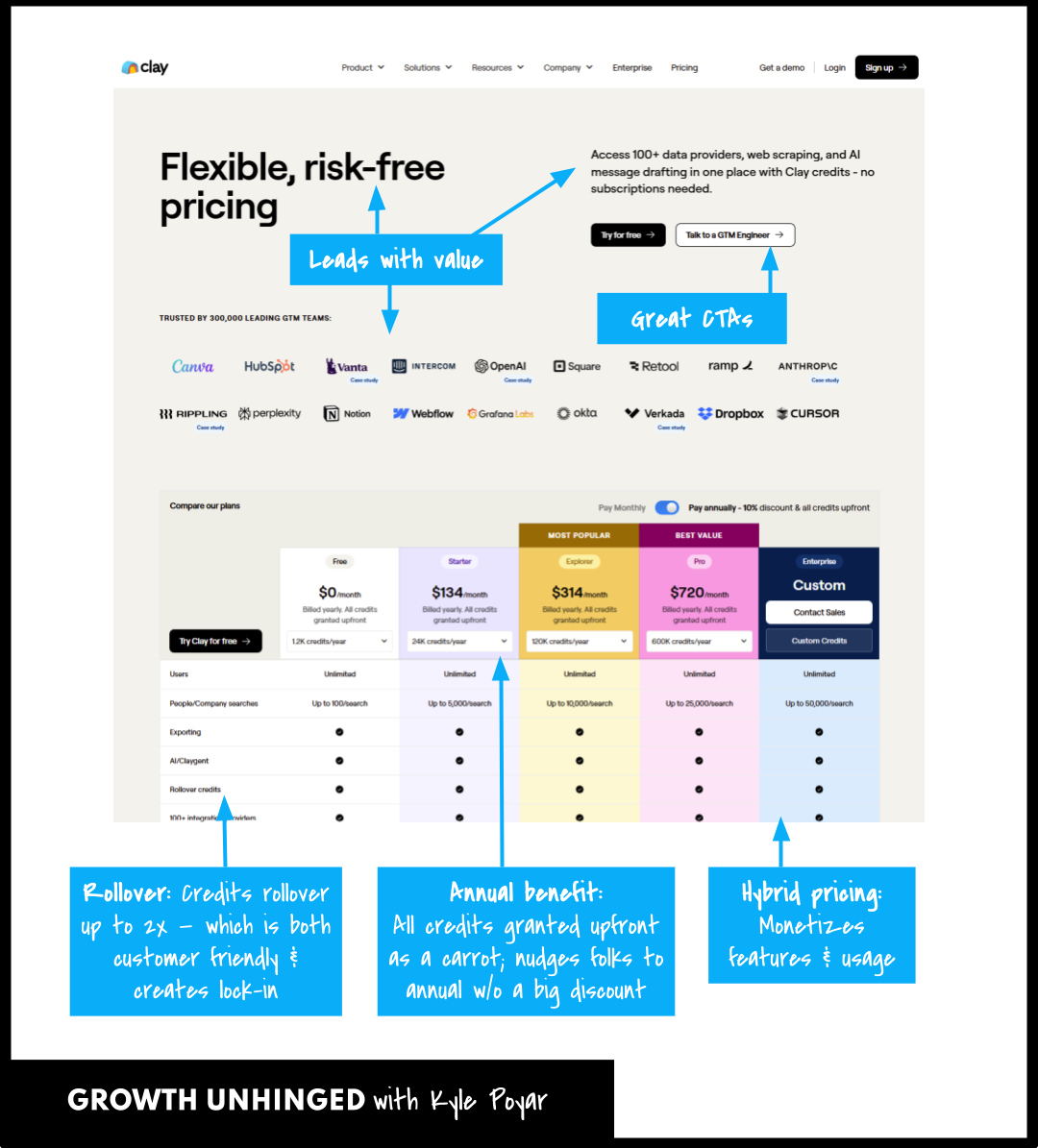

Software founders used to tell me their pricing was inspired by Salesforce or maybe Slack. Now they tell me they were inspired by Clay. (Other pricing inspirations include Intercom, HubSpot, OpenAI and, yes, still Salesforce.)

Clay's hybrid pricing model has multiple routes to expand customers while keeping pricing relatively simple: more features (subscription packages) and more usage (credits). All of Clay’s plans include unlimited seats.

Instead of offering a huge discount for an annual plan, Clay offers a small discount (10%) and lets the customer get all their credits upfront. Unused credits can be rolled over to the next month (up to 2x), which is both customer friendly and creates lock-in.

Similar hybrid models have been recently introduced by startups and large incumbents alike. I’ve been tracking monday.com (which now offers 500 AI credits per month across all paid plans), Agentforce by Salesforce (which added a flex credits model in May), Atlassian and numerous others.

Hybrid pricing is a natural evolution from seats or flat-rate subscriptions. I see four reasons why they’re becoming so popular:

Minimal disruption. Hybrid pricing doesn’t require reinventing the wheel – it can be layered into existing seat-based and subscription models.

Upsell path. It creates a natural upsell path, letting customers try new products ‘for free’ and then monetizing as usage grows.

Margins. By capping usage, companies control costs and minimize the risk of unprofitable customers.

Relatively predictable. By staying within a traditional pricing paradigm, buyers can estimate their costs and feel in control of their spend.

Takeaway 3: There are a seemingly infinite number of ways to structure hybrid pricing. Choose wisely (or support multiple models).

Keep reading with a 7-day free trial

Subscribe to Kyle Poyar’s Growth Unhinged to keep reading this post and get 7 days of free access to the full post archives.