👋 Hi, I’m Kyle and welcome to my newsletter, Growth Unhinged. Every other week I take a closer look at what drives a SaaS company’s growth. Expect deep dive takes on SaaS pricing, product-led growth, public company benchmarks, and much more.

Investors look closely at retention rates as a signal of customer health, product stickiness, competitive differentiation and pricing power. Happy customers are the best long-term store of value at your disposal. They drive word-of-mouth adoption, demonstrate credibility with prospects in the sales cycle, and fuel continued innovation.

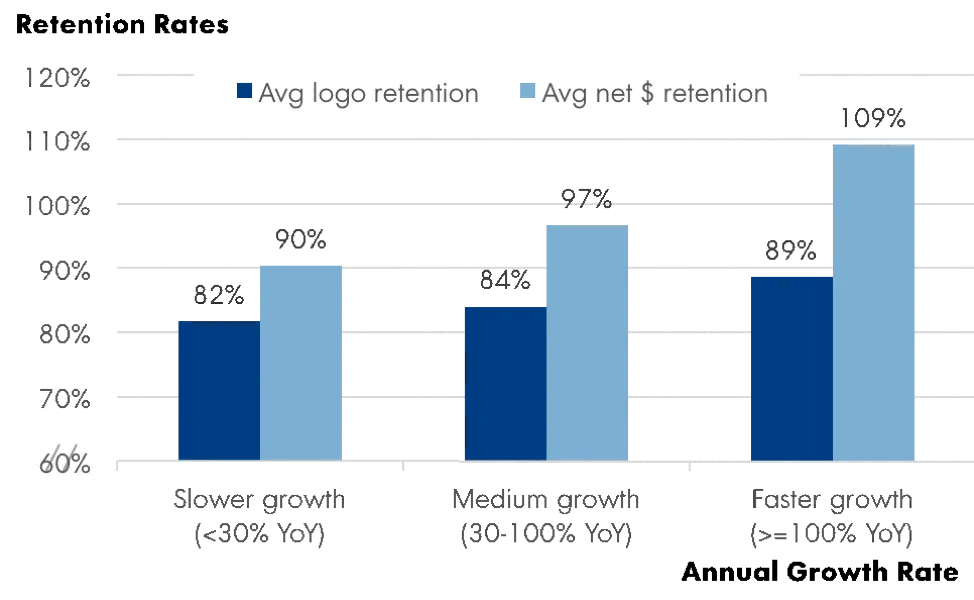

Retention rates—particularly net dollar retention—also strongly predict a SaaS company’s growth rate. The fastest growing SaaS companies see 89% annual logo retention and 109% net dollar retention (NDR) in their cohorts, according to data from OpenView’s SaaS benchmarking survey. That’s compared to 82% and 90%, respectively, among slower growing companies.

Somehow NPS has become synonymous with retention. These days it’s difficult to find a SaaS company that isn’t tracking their NPS on an ongoing basis (or boasting about their impressive NPS relative to peers). NPS is even a Board-level discussion point at many companies.

It’s time to take a step back and ask: Is NPS really the best we can do?

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library