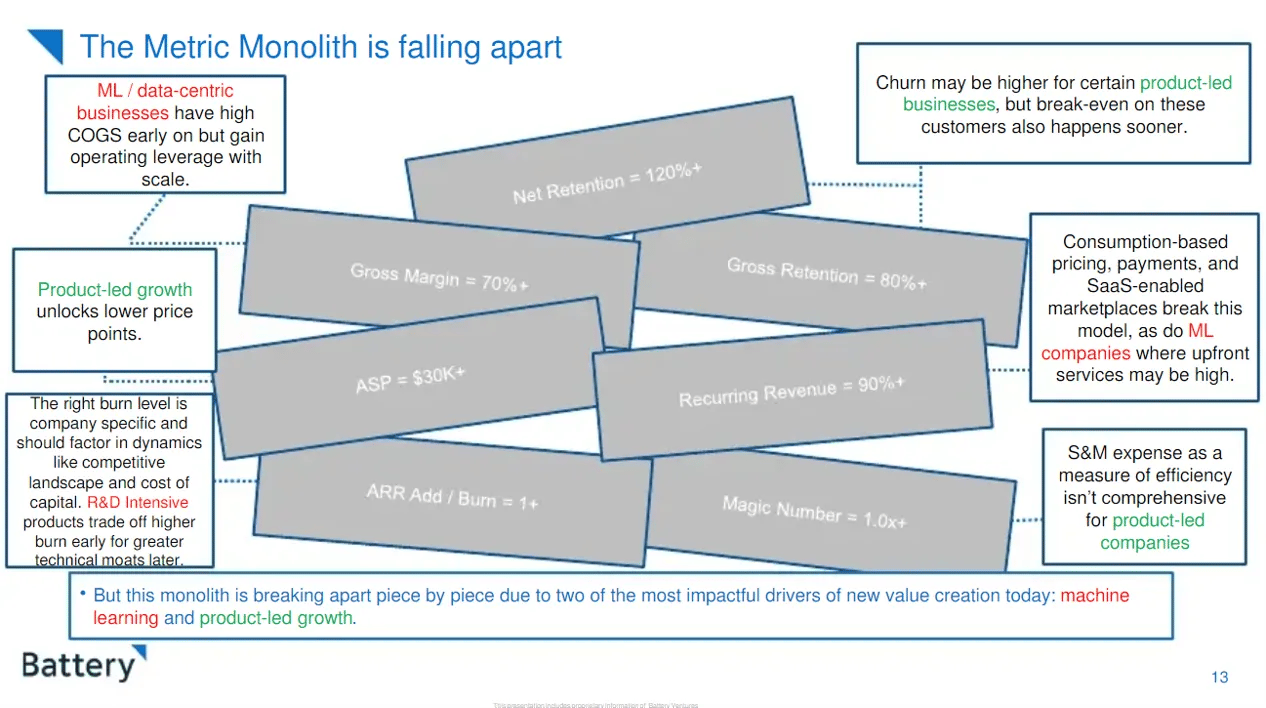

We’ve grown accustomed to the traditional set of SaaS metrics as just part of how to operate a SaaS business. It’s hard to conceive of what to do without metrics like CAC payback, LTV:CAC, average ACV, or the magic number.

Here’s the thing: the traditional SaaS metrics playbook can be extremely misleading when it comes to managing a PLG or consumption-based SaaS company. (Battery has a helpful visual of this in their latest Software 2021 report.)

Let’s look at a few examples, shall we?

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library