What I learned from tracking 443 SaaS pricing pages

The state of SaaS pricing changes in 2024

👋 Hi, it’s Kyle Poyar and welcome to Growth Unhinged, my weekly newsletter exploring the hidden playbooks behind the fastest-growing startups.

One of the most-read pieces this year was my state of SaaS pricing analysis, which asked the question: is usage-based pricing still the future of SaaS? I wanted to get even more tactical and investigate the state of SaaS pricing changes so far in 2024. Keep reading for a deep dive by John Kotowski and Rob Litterst of PricingSaaS, the pricing intelligence platform. (Spoiler: price increases were the most common change with an average price increase of 20%.)

You’ve heard it a thousand times—pricing is the ultimate growth lever for any SaaS company. And that makes the pricing page one of the most valuable pages on your website.

It’s where product meets strategy. Your pricing page isn’t just about numbers—it’s where you showcase your unique blend of your product, positioning, and pricing. It’s the heartbeat of your business, giving any visitor a snapshot of what you're aiming for and how you’re doing it.

At PricingSaaS, we monitor over 3,000 SaaS pricing pages to spot trends, uncover shifts, and highlight stand-out examples. From subtle tweaks to full-scale overhauls, the pricing page gives us a window into the strategy behind the numbers.

And 2024 hasn’t disappointed.

In just the first three quarters, 42% of companies in our index have adjusted their prices. We’re diving into the good, the bad, and the downright ugly of this year’s pricing shifts, along with some of the wider trends we’re seeing across the SaaS landscape.

The Good:

Monday.com raised prices across all plans.

Monday.com delivers new features at a rapid pace, constantly adding value to its product. This consistent improvement has given them the leverage to raise prices with confidence. When customers push back, they can point to a massive list of feature upgrades that justify the added cost.

They approached their price increase strategically—raising the price of their most popular plan, the Standard plan, by 20%, while only increasing the Basic plan by 12.5% to accommodate more price-sensitive customers and maintain a price point below $10 per seat.

Linear professionalized its pricing page.

This overhaul was overdue. While Linear’s pricing page had a sleek design, the packaging mix felt like an afterthought. With the update, they pulled the Enterprise plan into the main grid and renamed the other plans to better align with the needs of their customers.

Previously, their highest-tier plan besides Enterprise was called Plus—a name typically associated with lower-end plans. Now, visitors can quickly identify the right plan for them, and larger prospects can easily self-select Enterprise and start a conversation with Sales.

Jira adjusted the default number of users on its pricing page.

You don’t always need to change prices or packaging to make an impact. Jira did this by increasing the number of default users from 10 to 300. This accomplished two things:

It made their pricing look more attractive.

It appealed to larger customers.

In Atlassian’s latest earnings call, they emphasized that building momentum in the Enterprise market is a top priority, and cross-selling Jira plays a crucial role in driving Enterprise adoption.

The Bad:

IFTTT raised the price of one plan by 150%.

We’re all for price increases, but this one is aggressive—even for their highest-tier plan. Pro+ customers are now paying more than double what they were previously, while the Pro plan only saw a 16.8% increase.

The Pro+ plan offers a flat rate with unlimited usage. IFTTT could have taken a different approach – either adjusting usage limits or adopting a hybrid pricing model that factors in both usage and features.

While simplicity might have been the goal, a more balanced model could have appealed to moderate users while still capturing the upside from power users—without such a drastic price hike.

ProductPlan took its pricing page private.

ProductPlan made a big shift toward the Enterprise market, which included removing public pricing. On the surface, that’s fine.

But there’s a better way to present this to prospects. Currently, the page features awkward hero text about their "best-in-class Enterprise offering," followed by a CTA promoting a “straightforward solution”—yet the content that follows is anything but clear.

The page is cluttered with 15 Enterprise capabilities, 10 service offerings and 3 Enterprise integrations. The result is a confusing wall of text that’s hard to navigate and doesn’t highlight the most common ways ProductPlan helps its customers.

The Ugly:

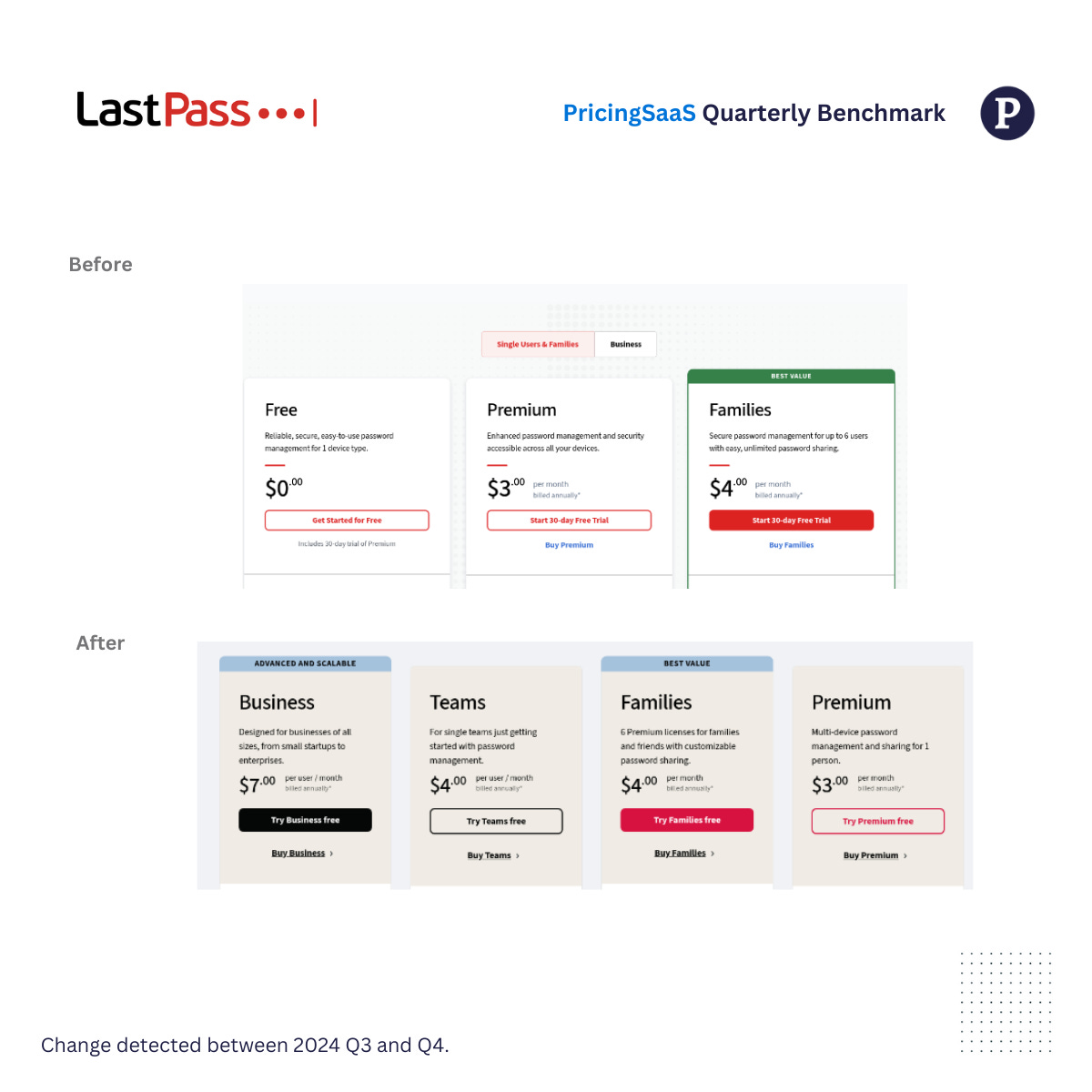

LastPass might have the most confusing pricing page flow of all time.

Let’s be honest—we’re not here to embarrass anyone, but this pricing page is a mess. A few issues stand out:

The plans are listed backwards, with the largest plan first. It’s confusing and feels gimmicky. I don’t care what behavioral psychology says—it’s harder to read, and no one likes it.

The page now mixes plans for Families and Businesses, which were previously separated by a toggle. The toggle was much clearer.

There are multiple banners on each plan: one for “Best Value” and another for “Advanced and Scalable.” Are we just handing out banners for anything now?

I am a happy LastPass customer, but this pricing page needs to be better.

These examples show how companies are getting creative with pricing—but they’re just the tip of the iceberg. Let’s zoom out to the key benchmarks and trends shaping SaaS pricing in 2024.

Wider Trends

A total of 188 companies (42.4% of the index) updated their prices in the first three quarters of 2024. These updates include adjustments to existing price points, the introduction of new plans at different price levels, and the removal of existing plans.

Out of the 188 companies, 42 updated their pricing two or more times per quarter over the last three quarters, showing a substantial number of SaaS companies are embracing an iterative pricing strategy.

Price Increases

A total of 64 price increases were recorded, though the scale of these increases varied greatly. Some companies made modest adjustments, while others implemented significant hikes. Excluding outliers, the average price increase settles at around 20%.

Some of the notable ways companies are raising prices include:

Monthly-only increases: Companies like Similarweb opted to increase prices solely for monthly plans, making annual plans more attractive by amplifying the savings for longer commitments.

Selected plan increases: Instead of applying price hikes across all plans, some companies, such as Hiver, chose to raise prices for specific plans. This targeted approach allows companies to optimize revenue from high-value plans without impacting all customer segments.

Price Decreases

We recorded a total of 38 price decreases. Companies utilized price decreases to drive acquisition for existing products or to increase adoption of a new product.

Existing Product: Couchbase reduced its "Starting from" price, lowering the cost of potential customers to get started. This tactic was also employed by OpenAI and Cohere, likely in an effort to capture market share in a crowded market for Generative AI applications.

New Product: Oyster HR lowered the price of its Global Payroll product during its beta phase. This strategy could help attract early adopters while gathering feedback on the pricing model

Other Changes

Beyond SaaS players raising and lowering prices, we’ve seen a mix of other moves across the board, including:

Introductory discounts

A total of 17 companies (3.8% of the index) have employed introductory discounts as part of their pricing strategy. These discounts are typically offered for a limited time, usually lasting between 3 to 6 months, and are designed to attract new customers by providing them with a reduced price during the initial period of their subscription. Take Slack for example:

Plan Updates

We observed 57 companies that either added or removed plans, effectively altering the pricing options available to their customers. For example, Veed consolidated from 4 plans to 3:

Hiding or showing prices publicly

We observed a total of 33 companies (7.4% of the index) that made changes to whether their prices are publicly displayed. One example is Semrush, which removed the price of its Business plan, replacing it with a Contact Us CTA.

What’s Next?

This analysis is based on data from the PricingSaaS Index, which tracks 443 companies with at least 50 employees that have publicly available pricing information on their websites. Click here to see the full list.

In Q4, we expect to see more discounts as SaaS players look to hit their annual revenue targets. We’d also hope to see more banners warning visitors of upcoming pricing changes, given the popularity of Q1 as a time to make changes. However, pricing changes vary widely depending on the company, macro environment, and seasonality – and there’s no telling exactly how the next few months will play out. We’ll be monitoring the data closely, and will report back what we’re finding. Follow along at

to stay tuned.

Great read as always Kyle. Do you have any insights into whether these companies implement these price changes for all existing customers as a method to increase revenue? Or what is best / most common practice for increasing prices for existing customers.

Thanks

excellent write up. thank you!