👋 Hi, it’s Kyle from OpenView. Welcome to another edition of Growth Unhinged, my newsletter that explores the unexpected behind the fastest-growing startups.

As SaaS companies orient themselves toward efficient growth, CAC payback period has become a guiding KPI for startups and public SaaS companies alike. But CAC payback is one of the most misunderstood SaaS metrics and can be especially misleading for PLG companies (as I unpacked previously). Keep reading for a primer on CAC payback and how to avoid common mistakes.

CAC payback period – the amount of time it takes (in months) to recoup the costs of acquiring a new customer – used to be one of those wonky SaaS metrics VCs threw around when discussing an investment. But more and more, founders and operators are getting in the weeds on CAC payback.

CAC payback is a fantastic metric mostly because it’s better than the alternatives. It’s a more sophisticated metric than CAC on its own, which ignores customer quality – whether they actually buy, spend more over time, how much they spend, and so on. And it beats LTV:CAC too since LTV can be limitless in high retention SaaS businesses.

Knowing what metric you should use is just half the battle. You also need to know what “good” looks like. For this, we can turn to our 2022 SaaS Benchmarks Report, which collected data from 660 private SaaS companies. (Full disclosure: the self-reported benchmarks skew somewhat lower than what I usually see when working with portfolio companies; for more on why that might be, keep reading.)

Unfortunately, there’s no singular answer.

“Good” varies a ton based on who you’re selling to. Smaller companies have shorter buying cycles (lower CAC), but target customers are generally less committed to your product and may be quicker to churn (lower NDR, which will get to a bit later). The opposite is true for selling upmarket. An enterprise-focused company might see 110%+ NDR — rare for SMB SaaS — which may make spending more on customer acquisition both efficient and sensible.

In theory, if your CAC payback period is healthy, it should be easier to attract capital since you can quickly turn $ into $$$. And investors like that!

All this is good news for sure, but it’s not all roses. Because, despite your best efforts, you might still be getting CAC payback period wrong. Here’s what to avoid.

📊 Believing in a single gold standard for CAC payback.

“Good” CAC payback is highly business dependent. To know what that looks like, you need to closely tie CAC payback period to net dollar retention (NDR), for example:

Below 100% NDR: Look for a CAC payback <12 months

100-120% NDR: Look for a CAC payback of 12-18 months

150%+ NDR: You might be comfortable with a longer CAC payback depending on cash reserves and product stickiness

Low CAC payback + high NDR = efficient growth.

Tying the two metrics together can insulate companies from external volatility to a large extent.

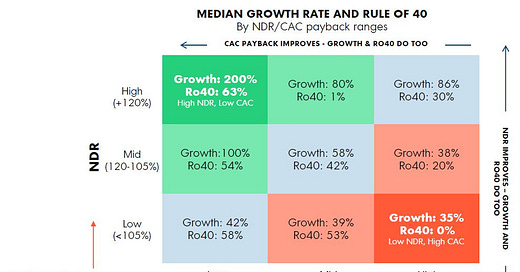

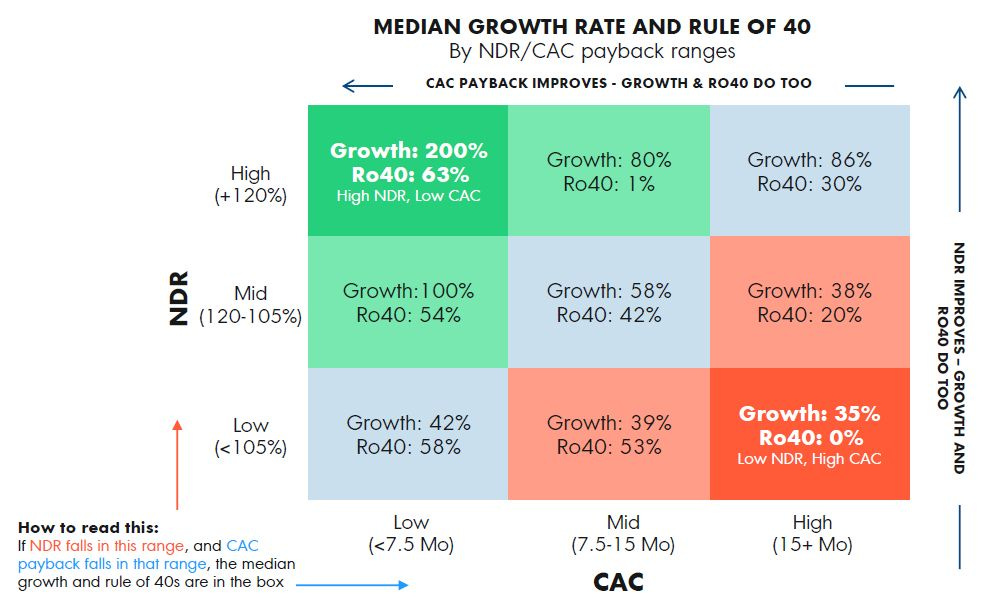

Data from the same SaaS Benchmarks Report shows that CAC payback and NDR are the underlying factors driving the two most popular metrics used to assign value to companies: growth rate and the Rule of 40.

When we put CAC payback and NDR together, the durability of companies in this low CAC/high NDR bucket jumps off the page:

Companies with great NDR and CAC payback have phenomenal growth rates (200% median) AND follow the Rule of 40 (63% median).

Companies that struggle on NDR and CAC payback have comparably poor growth rates (35%) and Rules of 40 (0%).

Companies that are average on both dimensions tend to have similarly middle of the pack growth (58%) and Rules of 40 (42%).

Intuitively, this makes sense. Companies that can acquire customers at a low cost relative to their peers will be able to grow at a lower cost and faster rate. These same companies that retain and expand the customers they acquire better than peers have an additional efficient growth model. When you put those two together, you’re left with the ability to fuel consistent growth regardless of market conditions.

👩💻 Believing that sales & marketing are the only costs of acquisition.

PLG companies invest in R&D as part of their customer acquisition mix (free sidecar products, freemium, growth teams, self-service purchasing, etc.). Atlassian, for instance, spends $2.43 on R&D for every $1 on sales and marketing. On the flip side, DocuSign has the inverse ratio, spending $2.15 on sales and marketing for every $1 on R&D.

But R&D investment usually isn’t factored into the CAC payback period calculation, blurring visibility into the health of the growth model.

If you’re investing in PLG, plan to stay below the “normal” CAC payback benchmarks.

💰 Underestimating your true CAC payback.

Common calculation errors include:

Looking at CAC payback on a revenue basis → adjust for gross margin

Looking at CAC payback only on a cash basis → even if you collect cash upfront, you need to amortize that cash over the customer’s tenure (cash payback or cash conversion is a different, but also important, metric)

Ignoring areas of spend → customer acquisition costs include more than just program spend and sales comp

The TL;DR: Long live CAC payback.

But make these three changes so it doesn’t mislead you 👇

Fix your calculations

Tailor the benchmarks to your specific business model (NDR profile, PLG vs non-PLG)

Surround CAC payback with other efficiency metrics, ex. ARR per FTE or burn ratio, to get a holistic sense of your business.

More CAC payback resources

CAC Payback Basics: What It Is, How to Calculate It and Why It Matters [Sean Fanning]

You Can’t Fix a CAC Payback Period [Dave Kellogg]

SaaS Metrics 2.0: The Case For Next Era Metrics Playbook [Growth Unhinged]

2022 SaaS Benchmarks Report [OpenView]

It's hard to find this level of quality insight. I appreciate what you are doing with this Newsletter Kyle.