👋 Hi, it’s Kyle from OpenView. Welcome to another 🪄 free edition 🪄 of Growth Unhinged, my newsletter that explores the unexpected behind the fastest-growing startups. Subscribe to join 27,000 readers and get access to this post (and every post).

I’ve got a special edition this week featuring 🔥 new data from the OpenView & Pendo Product Benchmarks report. Let’s nerd out, shall we?

Our team at OpenView released its first Product Benchmarks report in 2020 to help founders and product folks make better decisions. That first year we had a modest dataset of 150 products and product-led growth (PLG) wasn’t yet a widely used term, let alone a way that publicly traded SaaS giants described their strategy.

Fast forward to 2023. The interest in products as a growth driver is far greater than only a few years back. In partnership with Pendo, we’ve surveyed more than 1,000 products, allowing us to slice the data in novel ways.

You can check out the full report at this link. In today’s newsletter, I’ll unpack the five insights that stood out to me — and what to do about them.

How do you compare? Benchmarks across the PLG user journey

The hardest part of PLG might actually be… marketing?!

Forget about Threads. What’s your TikTok strategy?

Reverse trials: We’re talking about them more than we’re doing them

Activation: One of the most misunderstood metrics in SaaS

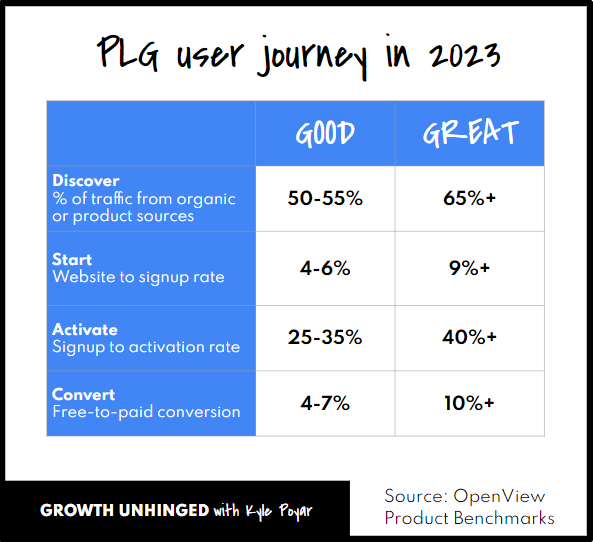

1. How do you compare? Benchmarks across the PLG user journey

As I’ve talked about before, we need a new go-to-market playbook for modern software businesses. This playbook should center around the user’s journey and treat product usage as a signal of buying intent.

With this new lens, the growth model isn’t rate-limited by SDR productivity or MQL volume. It’s defined by how many people discover the product, start using it, experience value (activate), and then decide to pay (convert).

Here’s what to expect in 2023 👇

Use this as a map to identify the biggest roadblocks holding back your growth. Keep in mind that marketing might be the most important area to focus on, and attracting higher quality users is often your best path to improve downstream product metrics.

(The benchmarks for GOOD and GREAT differ somewhat for freemium versus free trial products. You can see that data in the full report.)

2. The hardest part of PLG might actually be… marketing?!

The PLG funnel math is bleak. If an average freemium PLG product attracts 1,000 unique visitors to their website each day, they can expect:

90 free signups (9% conversion from a unique visitor)

4-5 paying customers (5% conversion from a new signup)

$10-$100 per month as an average initial spend for a new self-service customer

30-60 days to convert those free signups

⇒ You’ll make $1-$2 for each unique visitor.

Sales-led companies can afford high-touch channels for new leads like outbound prospecting (45%) and partner relationships (12%). Product-led businesses, on the other hand, need to find channel-market fit with low-cost, scalable channels for attracting new users.

Product-led marketing means making it easy for end users to discover your product when they need it, through two primary strategies:

Organic efforts like SEO, word-of-mouth, organic social

Product virality

Collectively these two sources account for more than 50% of leads for the average product-led business. Neither requires paying per click, which helps you scale efficiently.

3. Forget about Threads. What’s your TikTok strategy?

Many folks have been on the Threads hype-train. And, look, 100 million registered users in 5 days is EXTREMELY impressive.

But that pales in comparison to TikTok’s 1 billion+ active users. What’s interesting about TikTok is the visual nature of the product and the potential for viral discoverability through the TikTok algorithm.

The 2023 product benchmarks data shows that TikTok is on the rise as an acquisition channel, but it’s still extremely underpenetrated relative to both the opportunity and to peer social channels like Facebook or Instagram.

My personal view is that TikTok becomes particularly interesting for products that turn individual users into creators who then want to show off what they’ve built (think: Notion, Canva). It goes hand-in-hand with many AI-enabled applications, which can feel like magic for the end-user.

Some TikTok examples to inspire your growth marketing:

Canva - 368,000 followers

Shapr3D - 274,000 followers

Notion - 115,000 followers

Biorender - 1.9B views

4. Reverse trials: We’re talking about them more than we’re doing them

SaaS companies tend to offer one of three main product entry points: freemium, free trial, or contact sales. But there’s a lot more nuance than that.

We’ve seen more and more buzz about ungated products, interactive demos, and — of course — reverse trials. So, where are folks landing?

Ungated products let prospective users immediately try out the product — no sign-up required — and then ask for an email address only if users want to save their progress. 16% of respondents said they offer an ungated product experience and 9% said this is the primary entry path into their product. Examples I’m digging include PhotoRoom, Excalidraw, Eraser, SafetyCulture (for their checklist library), and Snyk (through their sidecar products like Snyk Advisor).

The promise of ungating a product is that it can dramatically increase the percentage of website visitors who start using the product (often 2-3x the rate of a freemium or free trial experience). Activation rates can skyrocket, too, since users only create an account after they’ve seen value.

What if you could provide a PLG experience – putting your product front-and-center to acquire, convert and expand customers – without having to change one line of code? That’s where interactive demos come in.

Interactive demos help turn high-value website visitors into customers by giving them a taste of the product before talking to a sales rep. They’ve now been adopted by 14% of SaaS companies in our survey, although usually as a secondary on-ramp.

Reverse trials, popularized by Elena Verna, seem to be talked about more than they’re actually put in practice. A mere 5% said they offer a reverse trial, and 2% said it is their primary product on-ramp.

My view: these 5% are among the most sophisticated product-led businesses including Airtable (which I wrote about previously) and Krisp. While based on a small dataset, reverse trials appear to see similar free-to-paid conversion rates as classic free trials (#efficientgrowth) while benefiting from the high signup rate of a freemium product.

5. Activation: One of the most misunderstood metrics in SaaS

Tracking activation has gone mainstream in PLG companies. Among PLG companies with <$1M in ARR, 60% had an activation metric. That figure jumps to 74% among PLG companies with more than $20M in ARR.

But having an activation metric is only half the battle — or maybe even less than half the battle. We found zero consistency in terms of activation metric definitions or benchmarks. While the median respondent said their activation rate is between 30-40%, we saw responses all over the map.

Here are the top five activation mistakes you're probably making — and what to do about it. (Yep, I've made these mistakes, too 😉)

⏱️ It doesn't happen fast enough.

👉 What to do: time-bound your activation metric.

We care about activation as a *leading* indicator of future outcomes.

Speed matters: the faster you know whether a user has activated, the faster you can get a readout on growth experiments and marketing channels. At Hotjar, for example, two-thirds of activations happen in the first 15 minutes of sign-up.

🌈 Your expectations are too high.

👉 What to do: plan for a 20-40% activation rate. Adjust your business case accordingly.

With PLG, you'll pull in *lower* intent users who are self-educating on your product, but aren't ready to buy. 40-60% of new sign-ups never return to the product on a second day.

📺 You're not connecting activation with marketing.

👉 What to do: segment your activation rates by marketing source, then focus on improving *this* metric.

The biggest influencer on your activation rate isn't your growth team. It's your marketing team. You'll want to measure activation by marketing source. Bonus points if *activated sign-up volume* is the top KPI of the marketing team.

🔮 Activation isn't predictive.

👉 What to do: measure whether improvements in activation flow-through to business outcomes. If they don't, change the metric.

Activation isn't the goal. It's the leading indicator of the goal. Conversion, $$, retention, PQLs, etc. — that's what you really care about. Your growth team might be laser-focused on improving activation only to find out that all of their work didn't improve business outcomes.

📏 It's one-size-fits-all.

👉 What to do: as you scale, start to segment users and personalize activation paths to different audiences.

Not all of your users are trying to achieve the same thing. So why do you push them down the same onboarding path?

Folks often focus on simplifying onboarding, reducing friction, etc., but can't crack the code on improving their activation rate. The problem: you shouldn't have only had one definition of activation.

What else you should know

Go read the full 2023 Product Benchmarks. Then drop a comment with your favorite insights and/or any questions on the data.

How will AI products make money? I unpacked this topic with

in his newsletter last week. (Since then, Microsoft revealed pricing for its new AI subscription 👀)HUGE shoutout to readers who’ve referred friends or coworkers (or even enemies!) to Growth Unhinged. Climb that referral leaderboard 🥾

Thinking about raising prices? Don't reinvent the wheel, steal this 🔥 email template from Otter.ai.

I’ve been digging Ed Sim’s newsletter,

, as he goes deep into the most fascinating stories hitting tech/SaaS each week.

Insanely valuable! Immediate must-read for my marketing team. Thank you, Kyle! Nils (CRO, https://brizy.io)

The quality of this newsletter is insane! Thank you 🙏