As much as we talk about AI in go-to-market, the reality is that 85% of enterprise sellers still manage their book in spreadsheets. Only 5% use CRM.

Deal data sits in Salesforce. Calls are in Gong. Content is scattered everywhere. It’s no wonder spreadsheets seem like the only unification layer.

ZoomInfo built the new ZoomInfo Copilot Workspace to finally fix this. It’s one hub with buyer context, CRM data, and intelligence on 100M+ companies and 500M+ contacts. No more tab-hopping or spreadsheet mishaps.

Execution wins deals. Everything else is just preparation. Learn more here.

The 2025 State of B2B GTM report

Growing a B2B startup can be, in a word, exhausting. The best channels quickly get saturated and returns get worse for everyone. Distribution shifts create opportunities, but you have the narrowest of windows to be a first mover. AI is making this window even narrower. And I won’t even mention the ever-growing list of three-letter acronyms (TLAs) you’re expected to memorize.

To understand what’s going on I asked readers: What’s working in go-to-market (GTM)? And where is AI honestly making an impact?

Maja Voje from GTM Strategist and I surveyed 195 software GTM leaders for our inaugural 2025 State of B2B GTM report. This report wouldn’t be possible without the help of readers — THANK YOU for contributing!

Today I’ll share the five most interesting takeaways that stood out to me. (For premium subscribers, keep reading to get the full 30-page PDF report and join an off-the-record, subscriber only AMA.)

There are six main GTM motions in B2B. Inbound is the most popular, but not by much. Don’t discount Outbound or Account-Based GTM.

2025 was a year of (endless) exploration. The average software company says they have five core GTM channels and another 5.5 GTM channel experiments.

2026 needs to be the year of ruthless scaling. The inaugural GTM scorecard can help prioritize where to place your bets.

Everyone uses AI, relatively few see real GTM impact. Where it’s been most effective: intent-driven outbound, market intelligence, and content marketing.

The new GTM tech stack is mostly ChatGPT? There’s been a proliferation of next-gen GTM tools. Only one, ChatGPT, is having a breakout impact. The potential next winners: Clay, Lovable, and n8n.

Who participated in the research

Before we dive into the data, I wanted to share more information about who participated in the research. The State of B2B GTM survey was run from September to October 2025. A typical respondent was between $1-10M ARR, headquartered in the US, and selling a product that’s a hybrid of SaaS and AI.

The participants at-a-glance:

Primarily SaaS (41%), AI-native (11%), and hybrids of SaaS and AI (31%). The remainder included larger enterprises and tech-enabled services firms.

Split fairly evenly between sub-$1M ARR startups (24%), $1-10M ARR startups (32%), and $10M+ ARR scaleups (42%).

Almost all were based in the US (63%), Europe (19%), or the UK (8%).

Mostly had an average deal size above $25k (42%). 33% charged between $5-25k and 25% charged less than $5k per year.

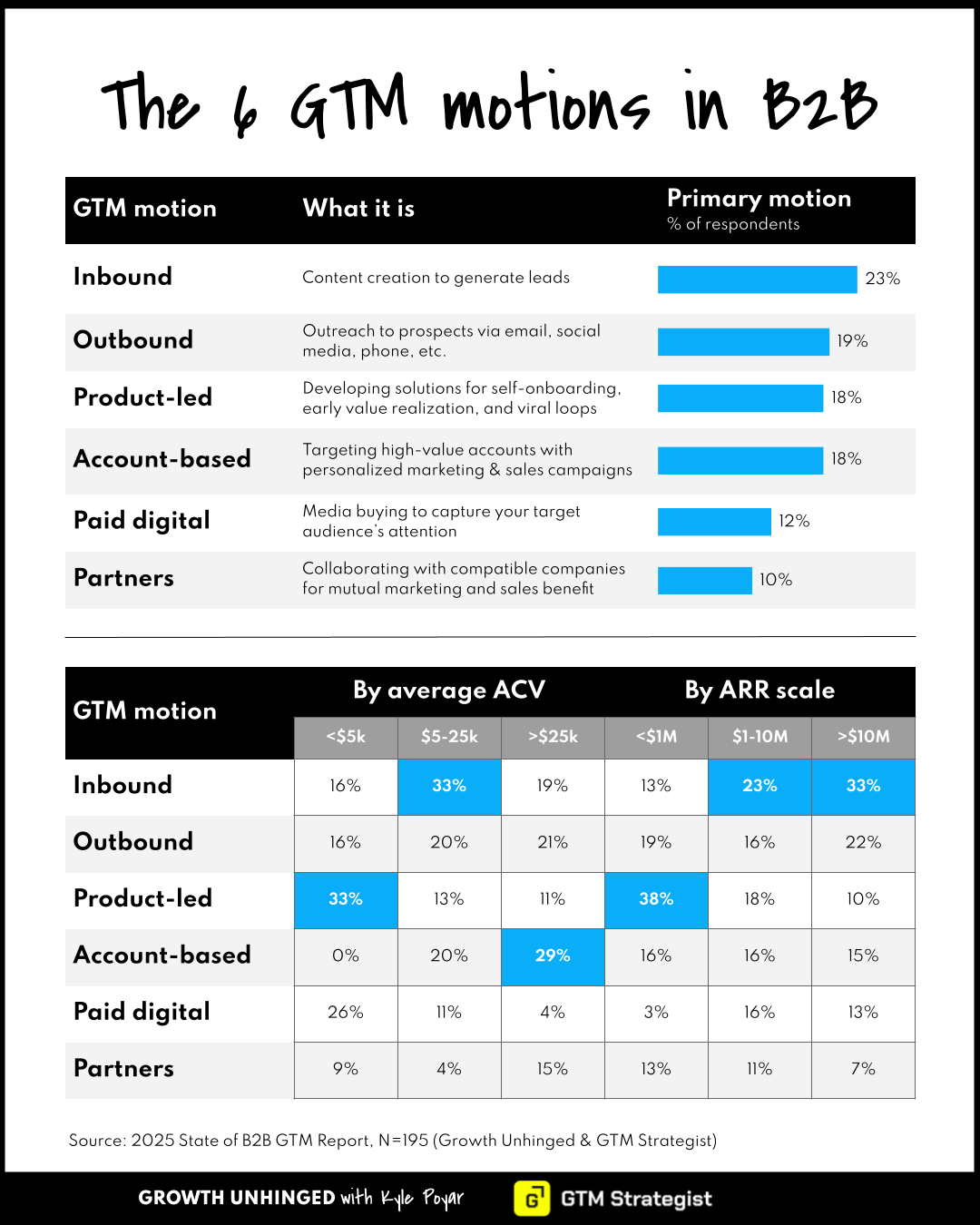

Takeaway 1: There are six main GTM motions in B2B

Inbound is the most popular GTM motion, but not by much. 23% said it’s their primary GTM motion. Don’t discount Outbound (19% said it’s their primary GTM motion) or Account-Based GTM (18%).

PLG was dominant for products that sell below $5,000 per year and for early-stage companies with <$1M ARR. Account-based was most popular for expensive products (>$25k average ACV). Those with less expensive products and some ARR traction see relatively more success with paid ads (Fyxer, profiled earlier, is a good example).

There was no correlation between a company’s primary GTM motion and their growth rate. Each GTM motion and even GTM channel could work – in fact, even the ‘dead’ channels still seem to have life left in them.

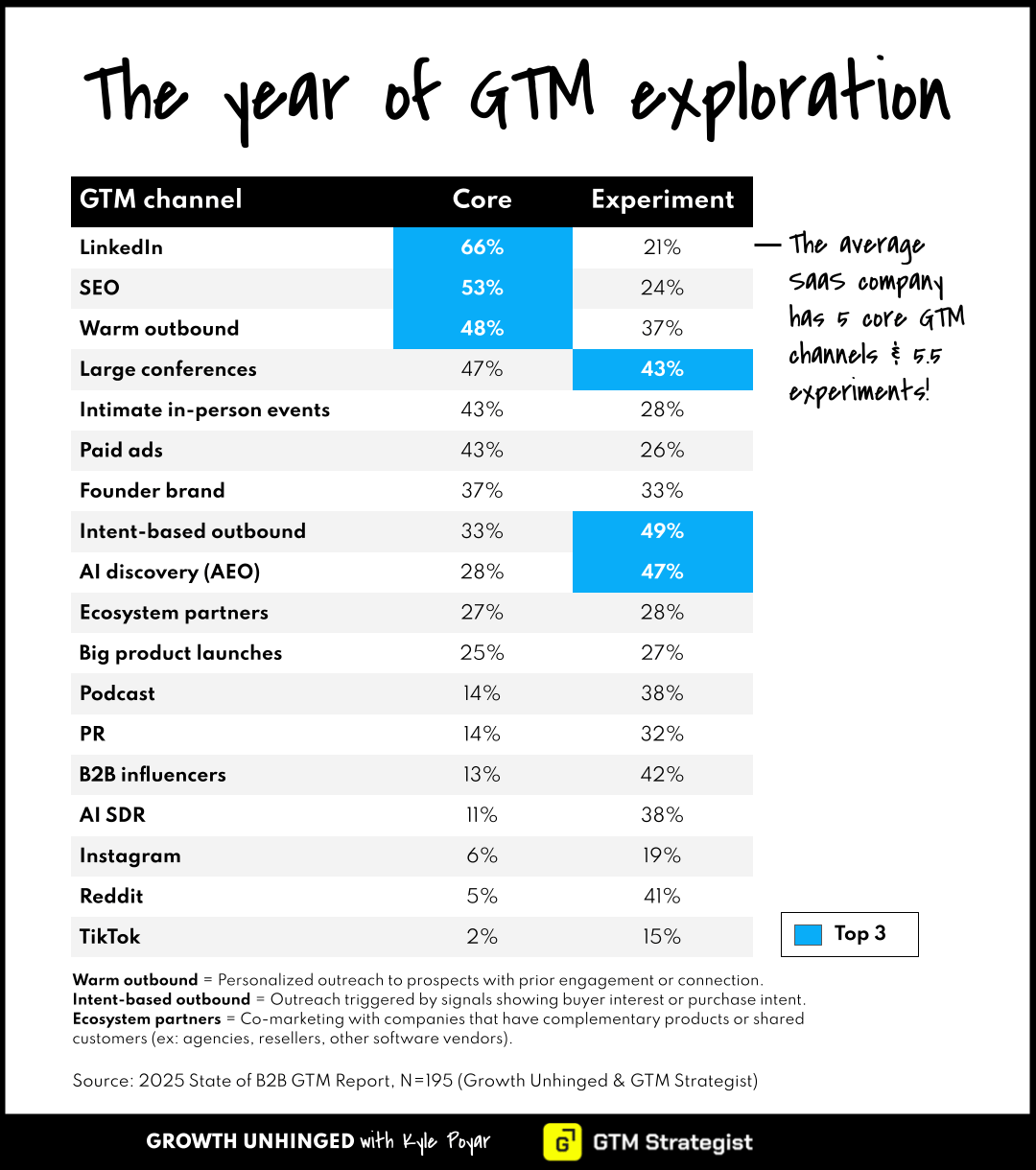

Takeaway 2: 2025 was a year of (endless) exploration

The average software company says they have 5 core GTM channels and another 5.5 GTM channel experiments. It’s no wonder we all feel exhausted.

The most common GTM channels were LinkedIn (66%), SEO (53%), and warm outbound (48%). The most common channel experiments were intent-based outbound (49%), AI discovery aka AEO (47%), and large conferences (43%).

On LinkedIn, it’s important to mention that this doesn’t just mean posting from the founder account. People also use LinkedIn for finding their target audience, researching accounts, sending InMails, and running ad campaigns.

You might wonder what’s the difference between warm outbound and intent-based outbound. The lines are honestly a bit blurry. My rule of thumb: warm outbound indicates the prospect has a prior engagement or connection with you while intent-based outbound indicates there’s a signal of buyer interest or purchase intent (ex: based on job posts, funding, tech signals).

Looking ahead, B2B companies seem more prepared to add GTM channels than to subtract them. The areas where respondents are increasing GTM the most include:

AI search (AEO): 51% plan to increase GTM investment in AI search. By comparison, only 14% plan to increase SEO investment.

Intent-based outbound: 45% plan to increase GTM investment here. The data gold rush is on.

LinkedIn: 31% plan to increase investment in LinkedIn and 30% plan to do so in founder brand initiatives. Founders are trying to become LinkedIn influencers – and increasingly looking for help (here are my tips). It’s a good time to be a CEO ghostwriter.

While there are big audiences on social apps like TikTok and Instagram, it seems few B2B companies are placing bets in either place (3% for TikTok and 6% for Instagram). There’s also limited appetite for podcasts (9%), PR (10%), and Reddit (17%).

Related: Emily Kramer from MKT1 joins the Mostly Growth podcast to talk about marketing math and what’s working in 2025.

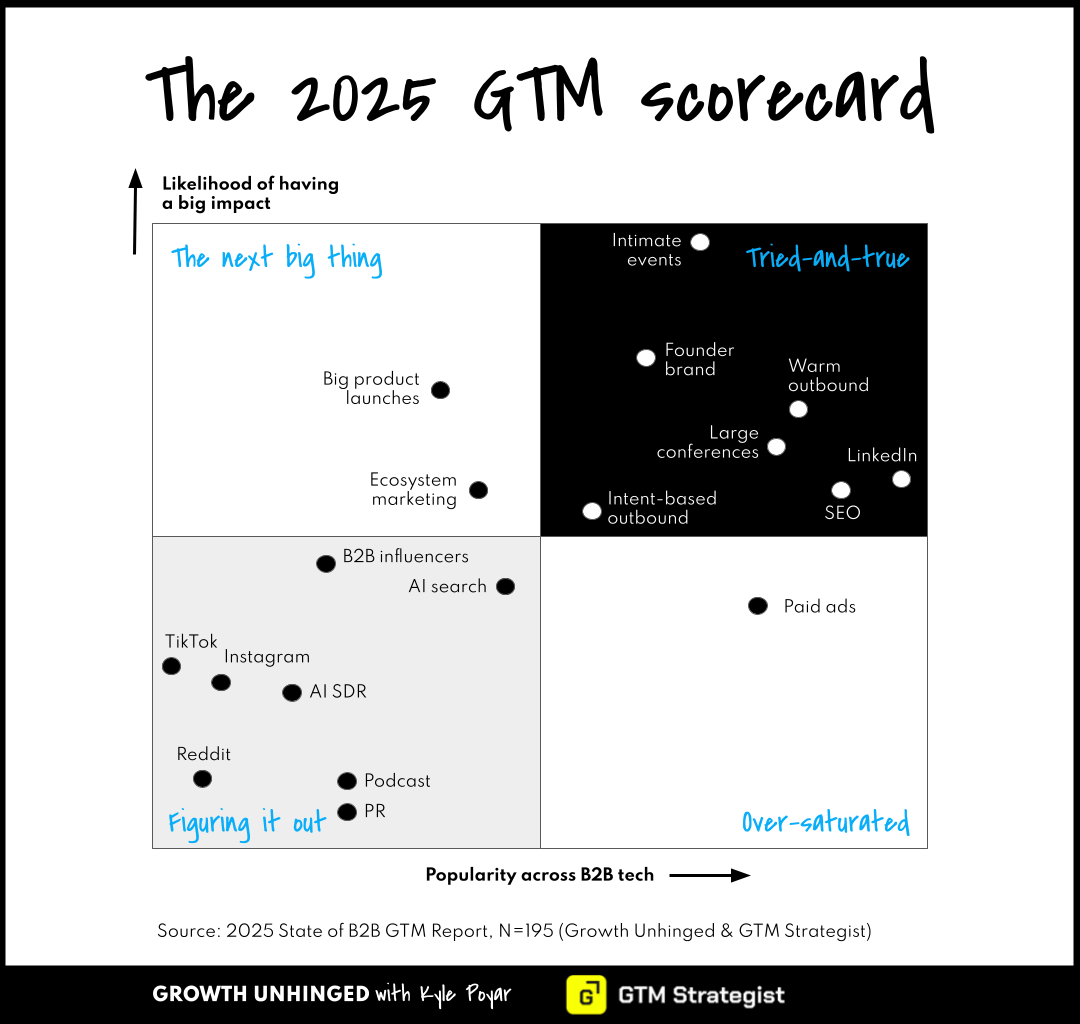

Takeaway 3: 2026 needs to be the year of ruthless scaling

Folks say they’re ready to move on from (endless) channel exploration. The top priority for GTM leaders in the survey: how to scale the GTM motions that are working to generate high-intent pipeline.

The inaugural 2025 GTM scorecard can help prioritize where to place your bets. We mapped how popular different GTM channels are (horizontal axis) versus how likely they are to be seen as impactful among adopters (vertical axis). The shorthand for interpreting this two-by-two:

Tried-and-true: Upper right

Oversaturated: Lower right

The next big thing: Upper left

Figuring it out: Lower left

The single best channel in terms of likelihood of having an impact surprised me: intimate events. Events in general are having a major resurgence with large conferences making the upper-right quadrant, too.

I didn’t expect to see SEO still in the upper-right quadrant. It seems to be barely hanging onto this position. Warm outbound had a surprisingly positive spot, too, proving that outbound isn’t over (except for bad outbound perhaps).

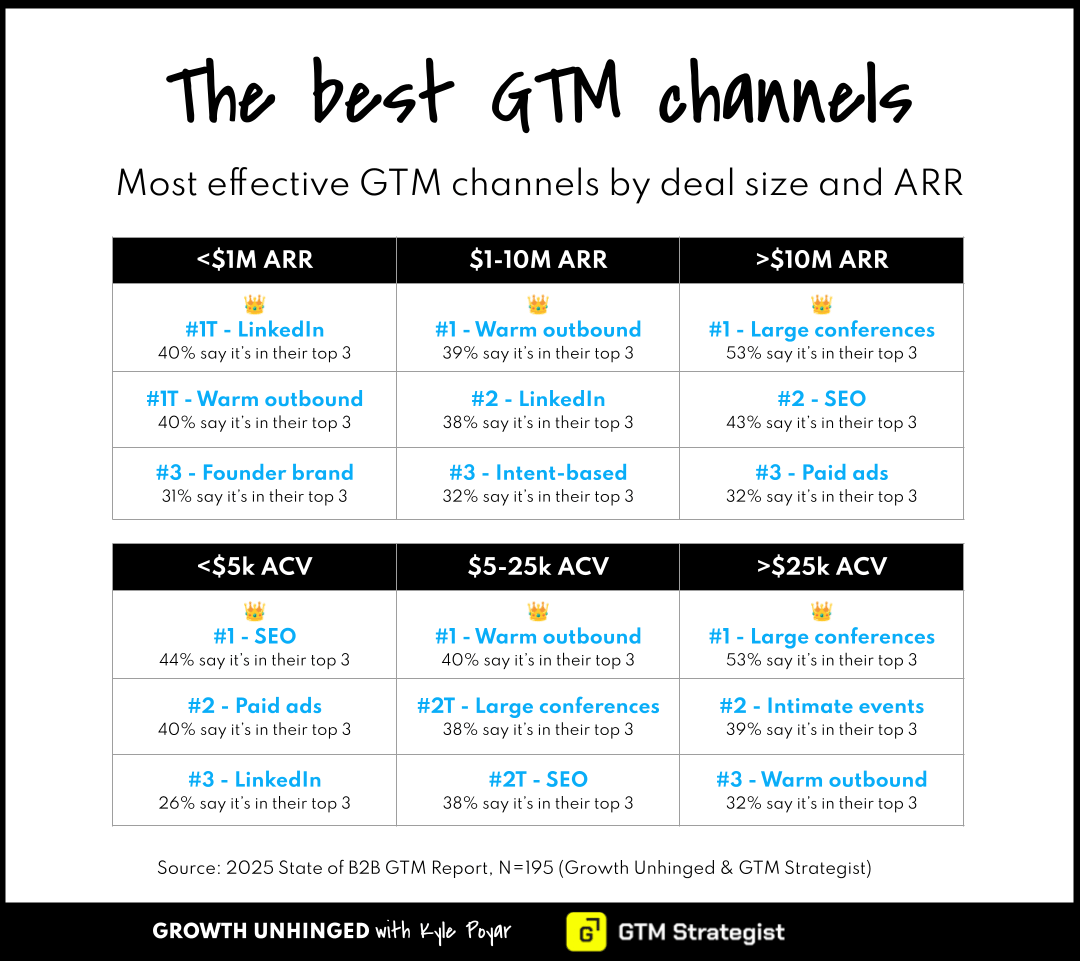

It’s worth looking at this data based on both ARR scale and deal size.

Early-stage companies rely heavily on founder-led GTM channels with LinkedIn, warm outbound, and founder brand efforts rating as the top three most effective. More mature companies shift to higher investment (yet more scalable) channels like large conferences, SEO, and paid ads. Those in the messy middle layer on intent-based outbound to target the buyers most likely to be in-market.

Related read: The best automated GTM plays you’re not running

Takeaway 4: Everyone uses AI, relatively few see real GTM impact

AI fluency is becoming the most in-demand GTM skill of 2025. Three-in-four GTM leaders said they have top-down pressure to adopt AI.

The current AI theme: build before you buy. 91% said they use general purpose tools like ChatGPT. Other AI capabilities that have been adopted include custom GPTs (56%), vibecoding or prototyping tools (41%) and AI agents (41%). Relatively few (21%) are using multi-agent workflows, although this number was higher than we anticipated.

The impact of AI is a mixed bag. More than half (53%) said they see either no impact or limited impact from AI. The disillusionment was most acute around AI SDRs. In the words of one survey taker, “We tried an AI SDR for six months and were unable to generate a single opportunity.” Ouch.

Those who are seeing positive results cite three main areas of impact:

Outbound including intent-driven outbound, automated SDR, and account targeting. This was cited most frequently in the survey.

Market intelligence including competitor analysis, account insights, and data enrichment. This was cited second most frequently.

Content marketing including generating SEO and AEO blog content, GTM documentation, and personalized messaging. While content use cases are widely popular, many said they’ve been disappointed with ROI beyond time savings for basic uses.

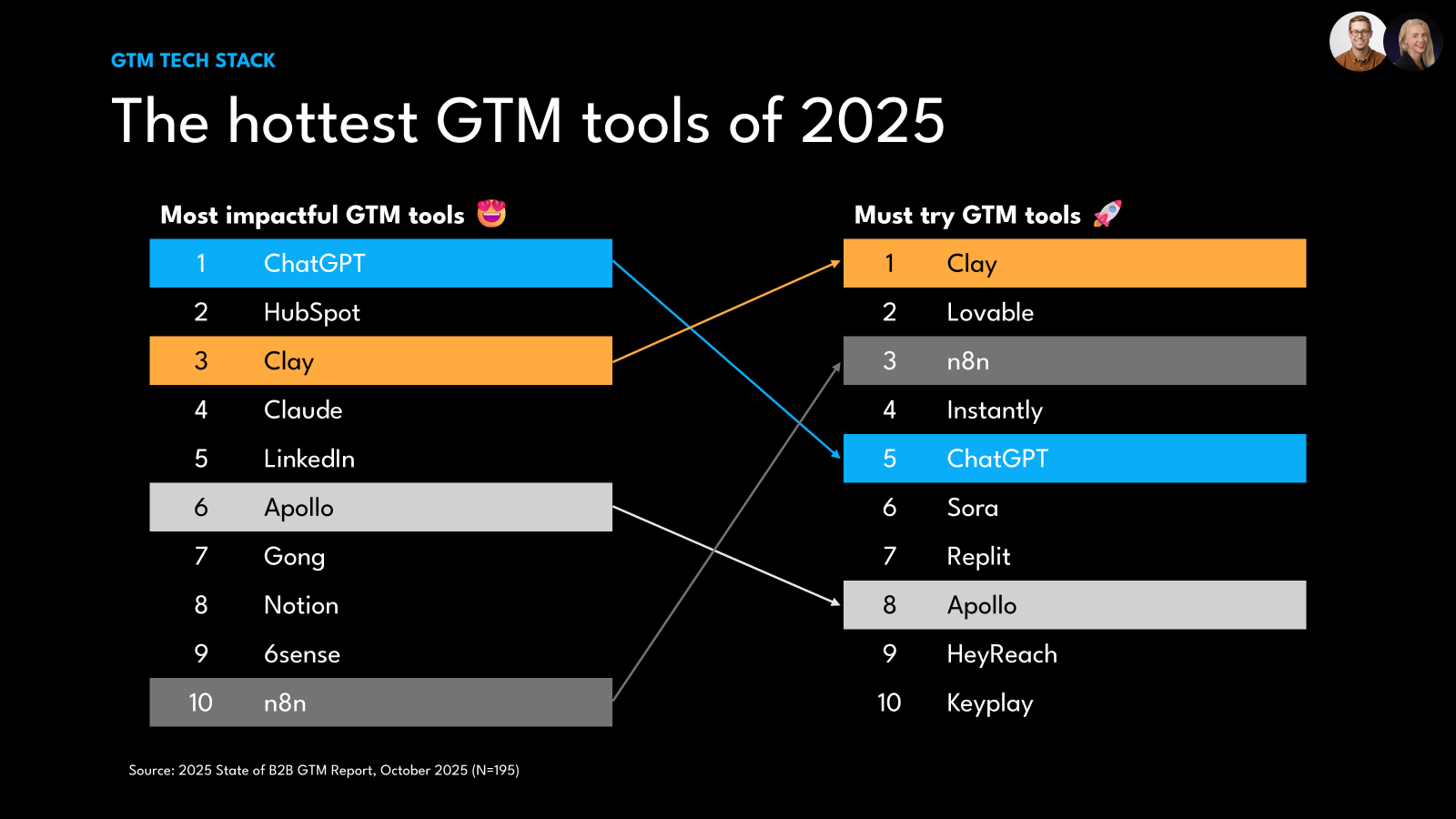

Takeaway 5: The new GTM tech stack is mostly ChatGPT?

There’s been a proliferation of next-gen GTM tools. Only one, ChatGPT, is having a breakout impact.

ChatGPT was rated the #1 most impactful GTM tool with roughly 50 write-in mentions. The closest alternative was OG HubSpot, which had about 40 write-in mentions. Clay came in third with nearly 30 write-ins.

The potential next winners: Clay, Lovable, and n8n. Clay took the prize for the GTM tool people are most excited to try or more fully deploy.

These three tools all point to the rise of the technical GTM hire. They provide power and flexibility for GTM teams to build agentic workflows, find unique data, run intent-based campaigns, and generate custom marketing assets. While it increasingly pays to be AI fluent, fear not: you don’t necessarily need to be a GTM engineer to harness the next-gen GTM tech stack.

Related read: What GTM teams are doing with ChatGPT

The full 30-page PDF report

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library