Why you (probably) shouldn't create a new category

James Evans, co-founder of CommandBar, on embracing “easy mode” and doubling their growth rate

👋 Hi, it’s Kyle and I’m back with a 🔥 edition of Growth Unhinged, my newsletter that explores the unexpected behind the fastest-growing startups.

The #1 edition of Growth Unhinged is Anthony Pierri’s definitive SaaS homepage framework (it has been viewed 55,000 times 🤯). Anthony urges folks to resist the temptation to create a new category. Most companies, he argues, already compete in an existing category whether they embrace it or not.

James Evans, co-founder and CEO of Insight-backed CommandBar, learned this lesson firsthand. Creating a category propelled CommandBar to a $19M Series A, but it meant building on “hard mode”, James says. Shifting to “easy mode” — disrupting an existing category — helped CommandBar double their growth rate. Keep reading to find out why.

CommandBar didn’t begin life as a product but as a weird little feature we built for ourselves.

My co-founders and I were building a web app. It became hard to use. As users ourselves, we found popups (the normal solution to “onboarding problems”) annoying, and we figured other users did too. So instead we built an alternative to the UI: a little magic search bar that let users search for what they were trying to do. Kind of like a command line. We didn’t invent the idea — it was already popular in products like VS Code, Linear, and Superhuman.

It worked so well that we thought this search interface should be as ubiquitous as help chat. 15 years ago, there was no chat. Now, every product has it in the bottom right. We thought cmd+k would follow the same trajectory. And we thought selling the next software building block as a service would be a giant opportunity.

It wasn’t clear if this company would work. No one else was doing this.It would embed into the frontend of other companies, which brought a bunch of challenges.

We did what many first-time founders do: we let YC make the decision. We applied with the idea, got in, and started building CommandBar. Here’s what our product looked like three months in (this is the demo we used in our $4.8M seed deck):

A year later, we were psyched with our progress. The cmd+k interface was spreading. We won exciting early customers — Gusto, LaunchDarkly, ClickUp, Netlify, etc. – that helped our team of five speed toward $1M of ARR.

The fact that no one else was doing this meant we were building a category, which challenged us in a few ways:

No competition. Our two biggest “competitors” were no action (a company thinking they didn’t need an interface like ours), or, less commonly, a company building it themselves.

Low product understanding. We explained what we did—a lot. We’d spend the first 20 minutes of a discovery call getting people to understand the fundamentals of our product. Some thought we did backend search (like Algolia), others believed we did product tours (which we do now, but didn’t then), etc.

Mixed buyer profile. We sold to different buyers. Sometimes the founder, sometimes the CTO, sometimes a PM, sometimes an engineer with a hackathon project.

We initially loved the former. How liberating not to have to worry about competitors! We actually pitched this to our first few hires — “we can build whatever we think is best.”

The latter two were problems, but we figured we could fight through them. I now call these problems symptoms of playing on “hard mode.”

But we didn’t make much progress because there was low buyer urgency. Companies often showed a lot of interest, then would take months or quarters for the project. With some, it never happened. This is why I call category creation “playing on hard mode.” Startups are never easy, but you don’t get extra credit for making it even harder.

We felt this most in the summer of 2022, right after our Series A. That summer, tech valuations reset, layoffs were widespread—and we realized we were a vitamin.

How we re-positioned CommandBar (and doubled our growth rate)

Prospects often asked us “Are you a replacement for X”? We always said no. We were unique. We were creating a category.

Prospects had compared us to Pendo (and other tools like it that fall under the nauseatingly named category “digital adoption”) more than any other product. Since Pendo wasn’t cmd+k-as-a-service, we never considered saying yes. We’d say things like “in-product pop-ups solve a similar problem to us (user education). So maybe you can stop using them if users have access to a command bar interface.”

In the summer of 2022, someone said: “if you can replace Pendo for me, I can buy you. If you can’t, it’s going to have to wait a year.”

This time we stopped to consider what saying “yes” would mean: switching to easy mode. So we took a closer look at products in the space.

The digital adoption category was a dozy field filled with mediocre products. The annoying popups that invite you to webinars, force you on 20-step tours the first time you login, and even bombard you with multiple CTAs at the same time? Powered by digital adoption products.

The status quo sucked for both sides: companies struggled to generate more than sugar-high increases in engagement, and annoyed users immediately closed the pop-ups.

It’s hard to name more perfect conditions for category disruption: dissatisfied customers for low-performing products that also cost too much.

So, we decided to say “yes.” We would become a replacement for <insert digital adoption vendor>.

To do this, we had to make three big changes:

Product — build functionality to replace the meaningful bits of digital adoption tools (without sacrificing our soul)

Marketing — bat signal to digital adoption buyers that we were ready to mingle

Sales — learn how to sell against competition

Here’s how we did those things (and how they went).

Product

The big decision here: how do we build enough to replace incumbent vendors without rebuilding their entire product or abandoning our insight that users find most popups annoying.

The insight that powers CommandBar is that it’s usually way easier to help users once you know what they care about (i.e. know their intent). We didn’t want to build a Popup Gatling Gun with a slicker admin interface.

We added check-the-box features. The hardest pill to swallow was that we needed to add some version of popups. They’re so central to digital adoption that no solution without them takes. PMs know the form factor, CPOs will tell their teams “We should try in-product popups.”

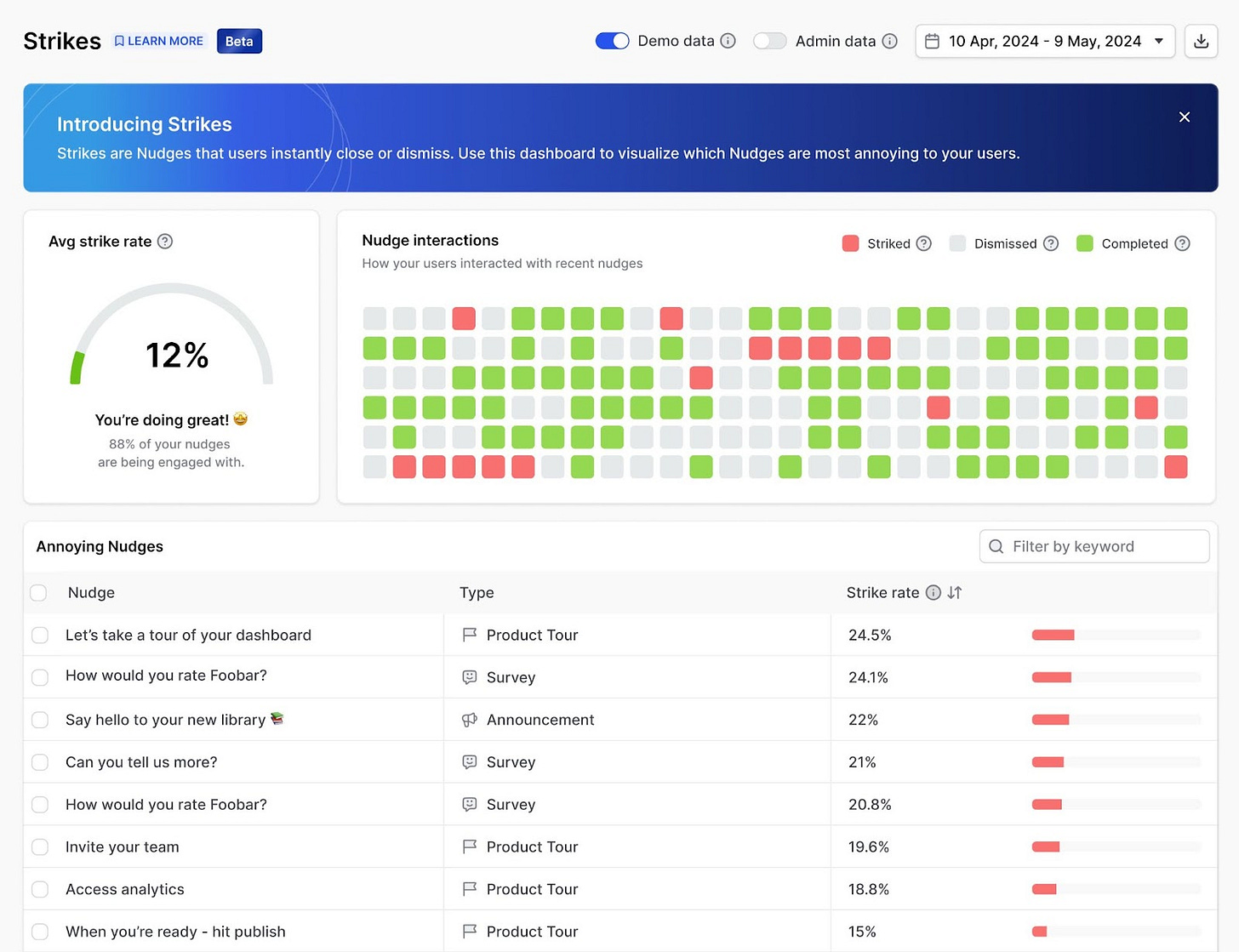

If we wanted to compete, we couldn’t avoid them. But we built them in a way that acknowledged the elephant in the room—most users find popups annoying. For example, we built behavioral triggers that only serve the experience when users seem confused. We also built a dashboard that measures how many users instantly close popups. This helps our customers ensure they’re not annoying. I don’t think anyone else in the space would have ever considered building this dashboard.

Because we believe in subtle, well-placed messaging, we called them nudges. These check-the-box features are another symptom of easy mode: we didn’t need to concoct something entirely new every time, but could look at what we’d improve about what already exists.

We kept our original product as a differentiator. Spotlight (our renamed original search product) is no longer our entire product, but a differentiator. Customers buy our product and also get Spotlight. That differentiates us from competitors who only do popups. And it allows us to do cool things like trigger product tours based on user searches. This differentiator has evolved into our Copilot AI chat product, which relies on the same principle — let users ask for help in their own words.

We ignored what doesn’t matter. It might sound contradictory to my check-the-box point, but you don’t need to build everything competitors have. You only need what customers care about.

An example of this is our chat widget Copilot. Had we blindly copied digital adoption vendors, we never would’ve built it. Instead, it was a logical extension of combining proactive help (nudges) with responsive help (Copilot and Spotlight).

I’d summarize this section as: we figured out how to package our differentiation (user responsive help) with enough of the status quo to get it to “take”—like a parent pairing vegetables with mashed potatoes to get a child to eat their greens.

Marketing

Our original marketing message was “cmd+k is the future so you’ll need CommandBar.”

So we built this hybrid popups + search product, and now we needed buyers to pay attention. You can see this best in the evolution of our marketing site.

The gist of our current messaging is: “we sell digital adoption but acknowledge the unspoken truth that popups are annoying.” We did this by coining a term for our flavor of digital adoption — “user assistance.”

To pull off “user assistance is digital adoption 2.0” we had to simultaneously:

Get people who care about digital adoption to notice us. We can’t just talk about how user assistance is good. We also have to talk about why digital adoption is bad.

Show why we are better.

This narrative suffuses our content, marketing site, social media posts, and sales processes.

To send the message to the right people, we entered category maps like G2 that pit us against digital adoption vendors. This graphic below (the latest installment of G2’s digital adoption momentum grid) crystallizes our marketing strategy: it’s much better to be the best digital adoption vendor than to have the same customers and revenue but in a category of one.

We regularly book demos from people who are researching digital adoption and come across us in grids or blog posts about the category.

This also became easier when we repositioned. We no longer had to explain why what we did was useful. Product teams already know what product tours and surveys are for.

Sales

A benefit of being a category of one: you’re not in a consideration set. Customers aren’t getting demos from seven cmd+k-as-a-service vendors when there’s only one. That changed when we entered digital adoption.

Many prospects now list the vendors they’re evaluating. We can tell them: “yes, we’re competing with X, but we’re better because of Y.”

Instead of taking 25 minutes and multiple customer examples to explain what we do (like in category creation hard mode), it now often takes two minutes. “We’re evaluating digital adoption vendors and came across you because of your unique approach.” Great. Qualified. That’s easy mode in action. We even had people adopt our wording and ask specifically for user assistance.

“I checked out your website and it seems like you do this in a way that’s not annoying to users” is now something we hear on sales calls. During our repositioning, we also went sales-led. This was a higher-risk experiment than you’d make on easy mode.

Here are a few takeaways from the sales side:

Before and after narratives are critical. We spend most of our time on this. What’s our take on the space? How does it differ from competitors’? It’s critical to do this, though it’s tempting to jump into feature comparisons. Why? Because…

You cannot win on feature parity. We deliberately aren’t copying other vendors’ products, so we sometimes disqualify prospects based on functionality. If you want X, and we don’t think X is a good feature, we won’t build it. If you’re right about what you don’t build, these situations should start to fade as the market moves on from features that don’t matter.

Your opinions will not resonate with everyone. Our stance that most popups suck causes many prospects to breathe a sigh of relief — “it’s so nice to hear you say that because I felt like I was going crazy.” Others disagree: some want a tool to bombard users with popups at every juncture. We joke internally that these people want a “User Coercion Platform” and disqualify them.

It’s not a pivot, it’s a repositioning

“Pivot” is a dirty word for startups. It implies failure. And failure maybe implies more failure.

A repositioning is a kind of pivot. It’s not a “hard pivot.” You aren’t throwing away your core purpose, or your entire product. But it’s a big change.

In addition to the morale change, I was worried about going from a company without competitors to a company with competitors. It felt like we had grown up in a zero-gravity environment and were flipping to 1G.

The things I focused on here were:

Focusing on upside. I emphasized that this change would allow us to achieve our goals faster. We could reach more end users (about 20 million at this point) and build a bigger company this way.

Transparent about my fears. I was transparent about the competitor thing.

Asked for help. I asked everyone to switch on their radar for how we could further tune our positioning. Features that no longer made sense? Things we could build quickly on our existing infra? A certain slide not resonating with customers? Everyone needed to be in “explore” mode (not “exploit” mode) in the months after our decision to reposition.

Everyone loved it, which wasn’t unexpected. We didn’t pivot out of a terrible situation. We had been growing, had tons of runway, and weren’t hard pivoting.

But the team experienced a more hidden benefit from the repositioning. Creating a category levies a subtle tax on everyone at the company: it’s hard to explain what you do to people in your life. Everyone on the early team brought this up: “How do you explain what we do?”

Now it’s easier to explain what we do to potential buyers, but also people in our lives — family, friends, etc. Along with the signals that this strategy was working, this change made everyone feel better and more proud of what we’re doing. “We’re replacing shitty popups and chatbots” (easy mode) is a lot clearer than “we’re building this search bar thing” (hard mode).

The TL;DR:

Every founder wants to be an inventor — building a new mousetrap the world has never seen and building a market before any competitors catch on.

In most cases, I firmly believe that process is hard mode. It adds so many challenges that are unnecessary.

Easy mode is taking the insight behind your mousetrap and using it to disrupt an existing category.

Do that by:

Product — building a narrower version of competitors, with just enough functionality to compete, and that preserves your core insight.

Marketing — make it clear you compete in your category of choice, and focus on a before/after narrative for why your way is better.

Sales — recognize that you can’t sell to everyone, and focus on the people who resonate most with the version of the product you want to build.

Thank you, James, for sharing the behind-the-scenes journey at CommandBar! Catch other startup stories by reading my Zero to One series.

Solid write-up with lots of well-earned insights. Frankly, you had to go through this journey to get to where you are as well as to understand where you've been. It may sound trite to say, but the journey is the message. Appreciate you articulating how far you've come!

a lot I learnt from this. i agree with your perspective that it is good to have competition, be like some other companies, and be part of a category, not a new category.