The inside story of Amplitude’s new self-service plan

Head of Growth Marketing Franciska Dethlefsen takes us behind the scenes

👋 Hi, it’s Kyle Poyar and welcome to Growth Unhinged, my weekly newsletter exploring the hidden playbooks behind the fastest-growing startups. This time we’re getting the inside story of how Amplitude (AMPL) introduced self-service.

Current subscribers: 42,051. Join the crew☝️

“The numbers said not to do it. We did it anyway,” Franciska Dethlefsen told me.

Franciska was reflecting on Amplitude’s two-year journey to test, launch and scale their self-service plan – and do so as a newly public company (AMPL). She had joined Amplitude, the digital analytics software company founded in 2012, through its acquisition of Iteratively where she was the Head of Growth. Today she leads all things growth marketing, a team of roughly 15 people across four different pods (acquisition, retention, monetization and community).

Amplitude tested a self-serve alpha in August 2022 – that’s over a year before the eventual public launch in October 2023. A disappointing 14 customers purchased the original self-serve plan during the five months of alpha testing.

But the team persisted. And the (early) results are impressive. Before self-service, Amplitude converted 0.1% of free accounts to paying customers. That figure is now “getting close to 2%” – a 10x improvement in conversion (and not far from B2B freemium self-serve benchmarks of 3-5%).

I invited Franciska to Growth Unhinged to share the inside story of self-service at Amplitude. She spoke openly about the challenges and learnings, reflecting on topics like internal expectations setting, preventing sales cannibalization, getting pricing & packaging right and being newly accountable for churn. Let’s get into it.

From idea to public launch… in almost two years

While self-service was new to Amplitude, product-led growth (PLG) was certainly not. Franciska says that Amplitude started as an early product-led company with a generous free plan as well as a self-serve channel.

The company started to realize how much revenue there was to be made by going after larger and larger enterprises. “With that, we swung the pendulum all the way toward the sales-led side,” Franciska reflected. “We removed the self-serve tier but luckily kept the free plan alive.”

In early 2022, Amplitude started looking into its free plan again. Amplitude put additional resources toward bringing more users into it, improving activation rates and monetizing that customer base. At the time, monetizing free accounts meant a product-led sales motion where they’d mine the free plan for potential accounts that would pay and then hand those off to sales with the relevant data and insights.

While there were some wins, there was a glaring challenge with this approach. Going from spending $0 to upwards of $40-50,000 per year was too big of a gap for the average free user.

At the same time, Franciska acknowledged that competitors had compelling offers for the lower end of the market. “It was hard for us to stay competitive in that space,” she told me. “Amplitude in the market was seen as expensive and price intransparent.” Customers wanted more transparency to know how much they would need to pay both initially and as they grew.

The team began testing lowering the price floor to compete for these deals. Increasingly, that meant having highly trained people selling $10-15,000 deals, which was both resource-intensive and expensive. “We had conviction that the product could carry that load in the lower end.”

Growth marketing and product growth were starting to get conviction about self-serve. Now they needed to pitch the opportunity to leadership. They started having conversations in January 2022. “At this point, it was a lot of building business cases, showing what competitors were doing, creating financial models and making exec slides,” Franciska recalled.

“There was a lot of angst from the sales team,” she said. “We had to exclude a lot of accounts that sales were either talking to or thinking of talking to in the future. We weren’t allowed to talk about it or send emails about it. It was an MVP experiment where for it to be a wild success would have been almost impossible.”

The results came in. There were only 14 purchases of this self-serve plan over the course of five months. The team still took this result in stride and kept pushing for a broader rollout. “The critical part we showed was that Amplitude could sell this plan without a human involved in the process. That was enough to get to the next phase and keep testing.”

They launched the beta in January 2023 to all free users. Still, there was no marketing around self-serve and very limited monetization awareness. They saw an uptick with some early signs of the success they wanted. In fact, they almost launched publicly in April 2023, then pulled back.

“We didn’t have enough conviction in the plan itself,” Franciska remembered.

Meanwhile, Amplitude was fundamentally changing how to position the product, moving toward a ‘platform’ positioning. This meant rethinking pricing and packaging yet again.

Amplitude finally launched self-serve in October 2023, nearly two years after the team began working on it. They didn’t see a huge amount of customers buying during launch week, but it’s been steadily improving since then. “The launch itself was kind of flat, but over time those numbers kept increasing as we got more signups into the product and had more customers aware of it.”

The metrics have been (very) encouraging. Free-to-paid conversion rate is getting close to 2%, not far from the benchmarks. This is up 10x from the prior free account conversion. And it hasn’t had a negative impact on Amplitude’s commercial and enterprise sales teams. If anything, it’s already showing signs of having a benefit to sales by bringing them customers who are already used to paying and are growing fast.

Franciska reflected on five major learnings from Amplitude’s self-service journey.

Learning #1: Moving forward even when the numbers say not to do it

“It was one of those experiments that are set up to fail,” Franciska said. “We knew we didn’t have enough people or enough built-in monetization awareness in the product yet.”

She stressed the importance of setting expectations before running the test. “Make it clear that the tests you’re able to run in closed environments won’t be at benchmarks or anywhere close, but they’ll give you direction about whether it’s worth it or not.”

For Franciska, simply being able to show the leadership team that someone was willing to put down a credit card and pay did wonders for getting approval to move forward.

She believes that testing self-serve via the pricing page on the website would have been a better way of testing (a painted-door test). This page has a lot more traffic and would’ve produced a steady flow of new customers where monetization awareness was built-in. It would have also helped if Amplitude would’ve promoted the offer to the large pool of existing customers on the free plan.

Learning #2: Bringing sales along the self-serve journey

“We were very worried about sales cannibalization from both new and existing customers,” Franciska said. “We did a lot of analysis on this and had to get buy-in from the top.”

They analyzed usage patterns from existing customers. That analysis revealed a lot of existing paid customers who’d be newly eligible to downgrade to a self-serve plan. If that behavior were to play out in the real world, it would’ve accelerated churn and offset any benefit of self-serve revenue.

Ampliude’s beta test helped prove that self-serve could co-exist along with enterprise plans. Prospects would mention the self-serve plan on sales calls, but they would still end up buying enterprise anyway.

Besides, some level of cannibalization was actually healthy since it meant removing humans at the very bottom of the market in terms of ARR. Introducing self-serve helped the sales team move upmarket and sell deals of $25-30,000 or more. (Deputy experienced something similar when they launched self-serve.)

There are now clear guardrails. Deals from $0 to $20,000 go through the product. Deals above $40,000 are fully sales-led. Deals in between are a shared playground where both can co-exist. (In these ‘playground’ deals, Amplitude does still allow sales to offer better volume discounts than what’s available in the product.)

“We have more than 12,000 customers on the free plan so it’s impossible for sales to be on top of all of that today. We give them the data and insights they need around what users and accounts are most active, what they’re doing in the product, how advanced their usage is and we send those accounts to sales in order to keep their pipeline full.”

Learning #3: Getting pricing and packaging right

Amplitude has now gone through three iterations of pricing and packaging. “For our alpha and beta launches, we knew we hadn’t nailed pricing and packaging,” Franciska admitted.

The final iteration has been much improved. They’ve both made additional restrictions to the free plan along with giving more stuff away. This is part of the company’s platform positioning where CDP and experimentation features are now available on the free plan.

Amplitude went “way lower” on pricing, too. Instead of $10-15,000 per year, customers could start at just $49 per month. “We wanted it to be a no brainer.”

There were three primary inputs into this pricing and packaging redesign:

User interviews asking customers about different features and their willingness-to-pay. (I wrote about how to run those interviews here.)

Feature analysis looking at the adoption rate of all Amplitude’s features and how that compared for free as well as various paid plans.

Competitor analysis to make sure Amplitude wouldn’t be wildly different compared to similar offerings (although Franciska doesn’t recommend over-indexing on competition).

The earlier pricing iterations were anchored on “feature grids” with specific features available only on specific plans. This latest iteration is much more flexible with gates rooted in the customer journey. “We thought more about what people needed on a given plan, but also how people could experience part of a certain feature, then if they needed more they could unlock advanced functionality within that feature on a different plan.”

For example, free users can create a cohort analysis, but they can’t save it or sync it without upgrading (paying). This progressive feature gating has been much more effective for Amplitude, which Franciska attributes to having a much more natural progression between different plans.

Learning #4: Resourcing for a new product line

During the experimentation process, self-serve was effectively a side project across a number of different teams. Now that it’s proven, Amplitude has needed to resource accordingly. This includes reporting on it, staffing it and allowing people to focus their energy on growing it.

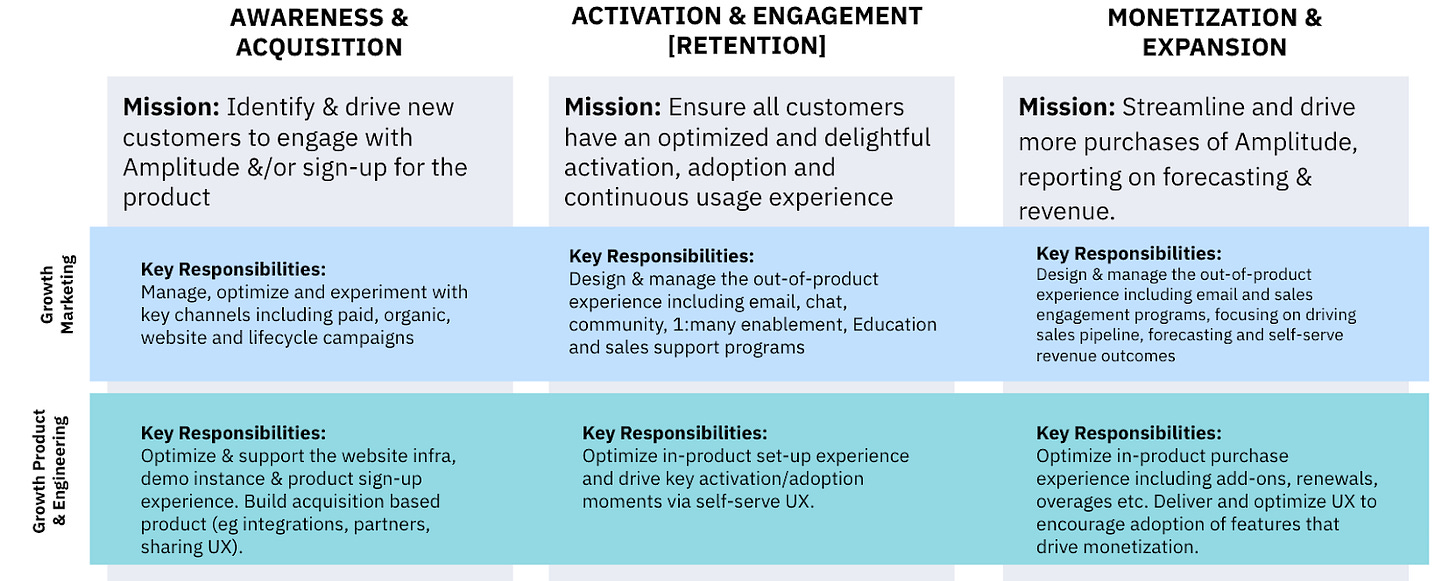

They’ve landed on a PLG squad that’s a partnership between growth marketing and product growth.

Growth marketing includes acquisition (website, paid, organic, signups), retention (product adoption, churn) and monetization (free-to-paid lifecycle, in-product plays, product-led sales).

Product growth includes retention (improving activation and adoption) and monetization (driving monetization awareness across surface areas).

Engineering is a critical partner across all three surface areas working hand in hand with both Growth teams, including managing all pricing and packaging work (growth platform)

The team has a PLG scorecard across all of these efforts. They run weekly sales forecasting calls, similar to the traditional sales team. And they’re accountable to a self-serve revenue number, which has been somewhat new to marketing and product too.

Learning #5: Minimizing churn

Amplitude’s primary customer base had been mature businesses spending $40-50,000+ per year and signing a long-term contract. Churn wasn’t necessarily something that marketing or product were tasked to worry about. Amplitude has post sales, success and support teams focused on long-term retention.

That’s changed with self-service and monthly plans, which start for as little at $49. It’s now part of marketing and product’s goal to make sure that the self-serve customer base doesn’t churn. The team needs to get under the hood around why customers churn, understanding the benchmarks and reporting on where they are. “It has been a lot of education to finance, ourselves and to sales.”

Franciska emphasized that there will be new responsibilities for the team that weren’t there prior to self-service. “There’s a lot more responsibility and accountability for product and marketing teams. It’s a new world of owning business metrics like revenue and churn.”

Parting thoughts

Reflecting on her experience, Franciska’s primary advice to others is that you need acquisition and adoption to be in a good spot before jumping into self-service.

“If the product can’t activate and retain users without any human intervention, it’s not ready to sell itself,” she stressed. “Get close to the benchmarks on those two metrics before introducing self-service monetization.”

Recommended resources

Follow Franciska on LinkedIn for more insights on product-led growth.

Deep dive into the new product-led sales (PLS) benchmarks. I teamed up with Pocus, Leah Tharin and Adam Schoenfeld to get the latest data from 170+ companies. The theme in 2024? It’s all about finding balance in your GTM.

Check out Deputy’s journey growing self-serve from 0 to 70% of new customers.

great review of the journey. Thanks for sharing. I thought most companies cap self serve at $10k due to how much people can pay on a CC. Nice to see that it's higher.

Love it!