The state of B2B contracts in 2024

📝 New data on sales contracts, AI clauses, price escalators and more

If you enjoy opaque and tedious contract negotiations, you should stop reading now.

Did I lose anyone?

This newsletter usually focuses on the exciting parts of growth like PLG strategy for buzzy AI startups, marketing quick wins or the path to product-market fit.

But, let’s face it, most of the work day isn’t about coming up with new ideas. It’s about everyday occurrences like getting a contract over the finish line before quarter-close (too soon?!) or figuring out the mechanics of your first design partner agreement.

We usually think of sales contracts as bespoke and secretive agreements between us and a specific vendor or customer. That is, until now.

I’ve been collaborating with Jake Stein, Co-founder & CEO at Common Paper, to unpack the real-life data behind B2B contracts in 2024. Jake is a serial founder of startups like RJMetrics (acquired by Magento) and Stitch (acquired by Talend) where he experienced the pain of contract negotiation first-hand. He’s now reimagining a future where B2B companies can create and sign contracts in minutes.

Jake and his team investigated actual contract data from more than 1,000 companies on their platform, and paired it with the collective experience of 45 tech attorneys who are part of the Common Paper Committee.

Growth Unhinged readers are getting a first look. Keep reading for some highlights, then dive into the full contract benchmark report here. In today’s post we’ll unpack:

Key stats on B2B software contracts

Trends around AI clauses (spoiler: these have exploded lately 👀)

Best practices for design partner agreements (pro-tip: set expectations for regular feedback)

Learnings around automatic fee increases (these could be making you 🤑)

Key stats on B2B software contracts

Negotiations are usually private. It always feels like the other side has the upper hand. Here’s what to expect before you’re expecting (a signature):

If an above-the-line decision maker isn’t involved in your deal, plan for a delayed signature.

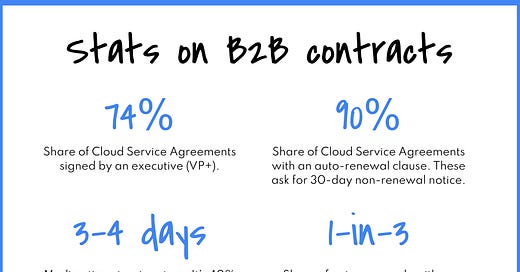

74% of signed Cloud Service Agreements are signed by an executive on the customer side (CXO, VP, Founder). 18% are signed by a Director and only 8% by a Manager or Lead.

Add in a 3-4 day buffer for a signature.

If the contract isn’t out for signature by the 27th, it’s probably not getting signed before quarter-end. Interestingly, Common Paper found that the median time-to-signature for an enterprise customer was only 40% longer than an SMB one (~4.5 days vs. 3 days).

There are a handful of commonly negotiated terms.

Specifically, the pricing details (no surprises there), auto-renewals and the invoice period. (In my experience as a software buyer, I usually redline auto-renewals the most.)

90% of Cloud Service Agreements (CSAs) have an automatic renewal clause.

In most cases, vendors ask for a 30-day non-renewal notice period.

But wait, there’s more…

39% of CSAs include a service-level agreement, 37% include a security policy and 45% include publicity rights (which give a vendor the right to talk about a company as a customer).

The TL;DR: there are valuable concessions you can get in exchange for giving a discount. Look to negotiate for things like publicity rights, auto-renewals and automatic fee increases so there’s something in it for you.

Trends around AI clauses

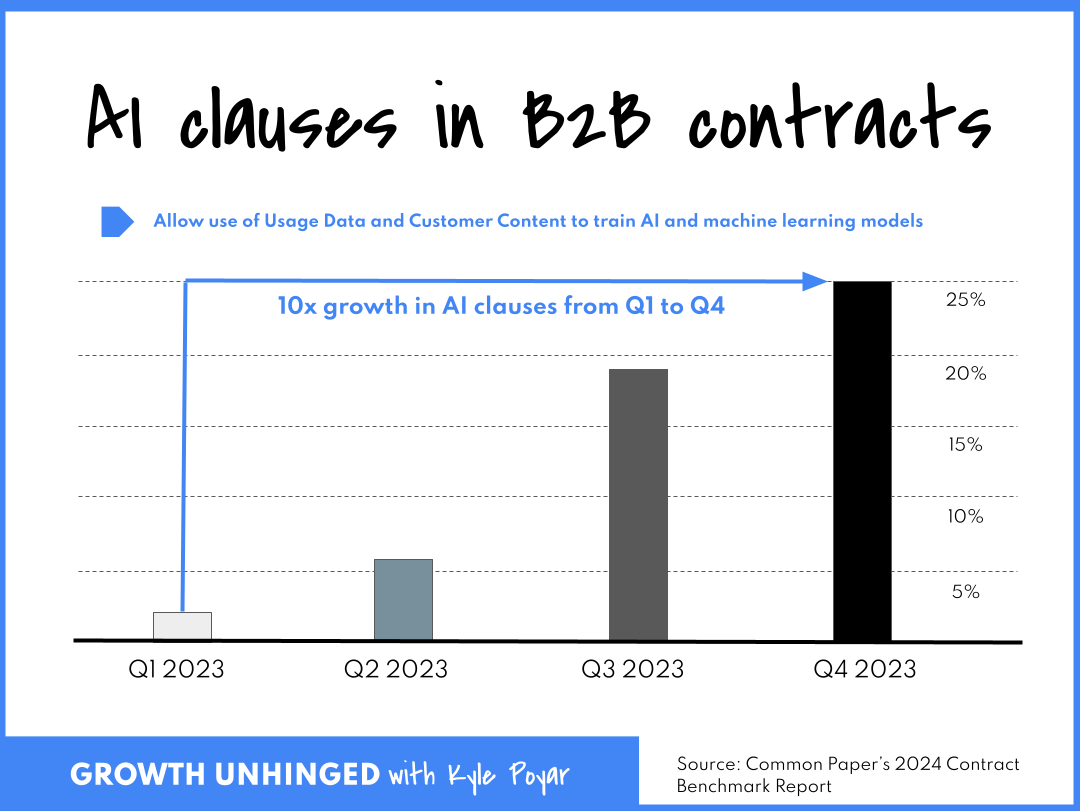

It’s not just you. Over the past two quarters, legal teams have given far more scrutiny to AI and, specifically, rights to use customer data to train AI and ML models.

There’s been a big push to both include these clauses, which give SaaS companies the explicit right to use customer data for AI training, as well as a counter-push from enterprises to forbid this from happening. Companies are nervous about sensitive or personal data being accidentally leaked along with the possibility of their proprietary information helping competitors get a leg up.

The data shows there’s been a roughly 10x increase in the proportion of CSAs with these clauses, up from 2% in Q1 2023 to 25% in Q4 2023.

What language should you use for AI training? Here’s some sample language, via Common Paper’s tech attorney committee.

Best practices for design partner agreements

Many readers are either startup founders or future startup founders. You might not be ready for a Cloud Service Agreement and would instead start with a simpler Design Partner Agreement. Jake shared best practices about how these should work:

“A design partnership is a relationship between a startup and an early believer in their vision. The startup’s product is pre-launch, and in some cases, there is only a problem to be worked on with a still-to-be-defined solution. The two parties work together to define what the product will be. The startup gets feedback, validation, and domain expertise, and the design partner gets to have a big influence on the roadmap and hopefully a solution tailor-made to their problem.

Most design partnerships (75%) don’t include fees. That makes sense since it’s not a traditional vendor-customer relationship, but it’s important to talk about the eventual economics early. This is a mistake I have personally made before.

Design partners want you to succeed. They’re taking on a lot more risk than just buying a product off the shelf, and they’re fundamentally making a bet on the founders.

That’s great, but as a founder, you also want to get feedback about cold, hard ROI calculations. Put another way, you’ll get very different feedback from the following prompts:

“I’d love your feedback on these mockups and planned functionality”

versus

“When we launch the product based on these mockups in three months, it will cost $60,000 per year. Help me understand what your team’s criteria and process will be for deciding if you’ll move forward at that point.”

You can always update your price and timeline, and you can frame the question in other ways. l like highlighting that the design partner will get a discount on the list price in recognition of their contributions. The key is to find out not just what your champion thinks, but what will need to be true for their company to make a purchase decision. This tactic has helped surface insights like other decision-makers and requirements that I’d need to replace a related product to be budget-neutral.”

- Jake Stein

Including a partner obligation of regular feedback participation is typical with the most common schedule being 2x per month (46% of cases).

When design partner agreements include a defined discount, it’s usually 50% off (in two-fifths of cases). In a smaller number of cases it’s 30% off (14% of cases) or 20% off (21% of cases).

It’s rare for founders to commit to building specific functionality in the agreement itself. This commitment only shows up in 17% of cases.

Learnings around automatic fee increases

Automatic price increases. We’ve all seen them (for instance from your favorite neighborhood CRM) and we all have opinions.

Like them or hate them, they are not out of the ordinary. In many cases, enterprise customers plan for them and appreciate the budget predictability they provide.

One-in-three auto-renewing CSAs include an automatic fee increase. These are generally between 5-8% on an annual agreement. Said differently, you could be adding ~2 percentage points onto your growth rate with a relatively straightforward contract tweak.

I asked Jake to double click into this data for us. He found:

No difference in the frequency of automatic price increases based on the size of the VENDOR. In other words, it isn’t just the Salesforces of the world who do this.

Big differences in the frequency based on the size of the CUSTOMER. Specifically, Enterprise customers were 50% more likely to have them than Midmarket ones. And Midmarket customers were 46% more likely to have them than SMBs. (If I do some quick math, that means that nearly one-in-two enterprise contracts include an automatic price increase.)

It wouldn’t be a story about contracts with a caveat:

“One important caveat is that the absence of fee increase language in the contract does not necessarily mean no fee increases at renewal time. It just means the contract is silent on that topic. Enterprises (and the companies that sell to them) may be more interested in predictability and smaller companies more open to leaving things open-ended.”

- Jake Stein

What else you should know

🤓 To nerd out: Read the full Contract Benchmark Report here.

📖 To read: HubSpot announces a new pricing model effective March 2024. They’ll be introducing per-seat pricing across their product line. This is another example in the ongoing shift toward hybrid pricing (HubSpot’s core pricing metric has historically been the number of marketing contacts).

📺 To watch: 30 Rock. It might have more laughs-per-minute than any other show. And it’s on Hulu.

This is a great view behind the curtain. Fantastic piece.

Great writeup as always. I'm VERY curious about the following, I assume somewhat common, startup B2B contract issue. When signing a to us massive client, we didn't have a great contract in place. In fact we put one together just for them and it's lacking on all ends. They money we're getting is great, but some important provisions are missing. The contract has a 2-year term and is up for renewal in the summer.

Our options:

a) rock the boat, have them re-sign the new contract which has all those provisions (which now has all mentioned in your article, yay)

b) not rock the boat, and simply "apply" those provisions even though the original contract doesn't have them or is ambiguous about a few items (e.g. price increases)

c) not rock the boat at all, do exactly what it says in our meh-contract, not make more money

Would love to get some best-practices/ case studies/ guidance on this.

PS: there is 0.01% chance of the customer going somewhere else, our product is superglue-sticky, but I both want to be a good partner to one of my biggest clients AND still do what's right for my business