👋 Hi, I’m Kyle and welcome to my newsletter, Growth Unhinged. Every other week I take a closer look at what drives a SaaS company’s growth. Expect deep dive takes on SaaS pricing, product-led growth, public company benchmarks, and much more.

“You Can’t Win”

That’s how Freshworks Founder & CEO Girish Mathrubootham started out his opening letter in the company’s recent S-1 filing.1

From a traditional SaaS growth perspective, it’s hard to see how Freshworks - the help desk, CRM & IT service management company - could possibly break through:

How could they differentiate in (extremely) crowded markets?

How could they compete against far larger, better funded competitors?

How could they build a global SaaS company from India?

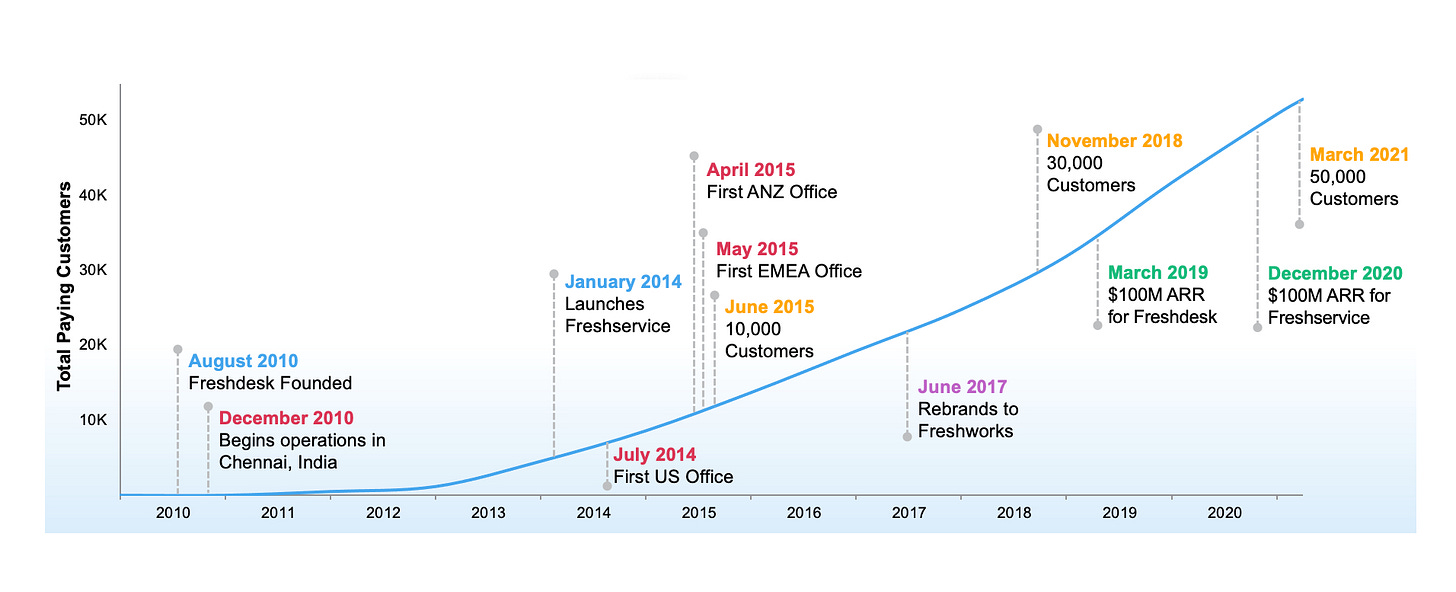

Fast forward to today. Freshworks set IPO terms on Monday, September 13 that would value the company at $8.9 billion. Some quick stats:

$308M in LTM (last 12 months) revenue

49% LTM growth rate

$35M LTM cash from operations

118% NDR

Two products - Freshdesk & Freshservice - each generate >$100M in ARR

Girish attributes Freshworks’ success to being unconventional from the beginning. A big piece of that was pioneering a product-led growth (PLG) strategy targeted at an underserved part of a large market.

Let’s dive in.

“We didn’t target large enterprises. We didn’t have access to a been-there-done-that talent pool. We designed our products for the people actually using them. We offered a ‘fresh’ approach relying on efficient, product-led, low-cost, and low-touch sales; and we targeted massive, underserved markets.” - Freshworks S-1

Focusing on users, not just buyers

Thankfully for Freshworks, they picked up on plenty of shortfalls from 'legacy SaaS' vendors (can you feel the knife twisting in?). First among them was that legacy vendors weren’t purpose-built to meet users’ needs.

Freshworks’ user is the frontline employee who’s interacting with customers everyday. These folks have come to expect consumer-like experiences similar to what they used in their personal lives.

But existing vendors have designed their products for executive buyers at the expense of frontline employees. Other products struggle with “complexity, feature bloat, and complicated user interfaces (UI) that often require extensive and ongoing training for users.” Sound familiar?

Even though the Freshworks buyer is likely not the same individual as the frontline employee, Freshworks recognized that end users are becoming increasingly important constituents in software buying. After all, if users don’t adopt the product, executives never see the expected ROI let alone see product insights that they can trust.

Being found organically when folks are solving a pain point

Freshworks focuses on being found ‘organically’ (i.e. via free or low-cost channels) rather than with expensive paid marketing and outbound sales efforts. The top channels they highlight in their S-1 are search marketing and word of mouth, both aimed to “encourage individual users or small teams within an organization to discover, try, and purchase our products.”

In addition to traditional blogs and eBooks, Freshworks’ organic marketing strategy includes a marketplace, academy, and community forum (great for user-generated content):

Marketplace: Features >1,000 pre-built apps to quickly customize Freshworks. Freshworks then ladders up these apps into collections like the “top apps for eCommerce” or “create leads with ease.” App marketplaces are great for reaching high-intent, long-tail users who have specific requirements in mind.

Academy: Freshworks offers both courses and certifications around using its products and upleveling customer service skills. The courses have enrolled 60,000+ learners.

Community forum: The Refresh community allows users to come together around shared interests and help one another when folks run into issues.

I’m also fascinated by the company’s guerilla marketing tactics, which help amplify word-of-mouth and target folks who are fed up with legacy vendors. Two examples:

#Failsforce: Freshworks actually flew a #Failsforce blimp over Salesforce’s Dreamforce conference. The blimp was meant to highlight ‘bloated’ legacy products (🤣). Not surprisingly, that campaign generated a good amount of PR and social engagement.

SaaS Wars: Freshworks then doubled down on #Failsforce, pitting their battle against legacy SaaS vendors as akin to the rebels vs. the empire in Star Wars. You can’t make this up.

Making it easy to get started without talking to a rep

Freshworks then puts its money where its mouth is, making it simple and easy for folks to trial the product and quickly onboard users.

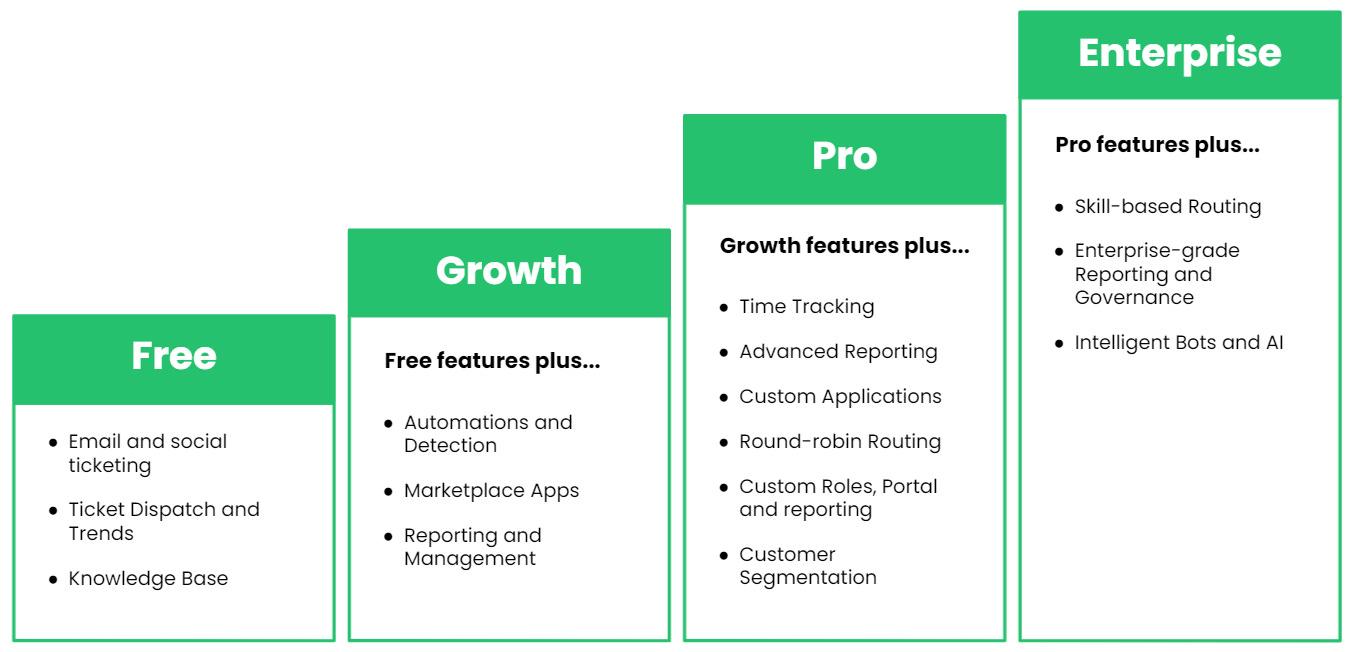

There are 21-day free trials for nearly every Freshworks product. The company also offers freemium editions of flagship products like Freshdesk (generous free editions, too, with unlimited agents) as well as a suite of free sidecar products.

I can attest that the Freshdesk product onboarding is extremely intuitive - especially given the inherent complexity of setting up a help desk system. It includes:

The ability to start configuring an account before requiring you to activate your email

A step-by-step checklist guiding you through the set-up

Guided tours with dummy data that get you excited about what the finished product will look like

Time estimates and status bars to gamify the experience

In-context tool tips

An AI-enabled chatbot to answer any questions

What’s next for Freshworks

Even as many companies drift away from PLG as they move upmarket, Freshworks appears to be doubling down. They’ve noticed that “PLG increasingly governs the buying patterns of not just SMBs, but also mid-market and larger enterprises.”

It’ll be fascinating to see where Freshworks goes next. This will be an IPO to watch.

Disclaimer: I do not provide personal investment advice. All information found here are for informational, entertainment or educational purposes only and should not be construed as investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I've hand some second hand experience with the fresh service team regarding their SSO/OpenID integration for the helpdesk product... Sales team made promises that weren't the lived reality and it has taken months to capture and accurately discuss the problems we were hitting (for a while we were caught in a loop of being pointed to multiple sets of documents that would suggest they could handle, in my opinion, basic sync/exchange with AWS Cognito but neither set hit the use case and product limitations made it impossible). It was a different team handling the integration so I wasn't involved in the meetings 100% of the time but following that experience this article greatly surprises me.

Congrats on their success, I hope other integrators were less frustrated.

Thanks Kyle! Another great share. I see a lot of comparisons to this approach with our freight collaboration platform (think outreach/salesloft with the ability to interface directly with the customer, but for the freight forwarding customer experience).

While everyone is going after the larger players...we're mission-driven and focused on impacting this fractured, smaller forwarder/shipper base and actually making something they WANT to use. And can get started using, without talking to a sales rep. Optimized for inbound, self sign up, onboarding. And FUN, for a sleepy legacy niche.

Q - Kind of surprised didn't see much mention of customer success. Any insights you're able to share in that department? Was CS department ramped up in advance of the sales dept primarily? Curious what those two organizations look like within FreshWorks.

Thanks!