If you’ve been following this newsletter, you’ve probably noticed my fascination with how AI products are increasingly rewriting the rules of SaaS pricing.

Many of the next generation AI apps don’t simply provide a platform to make people more productive, they own a process from beginning to end. They autonomously resolve customer support tickets (Intercom), cull and edit photos (Aftershoot), run outbound campaigns (11x) or take on the role of a sales engineer (Vivun). This creates even more economic value for customers – and it facilitates a different way of capturing that value.

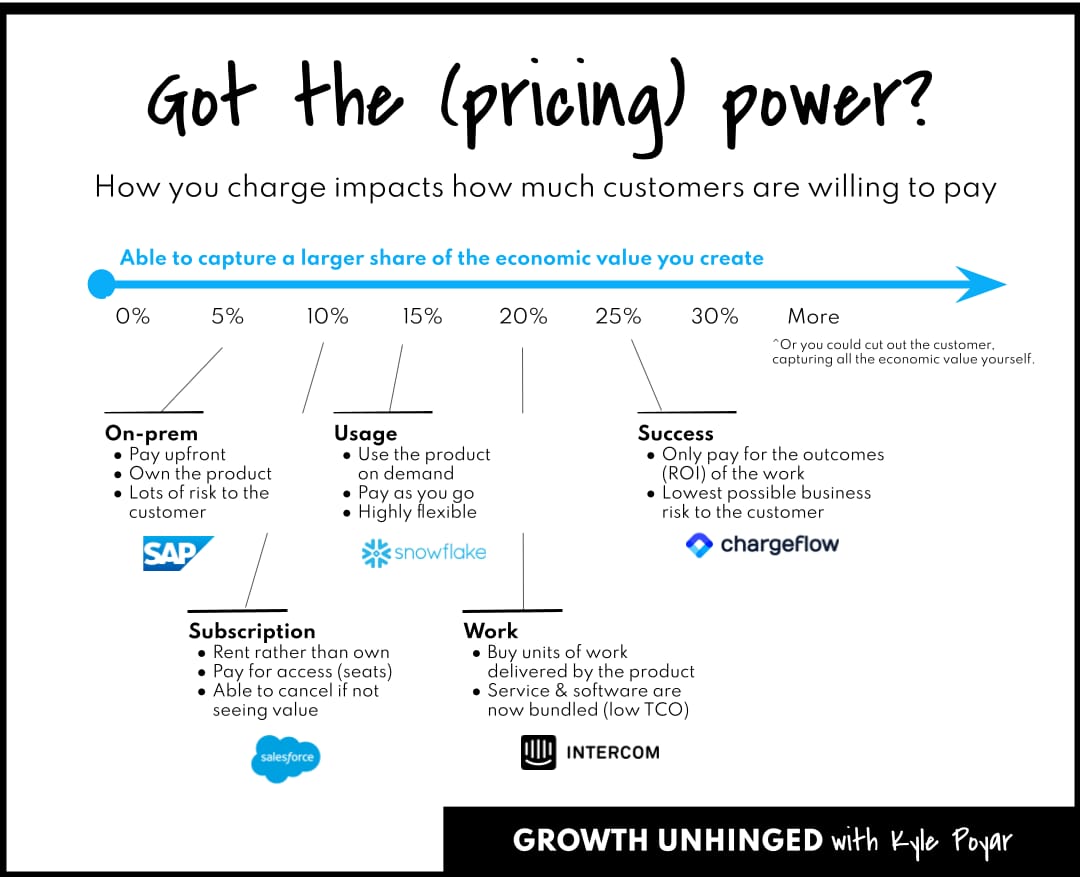

Rather than charging for people to access a product (seat-based pricing), I’m noticing more interest in charging for the work delivered by a combination of software and AI agents. In this world, we “hire” instead of “subscribe” and might be willing to pay more for “premium skills” (think: faster output, higher accuracy, SLAs) rather than “premium features”.

I’ve had a chance to see this shift first-hand at Chargeflow, a “Service-as-a-Software” platform that prevents and recovers fraudulent chargebacks on autopilot. (This happens most often when a customer disputes a transaction for a product or service they actually received – and it’s a major pain for anyone who sells online.)

Chargeflow was one of the first AI products to go all-in on a true success-based pricing model. There are no setup fees, monthly fees or contracts. Customers simply pay 25% of any successful chargeback settled in their favor.

And, by all accounts, they love it. Since officially launching in 2022, Chargeflow has attracted 15,000 merchants and recovered $100s of millions in chargeback revenue.

I’ve gotten to know co-founders (and brothers) Ariel Chen and Avia Chen over the past couple of years (OpenView led an $11M Seed round). They joined Growth Unhinged to unpack Chargeflow’s atypical path to hyper growth including embracing “Service-as-a-Software”, building GTM before writing code and standing out in the Shopify and Stripe App stores.

This is the 17th installment in my Zero to One series, looking back at the early GTM journeys of the next breakout startups.

The TL;DR: 5 learnings from Chargeflow’s “Service-as-a-Software”

Invested in GTM before product. With minimal upfront tech investment, Chargeflow could still deliver the service with humans in the loop. Doing so helped Charegflow nail their differentiation and figure out exactly what to build.

Got “on-the-shelf” where customers are buying. Specifically, Chargeflow focused on getting to the top of the Shopify and Stripe App Marketplaces – and then deepening those partner relationships over time.

Intentionally reminded customers about value. With a service owned from beginning-to-end, with zero work required from the customer, it could be easy for the customer to forget what things looked like previously. Chargeflow is intentional about reminding them of the time and money saved.

Disrupted services firms with simple, success-based pricing. Merchants hated being “double charged” for chargebacks (first by the credit card company, then by their chargeback vendor). Chargeflow’s model removes risk and puts chargebacks on auto-pilot.

Revamped sales compensation to let reps share in the upside. Chargeflow creatively combines estimated spend with true-ups to celebrate sales while minimizing downside risk.

Investing in GTM before investing in AI

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library