The anatomy of a breakthrough “Service-as-a-Software” business

How Chargeflow’s unorthodox approach led to explosive growth

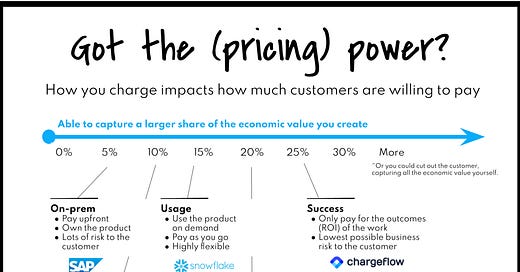

If you’ve been following this newsletter, you’ve probably noticed my fascination with how AI products are increasingly rewriting the rules of SaaS pricing.

Many of the next generation AI apps don’t simply provide a platform to make people more productive, they own a process from beginning to end. They autonomously resolve customer support tickets (Intercom), cull and edit photos (Aftershoot), run outbound campaigns (11x) or take on the role of a sales engineer (Vivun). This creates even more economic value for customers – and it facilitates a different way of capturing that value.

Rather than charging for people to access a product (seat-based pricing), I’m noticing more interest in charging for the work delivered by a combination of software and AI agents. In this world, we “hire” instead of “subscribe” and might be willing to pay more for “premium skills” (think: faster output, higher accuracy, SLAs) rather than “premium features”.

I’ve had a chance to see this shift first-hand at Chargeflow, a “Service-as-a-Software” platform that prevents and recovers fraudulent chargebacks on autopilot. (This happens most often when a customer disputes a transaction for a product or service they actually received – and it’s a major pain for anyone who sells online.)

Chargeflow was one of the first AI products to go all-in on a true success-based pricing model. There are no setup fees, monthly fees or contracts. Customers simply pay 25% of any successful chargeback settled in their favor.

And, by all accounts, they love it. Since officially launching in 2022, Chargeflow has attracted 15,000 merchants and recovered $100s of millions in chargeback revenue.

I’ve gotten to know co-founders (and brothers) Ariel Chen and Avia Chen over the past couple of years (OpenView led an $11M Seed round). They joined Growth Unhinged to unpack Chargeflow’s atypical path to hyper growth including embracing “Service-as-a-Software”, building GTM before writing code and standing out in the Shopify and Stripe App stores.

This is the 17th installment in my Zero to One series, looking back at the early GTM journeys of the next breakout startups.

The TL;DR: 5 learnings from Chargeflow’s “Service-as-a-Software”

Invested in GTM before product. With minimal upfront tech investment, Chargeflow could still deliver the service with humans in the loop. Doing so helped Charegflow nail their differentiation and figure out exactly what to build.

Got “on-the-shelf” where customers are buying. Specifically, Chargeflow focused on getting to the top of the Shopify and Stripe App Marketplaces – and then deepening those partner relationships over time.

Intentionally reminded customers about value. With a service owned from beginning-to-end, with zero work required from the customer, it could be easy for the customer to forget what things looked like previously. Chargeflow is intentional about reminding them of the time and money saved.

Disrupted services firms with simple, success-based pricing. Merchants hated being “double charged” for chargebacks (first by the credit card company, then by their chargeback vendor). Chargeflow’s model removes risk and puts chargebacks on auto-pilot.

Revamped sales compensation to let reps share in the upside. Chargeflow creatively combines estimated spend with true-ups to celebrate sales while minimizing downside risk.

Investing in GTM before investing in AI

Ariel and Avia have been serial entrepreneurs since the age of 12. They started their first eCommerce business at only 16 years old. And they had a breakout hit with Babe Cosmetics, their cosmetics DTC business that grew to 8-figures in revenue in a mere 13 months.

At Babe Cosmetics, the brothers realized they could automate just about everything in eCommerce including emails, checkout funnels, conversion optimization, upsells, reviews, returns and even inventory. The 8-figure business was built with 20 people (SaaS companies, take notice!).

The two main functions that couldn’t be fully automated (at the time) were customer support and chargebacks. In fact, Ariel personally managed customer chargebacks himself. The only available alternatives he found were services-focused vendors where you had to talk to sales, commit to a 2+ year contract, and pay high minimum fees before seeing results. Ariel and Avia believed there had to be a better way – and sold Babe Cosmetics in 2020 to build it.

But the brothers didn’t immediately start writing code. They took a GTM-first approach, making a GTM hire before hiring a single engineer. The GTM hire’s job was to start writing content and build an audience pre-product. Meanwhile, Ariel and Avia built out early mock-ups, a business plan and a pricing model – all so they’d know exactly how to differentiate Chargeflow with their target audience.

“The system was rigged against small business owners. The chargeback offerings out there only wanted to work with enterprises. And instead of contributing to your cash flow, they’d hurt you even more. Chargebacks already take money out of your account; vendors asked for even more money to recover it. We wanted to change the model so customers could benefit until they got the chargeback resolved.

The ability to develop an AI-driven chargeback solution that not only addresses the problem, but also automates the process marked a turning point for us. This convergence of innovation and efficiency is where things became truly exciting.”

- Ariel Chen, co-founder & CEO of Chargeflow

While Chargeflow intended to automate the entire chargeback process for customers, R&D was originally well behind the marketing team. Translation: there were originally humans-in-the-loop although customers still got what they needed – an end-to-end solution they could trust which required near-zero effort to manage.

In the first 12 months, Chargeflow attracted more than 1,200 business signups. At first, the product was essentially just “data fetch automation and then everything was built on Google Docs,” Ariel told me. Already in the first month, Chargeflow started negotiating with a large $400M brand that had already connected their platform; Chargeflow didn’t have a contract to send them. Chargeflow didn’t even have a billing system when they launched; that didn’t come until a few months later (they knew the first resolved chargebacks would take a few months anyway).

Taking a GTM-first approach helped Chargeflow hone in on two important areas for R&D: (1) integrations – this was quite important from a GTM perspective as well, (2) making AI deeply involved in delivering the service. LLMs were a perfect fit for Chargeflow, Ariel and Avia discovered, as the technology can learn how to translate complex order statuses, transaction types, and business types transforming 100s of chargeback reason codes into a fully automated, custom-tailored process, designed to fit each client’s unique cases at scale. With that approach Chargeflow is able to deliver an exceptionally high win rate, setting a new industry benchmark for success rate.

Related: How Keyplay built a media empire before building a SaaS product

Making it dead simple to get started – onboarding in 3 clicks

Coming from a DTC brand, Ariel and Avia wanted to put Chargeflow “on the shelf” where other products were being bought. Their first target: the Shopify App Store. And Chargeflow was first-to-market there.

Chargeflow invested heavily in four areas:

Ranking well on Google when customers were thinking about chargebacks

Figuring out how to be featured in the top position within the Shopify App Store

Running targeted Google ad campaigns around high-intent searches (there wasn’t much competition at this time)

Testing paid ads on the Shopify App Store

When a merchant landed on the Shopify listing, the brothers wanted onboarding to be as fast as humanly possible. “Business owners don’t have much time. Everything should work fast for the customer,” Ariel emphasized.

They were able to get it down to two clicks in Shopify. With a third click, merchants could connect each integration that Chargeflow supported. It’s all a loop: great onboarding led to great reviews, great reviews improved Chargeflow’s position on the App Store, a better position attracted more signups.

The Chargeflow team has extended this philosophy to self-serve onboarding via Chargeflow’s website (independent of Shopify) and now via the Stripe marketplace.

It took Chargeflow a few months to build their Stripe app. The initial interaction required a number of set up steps and questions from the merchant before they could use the product. Ariel and Avia saw this as a mistake. Why not fetch the data from Stripe and immediately show value for the customer?

The extra attention to detail made Chargeflow one of the top apps within Stripe’s marketplace (out of 200+ apps). It attracted 2,500 signups within the first month. Stripe now promotes Chargeflow on the marketplace homepage and even within the Stripe dashboard itself. This way Chargeflow is immediately discovered whenever a merchant has a use for it.

One of the few additions Chargeflow has made to its onboarding: now when a customer signs up, Chargeflow shows them how much time they could have saved with the product. They’ve applied this to the cancellation flow, too, telling merchants exactly how much money Chargeflow saved them as well as how much time Chargeflow saved them. (It’s similar to Canva’s ‘viral’ cancellation flow.)

Navigating sales comp with success-based pricing

Chargeflow’s success-based pricing model has played a big role in the company’s explosive growth. It makes it easy to win customers (who don’t pay until they get their money back) and then keep customers for years since there are no commitments, no monthly fees, and they pay based on what they get out of the product.

But that’s not to say success-based pricing doesn’t have challenges. “Everything is unique here,” Ariel told me. One thing that’s particularly top of mind is sales compensation.

Initially, Chargeflow assigned sales reps a new logo target and offered a bonus on closing the deal. But sales reps saw that their customers were growing – yet they weren’t sharing in that growth.

The team has since moved to spend-based quotas – with a twist. With a vanilla spend-based quota, it could take several months to figure out exactly what spending would look like, meaning that a rep could close a deal in March and not be able to celebrate until the summer. This got complicated quickly and wasn’t the most motivating for sellers.

Now Chargeflow estimates the next 12 months of spend based on a combination of historical data along with characteristics of the merchant (which they capture as soon as the merchant is onboarded). Reps get quota credit for estimated spend, which then gets trued-up over time based on the next 12 months of actuals. Bonuses get paid out in multiple installments over time. That way reps could celebrate on December 31st if they close a customer, but there’s still protection for Chargeflow if that customer quickly churns.

“Sales compensation is one of the most important things for sales. We should have built that first,” Ariel reflected.

I love the concept of "Service as a Software" and think we'll start seeing many more companies take advantage of this offering. I'm going to challenge myself to incorporate it into my consulting practice.

Looks like Stripe is also putting disputes on autopilot: https://docs.stripe.com/disputes/smart-disputes

Their marketing copy is a copy and paste of Chargeflow. Looks like the classic Google/Apple playbook, get some apps onto the app store and then copy the best ones. Stripe is not to be trusted to build apps on! Torpedo'ing their relationships with app developers from day 1.