👋 Hi, it’s Kyle Poyar and welcome to Growth Unhinged, my weekly newsletter exploring the hidden playbooks behind the fastest-growing startups.

My most popular post this year is a deep dive into the state of SaaS pricing. As SaaS increasingly morphs into Al-infused applications, what’s the state of AI pricing?

For help I teamed up with Palle Broe, a startup operator and pricing & packaging expert for high growth tech companies. Palle is Director of Monetization Strategy & Growth at Series D-funded Templafy, early at Uber and author of the Rule of Thumb newsletter where he shares tangible advice for operators.

In the past few years there has been an explosion of AI products and applications—in fact, AI products already attract more than one-fifth of all VC funding.

Many of these AI apps change our relationship with software from something that makes us more productive to something that generates entirely new work products. This makes for favorable market conditions to create new innovative pricing strategies, which leaves us wondering: how are AI apps making money?

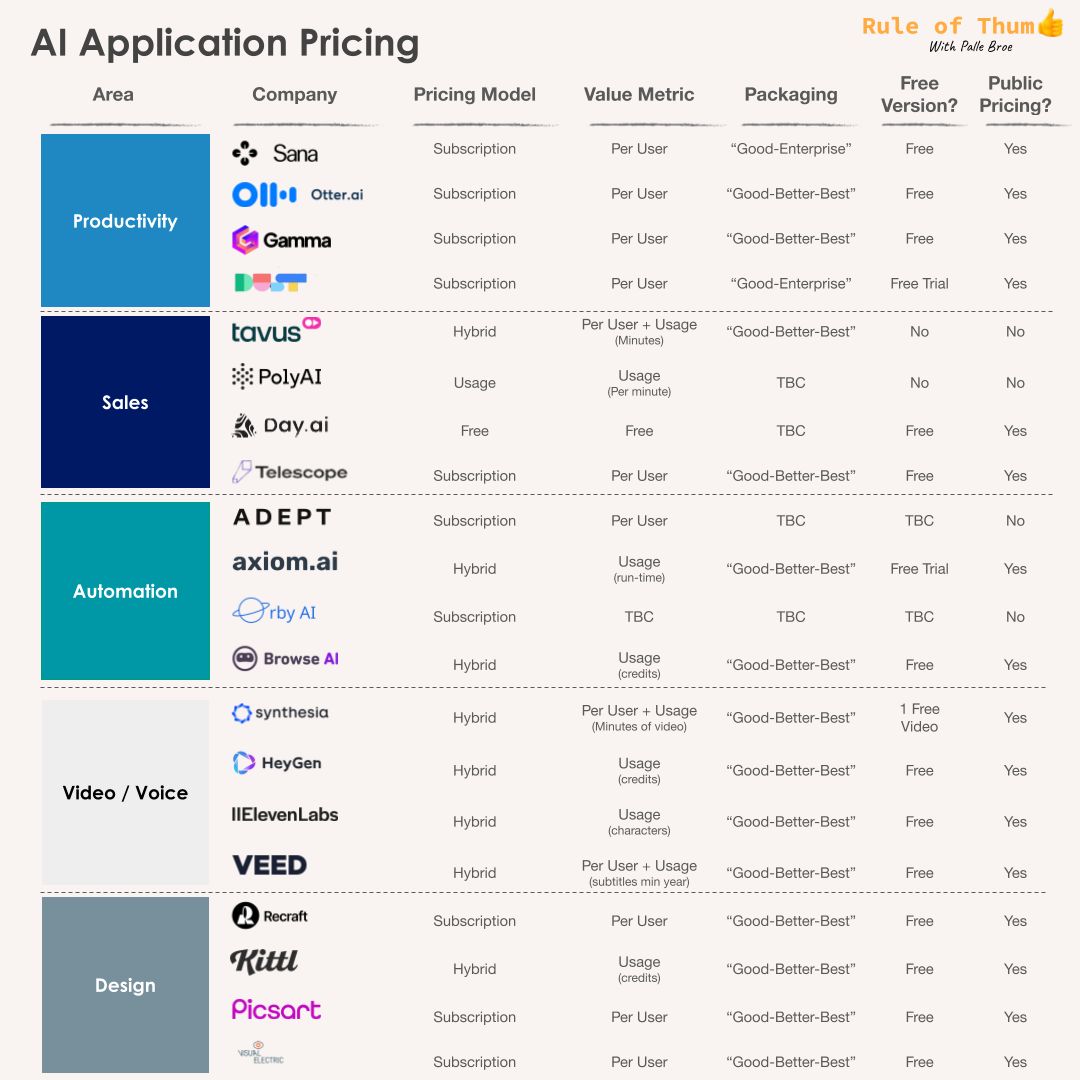

In the Large Language Model (LLM) space and the infrastructure layer, usage-based pricing models have been the norm since commercialization. Most of the companies charge on a per token basis, which is closely aligned with the cost of compute. We instead investigated 40 leading AI-native companies in the application layer to see what’s happening on the pricing front.

The primary criteria used to select the companies was based on external funding and traction from public sources like the Forbes AI 50 List and Sequoia’s Generative AI market map. The 40 companies include marketing tools (ex: Jasper, Copy.ai), productivity apps (ex: Tome, Glean), vertical specific products (ex: Harvey, Co:Helm), and others (ex: Synthesia, HeyGen).

Specifically, we reviewed public data focused around pricing models, value metrics, packaging, free versions and pricing transparency. We deliberately focused on AI-native apps rather than incumbents since these startups don’t have the baggage of a prior install base or legacy pricing model.

Pricing trends for 40 leading AI apps

Five findings stood out to us:

Limited pricing innovation—seven-in-ten have a subscription model and very few offer pure usage-based or pay-as-you-go pricing.

Most companies are charging based on the number of users—consistent with the notion of AI apps as “copilots” (assist people) rather than digital “workers”.

Free versions are extremely popular for initial adoption—one-in-two have a free plan, another one-in-five offer a free trial.

There’s a “Good-Better-Best” paradigm in terms of packages/tiers.

Varying degrees of pricing transparency—two-in-three have public pricing.

You can explore the full pricing data for yourself 👇

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library