👋 Hi, it’s Kyle Poyar and welcome to Growth Unhinged, my weekly newsletter exploring the hidden playbooks behind the fastest-growing startups.

I started the OpenView SaaS benchmarks report back in 2017 because there was a lack of useful metrics data for private startups.

Many folks worried the report might be over. Not so fast… I’m excited to share that I am teaming up with my friends at High Alpha and Paddle to bring back the 8th annual report! With so much changing in SaaS (and AI), it’ll finally provide objective data on what’s happening.

These benchmarks always yield surprising insights about growth, efficiency, tech stacks, go-to-market strategy, and much more. Keep reading for ten of my favorite growth charts from the last year (in no particular order).

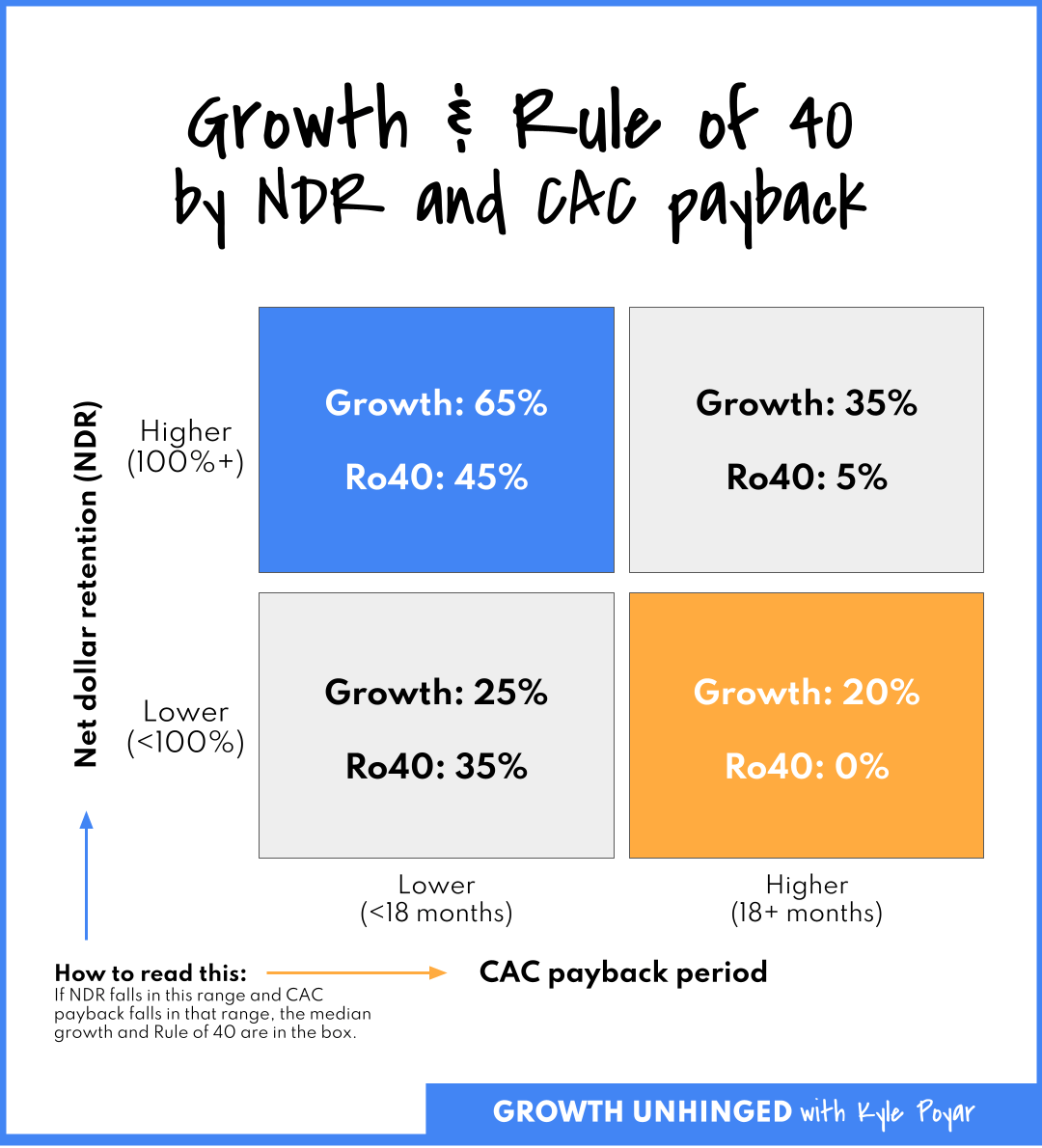

1. THE BEST PREDICTOR OF EFFICIENT GROWTH? LOOK AT CAC PAYBACK PERIOD PLUS NET DOLLAR RETENTION.

Low CAC payback (<18 months) and high NDR (100%+) is your ticket. Read more: your guide to CAC payback period.

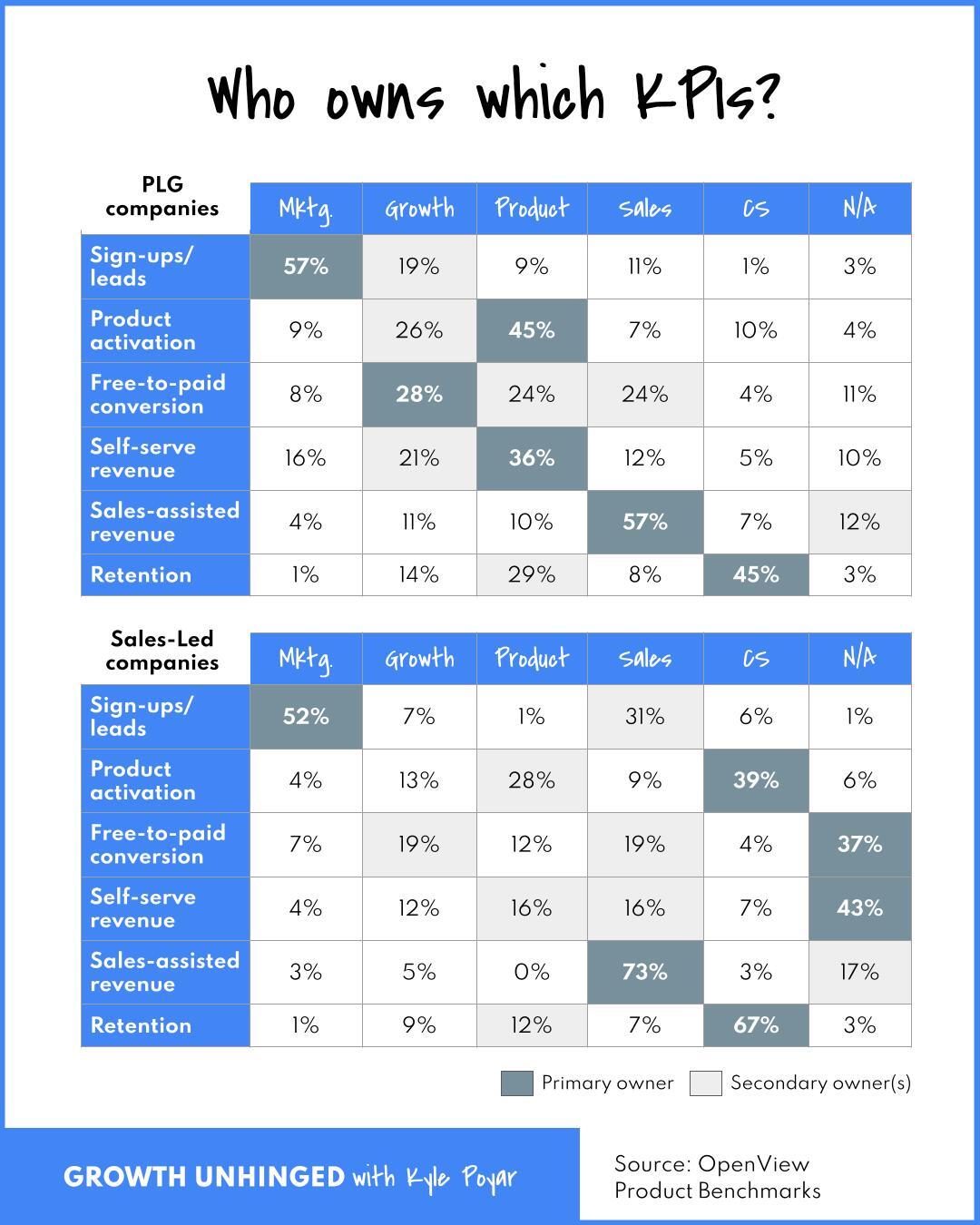

2. WHO OWNS “GROWTH”? IT DEPENDS…

It’s fascinating to see the differences between companies with a product-led growth (PLG) motion compared to those who don’t have one.

The TL;DR: especially in a PLG environment, there is no single revenue owner!

3. YOU DON’T NEED TO BE A CFO TO CALCULATE THE HOT NEW SAAS METRIC: ARR PER EMPLOYEE.

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library