👋 Hi, it’s Kyle Poyar and welcome to Growth Unhinged, my weekly newsletter exploring the hidden playbooks behind the fastest-growing startups. Subscribe to join 52,352 readers who get Growth Unhinged delivered to their inbox every Wednesday morning.

There might have been a time when marketing generated pipeline and sales closed it. But that’s not the world we live in now.

These days marketing, sales, product, customer success and even ops all play a role in acquisition. We’re running paid social, organic social, BDR/SDR campaigns, automated outbound, SEO, lead magnets, free trials, influencer campaigns, field marketing, ABM… heck, we might even be piloting an AI SDR. Anything that could build pipeline is fair game.

Some of these campaigns can be tracked; for others, we’re essentially flying blind unless the customer tells us about it later. A ton of calories go into figuring out precise attribution at a campaign and channel level. And most of those calories are ultimately wasted as attribution becomes a game of who gets credit rather than what’s the best way to influence target accounts to ultimately buy from us.

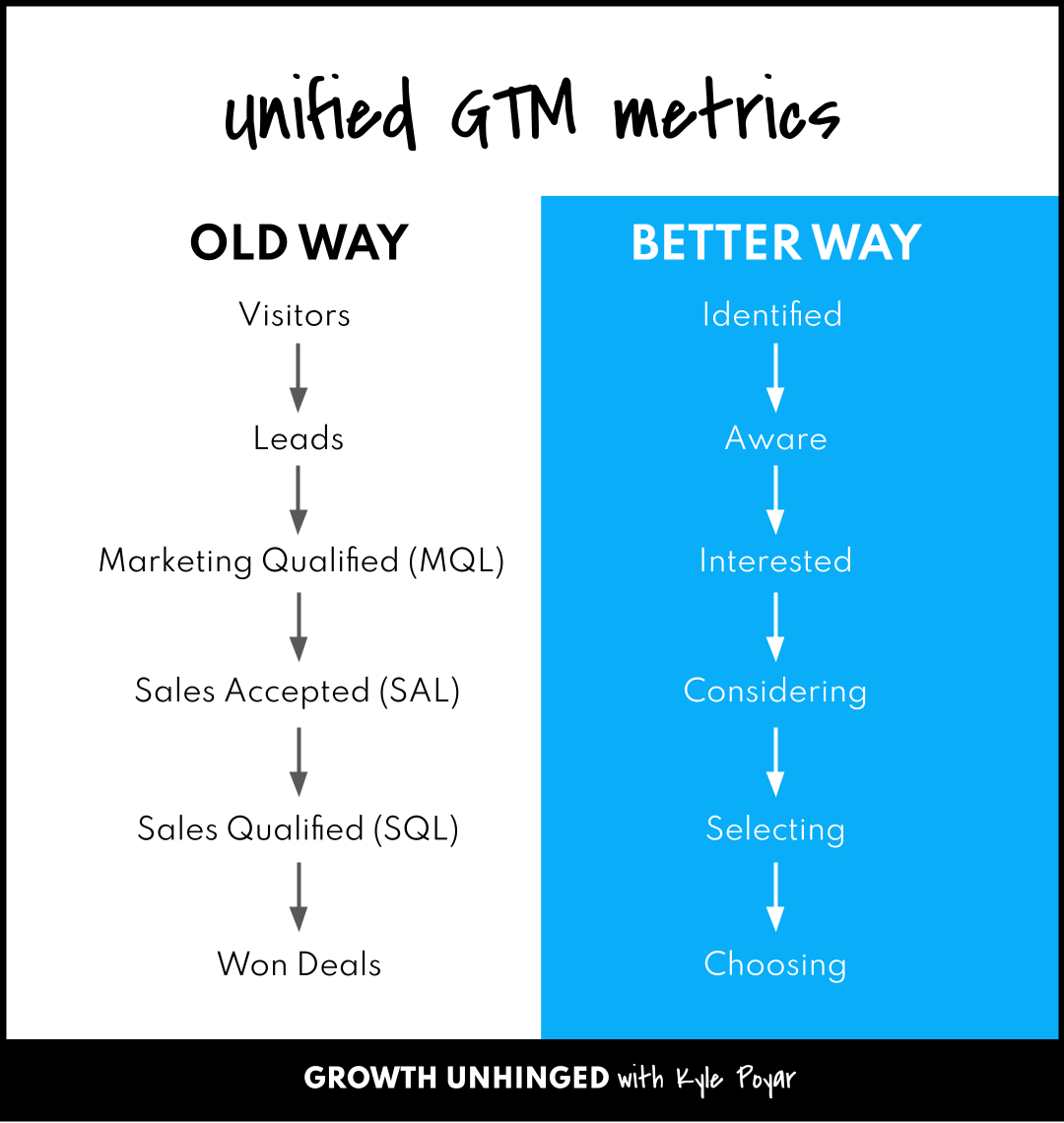

At a fundamental level, our foundational GTM metrics — like traffic, marketing qualified leads (MQLs) and sales accepted leads (SALs) — make it nearly impossible to understand where we stand with our target accounts and what influences those accounts to ultimately buy. What strikes me is that if we’re ever going to find out what works, we need a unified view of go-to-market (GTM) effectiveness.

Shifting to a unified view of GTM drives actual alignment across teams (no more fighting over lead quality). It uncovers hidden opportunities to accelerate pipe creation. And the best news: getting to a unified view should be more attainable than ever due to the explosion of next-gen GTM tools. Let’s dive in 👇

What’s wrong with MQLs

The old view of GTM:

Marketing generates leads… hopefully in our ICP!

Marketing scores those leads, sending the good-ish ones (MQLs) to sales.

Sales cherry-picks the most interesting and ignores the rest.

Of course, if we aren’t hitting our numbers, there might be a bit of what Elena Verna calls “MQL stuffing” at quarter-end. (All’s fair in love and pipeline.)

This playbook never worked particularly well for a product-led growth (PLG) motion where users sign up for, try, and even buy products before ever talking to sales. But we adjusted, flagging high-intent PLG users as “product qualified leads” (PQLs) — a variation of MQLs — for sales to upsell into enterprise customers.

The playbook also never made much sense for account-based motions where marketing and sales concentrate their efforts on a set of target accounts. Again, we pivoted, often flagging ABM as another pipeline channel.

These fixes were band-aids. In my view, the MQL paradigm is broken:

It’s nearly impossible to know whether our efforts are influencing the right people at the right accounts.

It sets up attribution fights and blame games between marketing and sales.

It’s a highly subjective and arbitrary stage — and in many cases is disconnected from the buyer’s intent.

It creates a leaky lead bucket with significant wasted effort and spend.

It encourages spray-and-pray demand generation tactics — with the logic that we can disqualify or filter out anyone who’s a bad fit.

Why not instead focus our efforts on reaching the accounts we care about where (a) our product works the best, (b) we have the best chance of winning, and (c) where our customers are most likely to renew and expand over time?

If we shifted to an account-centric view, we’d measure:

How many accounts are in our ideal customer profile (ICP)?

Where are those accounts in their buying journey with us?

Which activities are most effective at influencing accounts along that journey?

It might look something like this ⤵️

A unified view into GTM effectiveness

Nearly every software company I talk to says they want to focus on their ICP.

Why? Put simply, your best-fit accounts are dramatically more valuable than the average prospect. I’ve found that best-fit accounts have:

Higher win rates (2-3x better than average)

Larger deal sizes (2x better than average)

Faster sales cycles (shorter time-to-close)

Better retention and expansion rates

Staying focused allows you to build better, more differentiated products and then expand from a position of strength.

While nearly everyone wants to be focused, only a select few could show me the data points below. Here’s what it means to be focused on your ICP:

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library