If you enjoy opaque and tedious contract negotiations, you should stop reading now.

Did I lose anyone?

This newsletter usually focuses on the exciting parts of growth like PLG strategy for buzzy AI startups, marketing quick wins or the path to product-market fit.

But, let’s face it, most of the work day isn’t about coming up with new ideas. It’s about everyday occurrences like getting a contract over the finish line before quarter-close (too soon?!) or figuring out the mechanics of your first design partner agreement.

We usually think of sales contracts as bespoke and secretive agreements between us and a specific vendor or customer. That is, until now.

I’ve been collaborating with Jake Stein, Co-founder & CEO at Common Paper, to unpack the real-life data behind B2B contracts in 2024. Jake is a serial founder of startups like RJMetrics (acquired by Magento) and Stitch (acquired by Talend) where he experienced the pain of contract negotiation first-hand. He’s now reimagining a future where B2B companies can create and sign contracts in minutes.

Jake and his team investigated actual contract data from more than 1,000 companies on their platform, and paired it with the collective experience of 45 tech attorneys who are part of the Common Paper Committee.

Growth Unhinged readers are getting a first look. Keep reading for some highlights, then dive into the full contract benchmark report here. In today’s post we’ll unpack:

Key stats on B2B software contracts

Trends around AI clauses (spoiler: these have exploded lately 👀)

Best practices for design partner agreements (pro-tip: set expectations for regular feedback)

Learnings around automatic fee increases (these could be making you 🤑)

Key stats on B2B software contracts

Negotiations are usually private. It always feels like the other side has the upper hand. Here’s what to expect before you’re expecting (a signature):

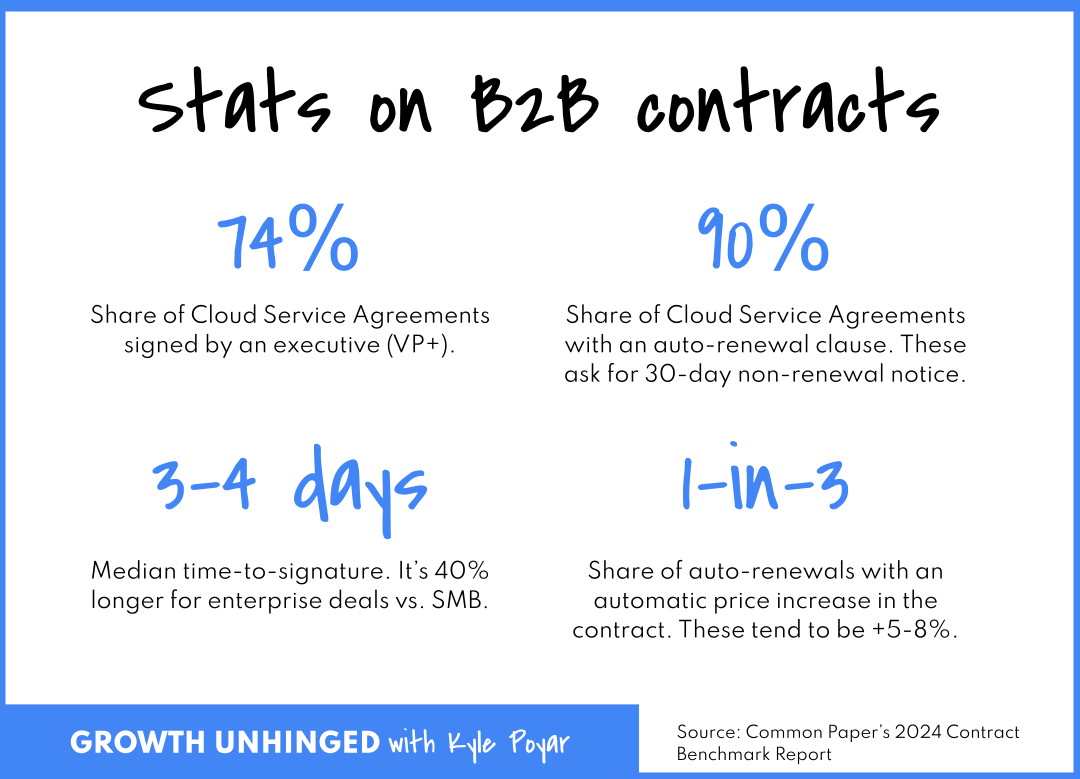

If an above-the-line decision maker isn’t involved in your deal, plan for a delayed signature. 74% of signed Cloud Service Agreements are signed by an executive on the customer side (CXO, VP, Founder). 18% are signed by a Director and only 8% by a Manager or Lead.

Add in a 3-4 day buffer for a signature. If the contract isn’t out for signature by the 27th, it’s probably not getting signed before quarter-end. Interestingly, Common Paper found that the median time-to-signature for an enterprise customer was only 40% longer than an SMB one (~4.5 days vs. 3 days).

There are a handful of commonly negotiated terms. Specifically, the pricing details (no surprises there), auto-renewals and the invoice period. (In my experience as a software buyer, I usually redline auto-renewals the most.)

90% of Cloud Service Agreements (CSAs) have an automatic renewal clause. In most cases, vendors ask for a 30-day non-renewal notice period.

But wait, there’s more… 39% of CSAs include a service-level agreement, 37% include a security policy and 45% include publicity rights (which give a vendor the right to talk about a company as a customer).

The TL;DR: there are valuable concessions you can get in exchange for giving a discount. Look to negotiate for things like publicity rights, auto-renewals and automatic fee increases so there’s something in it for you.

Trends around AI clauses

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library