A few years ago I started writing about what seemed to be a new trend in SaaS pricing.

Rather than charging upfront subscriptions tied to a number of user seats, I noticed more SaaS businesses pivoting to usage-based models where pricing better connected with the value delivered to customers.

Usage-based pricing (UBP), also known as consumption-based pricing, is a monetization model where customers pay for a product, at least in part, based on how much they use it.

These pricing models had a lot to like:

Less friction for customers: Usage-based pricing let customers start using a product for a comparatively low cost, lowering the barrier to entry and attracting more new customers.

Built-in expansion: It removed limits to the number of people who had access to the software, helping customers discover new use cases and achieve greater long-term success.

Bigger TAM: And in doing so, usage-based pricing promised to expand market sizes by making products more accessible while uncapping the potential upside.

Frankly, these pricing changes were overdue. SaaS companies had long relied on pricing models that no longer made sense for customers’ adoption patterns or value realization. Software trends like automation, AI and API-first products don’t square with traditional seat-based subscriptions:

Automation: Software increasingly automates manually processes. The more successful a product is, the fewer user seats a customer needs. Seat pricing doesn’t scale with the value of automation.

AI: AI takes automation a step further, eventually eliminating the need for whole teams of people for ongoing routine work. Monetization can no longer be tied exclusively to human users of a product.

API-first: For many software companies, the value is in the API – software talking directly to other software – rather than the UI. There doesn’t need to be a user to see value.

What I realized, though, was that usage-based pricing wasn’t merely a pricing change. Achieving the potential upside would require rethinking everything from billing to forecasting to org structures to sales comp. Was the juice worth the squeeze?

Additional challenges have arisen since then.

Many folks got spooked about the perceived uncertainty of usage-based pricing models, which appeared more vulnerable to changes in the buying environment. In fact, usage-based businesses did see their revenue growth decelerate faster than traditional subscription businesses during the SaaS slowdown of the past two years. At the other end of the spectrum, AI-first businesses have experimented with even more creative monetization models like ROI or success-based pricing.

It’s time to take a step back. Let’s revisit the state of SaaS pricing.

What’s happening in the market

Usage-based pricing (UBP) had been on the rise since at least 2018. Adoption appeared to be on pace to double from 27% in 2018 to approaching half of SaaS companies in 2022.

Enthusiasm has now cooled. UBP adoption is down slightly year-on-year from 46% to 41%. Meanwhile, 17% of companies are actively testing usage-based pricing, roughly in line with last year.

This data comes from over 3,000 respondents aggregated across six years of surveying private SaaS businesses, including more than 700 from 2023. Surveys were conducted in Q3 of the respective years.

Looking more closely at the data, the pendulum has been shifting away from pure usage-based or pay-as-you-go pricing and toward “hybrid” pricing models that combine usage and subscription pricing in creative ways. That shift seems to be continuing.

A majority of usage-based businesses have a hybrid model rather than pure usage-based or pay-as-you-go (PAYG) pricing. This is especially the case among businesses that sell to smaller customers who might be more sensitive to unplanned expenses.

Zapier makes a good case in point. The automation company recently rolled out big changes to their pricing model, but kept pricing as a hybrid of subscription packages and usage-based pricing. Customers can now build as many zaps as they want on the free plan (this previously had limits) and then need to choose a paid subscription tier based on their product requirements and # of automated tasks. Those who hit task limits keep their subscription and pay-as-you-go for extra usage.

It’s no longer usage-based pricing vs. subscriptions

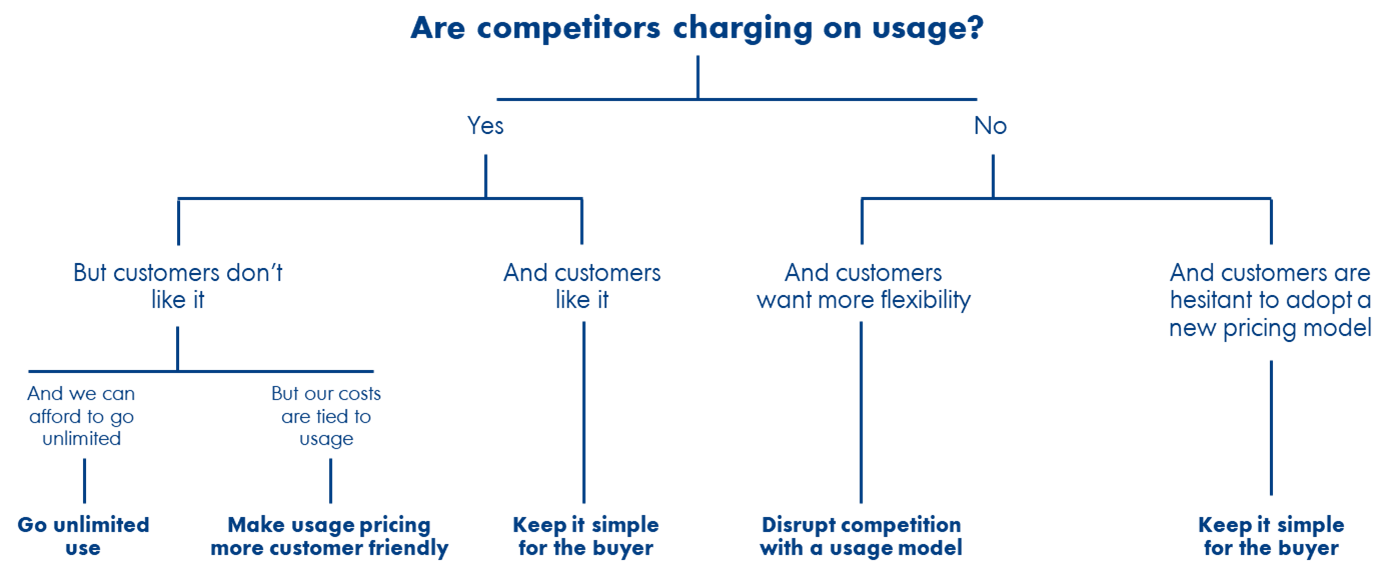

The real enemy of usage-based pricing isn't subscriptions. It's inflexible pricing models with significant upfront commitments where pricing is tied to software access rather than actual consumption or value.

There are (at least) seven flavors of hybrid to consider for your pricing.

📈 Usage-based expansion

GitHub charges on a per-user and subscription basis. They bake in usage of newer products like Actions, Packages and Codespaces “for free” within each subscription package. Customers then pay more as they use more.

💵 Usage-based subscriptions

Clay offers self-service packages ranging from $0 to $800 per month. Customers move up packages based on usage (# of credits), features, integrations or services/support requirements.

💳 Transaction-based revenue + subscriptions

Shopify charges on a subscription basis with a Good/Better/Best package lineup. But "subscription solutions" account for less than 30% of Shopify’s revenue. The rest is a combination of payments, FinTech and marketplace revenue. All of these grow as merchants are more successful.

🌱 Success-based pricing

Intercom made a splash with pricing for their AI support chatbot (Fin). The product is priced at $0.99 per successful resolution — directly aligning the price paid with the value received. Intercom counts a resolution as either (a) the customer confirms the answer is satisfactory or (b) the customer exits the conversation without escalating to a human. The AI chatbot is an add-on to the company’s core subscription offerings, which are priced on a per-seat basis.

🧪 Usage-based pricing for specific segments

Autodesk introduced Flex, a pay-as-you-go offering for occasional product use, in 2021. This was designed to get folks to try out the broad suite of Autodesk products with minimal commitment. Tokens grant access to a given product for 24 hours at a time with different products having different token rates.

👩🏽💻 "Active" user subscriptions

Slack charges for "active" users on a subscription basis. Customers don't need to worry about over-buying for folks who never log-in; they can grant everyone access and are only charged for those who actively use Slack. This is as part of Slack’s Fair Billing Policy (note: it is specifically for self-serve plans).

💳 Credits-based enterprise license agreements (ELAs)

Imagine you're selling a complex multi-product deal where each product is used by different folks in an org. In such cases, some SaaS companies adopt a "retainer" style model where customers commit to a level of spend, then draw down that spend flexibly based on actual licenses allocated to different products.

Common pitfalls of usage-based pricing

As UBP adoption accelerated in 2021 — and as the data showed usage-based companies outperforming their peers — it started to seem like it was an imperative for every SaaS product.

In my view, usage-based or hybrid pricing isn’t for every product. Here are three potential “gotchas” that could cause UBP to backfire.

1) Taximeter effect.

If customers are constantly watching how much the meter is running, they might artificially constrain adoption or hoard their usage credits. This creates a reverse flywheel where customers consume less and less over time.

When AOL famously shifted dialup internet pricing from pay-per-hour to all-you-can-eat, internet usage tripled. Usage-based pricing was literally leading to less internet use. (This was back in the late 1990s 😬)

AI startup Rewind found that capping the number of “rewinds” didn’t work because it dis-incentivized usage of the feature that correlated most strongly with retention. When the company removed this usage cap, rewinds grew by 3-4x according to CEO Dan Siroker. (You can read our full interview here.)

The best way to combat the taximeter effect is to put special attention into picking the right value metric for your pricing. In an ideal state, you provide access to experiencing value and then monetize on the basis of how much value is realized.

Think about Zapier’s recent pricing change, which I mentioned earlier. Once a customer has done the work to set up a new zap — an input to experiencing value — they’re less likely to stop that zap from running and delivering the automation. It’s logical that Zapier would start offering an unlimited # of zaps in every plan and focus their monetization on the # of tasks automated instead.

Look for a usage metric that consistently grows over time for the average customer. It should grow on auto-pilot without the customer having to opt into each use. This metric ideally corresponds directly to the outcomes your customers are trying to achieve meaning that any extra usage is win-win for both parties.

There are subtle things you can do to combat the taximeter effect as well like:

Including a baseline level of usage in all plans. This gets customers in the habit of adopting the product before they have to worry about paying for usage. (This is called a three-part tariff.)

Not penalizing ‘overage’ (in fact, don’t say ‘overage’ all together). Overage indicates penalizing the customer for being more successful than they originally planned. Avoid locking their account until they upgrade or charging punitive overage fees because they didn’t make a large enough pre-commitment. CTRL-F “overage” and replace with either “on demand” or “flex” usage.

2) Fear about a lack of predictability.

A common hesitation about usage models is that customers have a hard time budgeting for an unpredictable or uncertain expense. Budgets are real and procurement teams are certainly scrutinizing software purchases more than they did a couple years ago.

The best way to solve for this concern is to reframe “unpredictable” as a good thing for the customer. “Unpredictable” actually means customers only pay for what they need, and don’t pay for what they don’t need.

That message doesn’t land with everyone, and it’s especially challenging among more traditional buyers. You can control for that by making customers more comfortable with forecasting how much they’ll use and therefore how much they’ll pay. That can happen through the sales process or through a proof of concept.

Another approach that I’ve found to work is to allow customers to draw down their usage flexibly over a longer time horizon (for instance, a 12-month period). This gives the customer plenty of advance warning if their usage is trending ahead of their commitment, helping them plan accordingly.

Some companies take this a step further and promise that there will be no overages during the commitment period. Instead, customers simply true-up at renewal based on the prior year’s usage.

3) Internal behaviors don’t match the new model.

A traditional SaaS go-to-market org looks something like an assembly line. Marketing generates the opportunity, SDRs qualify it, AEs close the deal, etc. Each team becomes myopically focused on what matters for their specific role even if it creates negative repercussions down the line.

This operating model doesn’t apply particularly well in a usage-based context.

In fact, the hard work now *starts* at contract close. Every day the customer is making a decision about whether to use the product, which means every day they could potentially decide to stop paying altogether.

You need to set up your entire company to do what’s in the best interest of making sure your customers are seeing value. That includes things like:

Sales: Not treating “bookings” or “commitments” as the holy grail. Sales compensation needs to adapt accordingly.

Product: Investing in the product as a revenue-generating expense. This tends to mean more product and UX resources toward adoption rather than new features.

Marketing: Connecting marketing efforts with the product and user community.

Customer Success: Being proactive, looking for leading indicators of future success.

For many usage-based companies, the goal is to get new customers in the door with as little friction as possible. They don’t want to maximize the initial deal size. Rather, they’d prefer to spend their time making sure that the customer has successfully implemented the product and is seeing value.

Compensation needs to align with these behaviors. You may, for instance, pay a bounty on all new lands independent of the initial deal size so that reps close deals quickly. Document the behaviors you want each team to drive, then ensure comp isn’t mismatched.

Some may find that it’s not possible or advisable to change mindsets and behaviors with their existing team. Keep in mind what you’re signing up for before pivoting the company.

What’s next?

I’m still bullish about usage-based and hybrid pricing models, but increasingly I see them as a stepping stone toward true success-based pricing.

The reason why usage-based pricing started to take off was because it beat the alternatives. It was a welcome improvement compared to inflexible pricing models with significant upfront commitments where pricing was tied to software access rather than actual value.

If we could get to the promised land — success-based pricing — we wouldn’t have to worry about things like a taximeter effect or customers being afraid of an unpredictable bill. And we’d build a software company where every department is oriented around helping customers achieve their ambitions.

I’ll be watching to see who’s able to unlock this next evolution of software pricing. Circle back next year?

time for an update - as buyer become more self service and digital, and as AI ML, and predictive analytics increases the buyer doing more of the purchase on their own, might be less seats, thus a consumption or usage based becomes like when SFDC introduced subscription because perpetual didn't work for SaaS tech models. Look forward to your update as you are one of the best sources for pricing research and reporting.

Tackling exactly this topic with the startup I'm working with. Thanks for the timely post! Super useful.