A few years ago I started writing about what seemed to be a new trend in SaaS pricing.

Rather than charging upfront subscriptions tied to a number of user seats, I noticed more SaaS businesses pivoting to usage-based models where pricing better connected with the value delivered to customers.

Usage-based pricing (UBP), also known as consumption-based pricing, is a monetization model where customers pay for a product, at least in part, based on how much they use it.

These pricing models had a lot to like:

Less friction for customers: Usage-based pricing let customers start using a product for a comparatively low cost, lowering the barrier to entry and attracting more new customers.

Built-in expansion: It removed limits to the number of people who had access to the software, helping customers discover new use cases and achieve greater long-term success.

Bigger TAM: And in doing so, usage-based pricing promised to expand market sizes by making products more accessible while uncapping the potential upside.

Frankly, these pricing changes were overdue. SaaS companies had long relied on pricing models that no longer made sense for customers’ adoption patterns or value realization. Software trends like automation, AI and API-first products don’t square with traditional seat-based subscriptions:

Automation: Software increasingly automates manually processes. The more successful a product is, the fewer user seats a customer needs. Seat pricing doesn’t scale with the value of automation.

AI: AI takes automation a step further, eventually eliminating the need for whole teams of people for ongoing routine work. Monetization can no longer be tied exclusively to human users of a product.

API-first: For many software companies, the value is in the API – software talking directly to other software – rather than the UI. There doesn’t need to be a user to see value.

What I realized, though, was that usage-based pricing wasn’t merely a pricing change. Achieving the potential upside would require rethinking everything from billing to forecasting to org structures to sales comp. Was the juice worth the squeeze?

Additional challenges have arisen since then.

Many folks got spooked about the perceived uncertainty of usage-based pricing models, which appeared more vulnerable to changes in the buying environment. In fact, usage-based businesses did see their revenue growth decelerate faster than traditional subscription businesses during the SaaS slowdown of the past two years. At the other end of the spectrum, AI-first businesses have experimented with even more creative monetization models like ROI or success-based pricing.

It’s time to take a step back. Let’s revisit the state of SaaS pricing.

What’s happening in the market

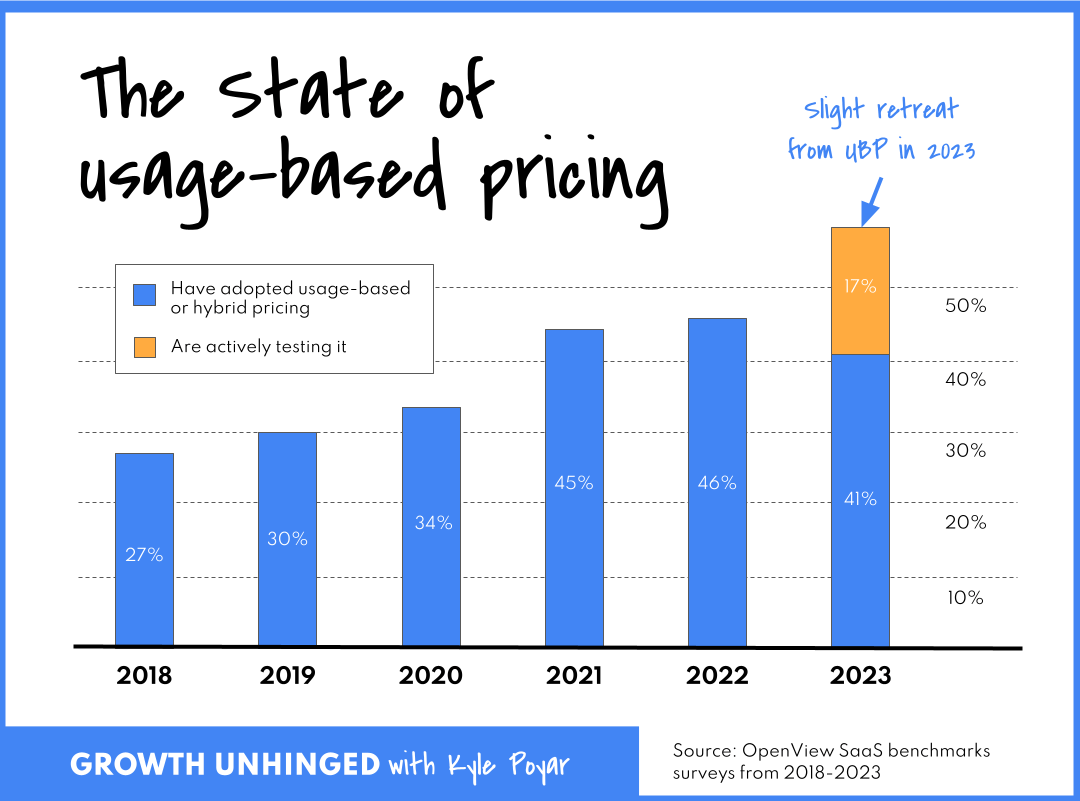

Usage-based pricing (UBP) had been on the rise since at least 2018. Adoption appeared to be on pace to double from 27% in 2018 to approaching half of SaaS companies in 2022.

Enthusiasm has now cooled. UBP adoption is down slightly year-on-year from 46% to 41%. Meanwhile, 17% of companies are actively testing usage-based pricing, roughly in line with last year.

This data comes from over 3,000 respondents aggregated across six years of surveying private SaaS businesses, including more than 700 from 2023. Surveys were conducted in Q3 of the respective years.

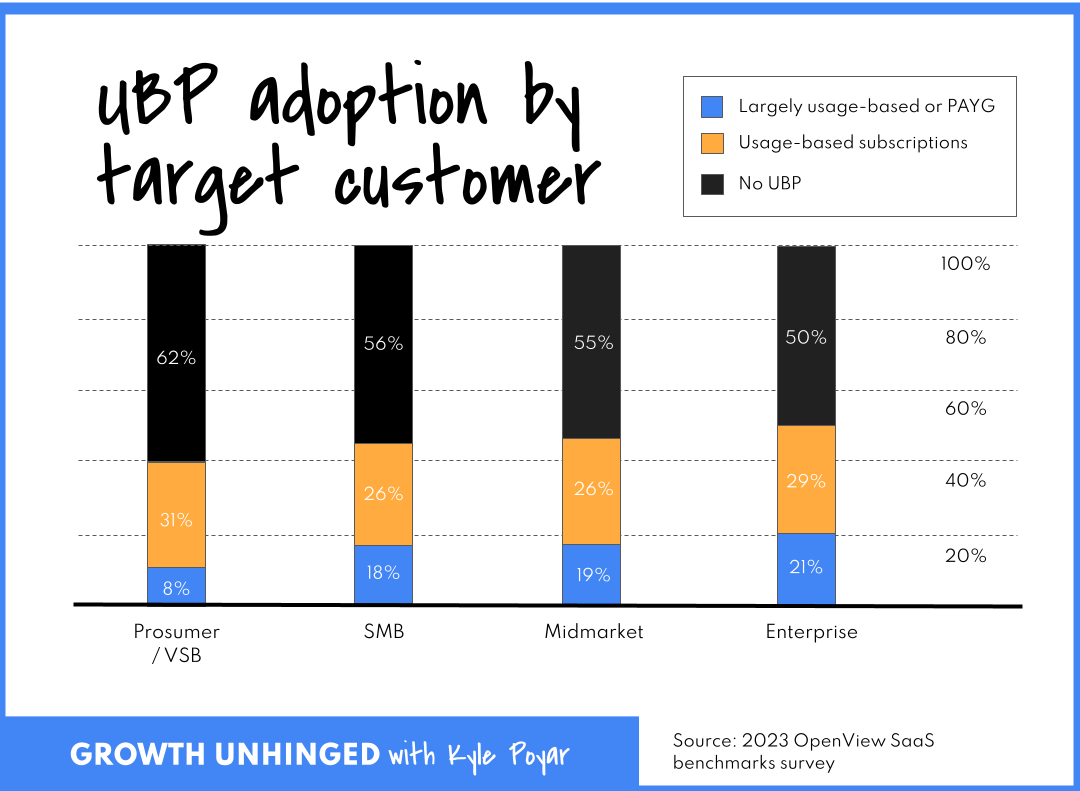

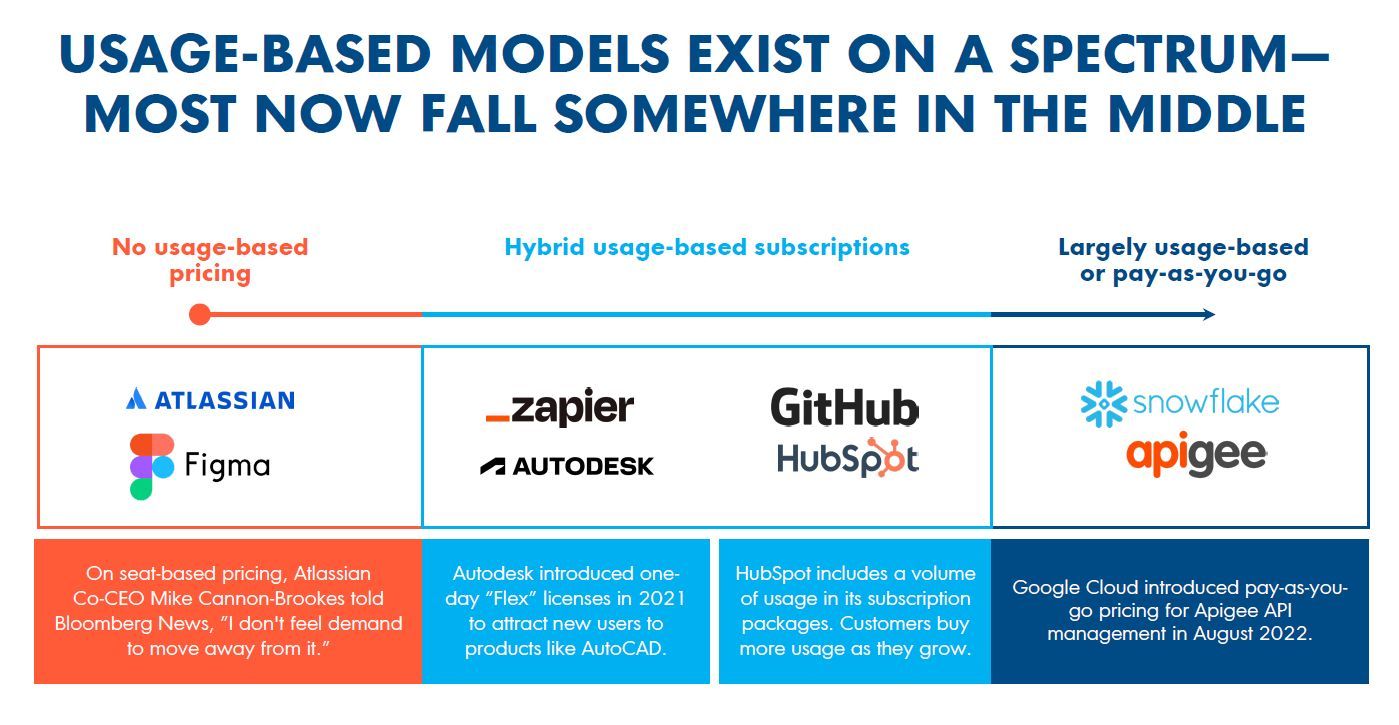

Looking more closely at the data, the pendulum has been shifting away from pure usage-based or pay-as-you-go pricing and toward “hybrid” pricing models that combine usage and subscription pricing in creative ways. That shift seems to be continuing.

A majority of usage-based businesses have a hybrid model rather than pure usage-based or pay-as-you-go (PAYG) pricing. This is especially the case among businesses that sell to smaller customers who might be more sensitive to unplanned expenses.

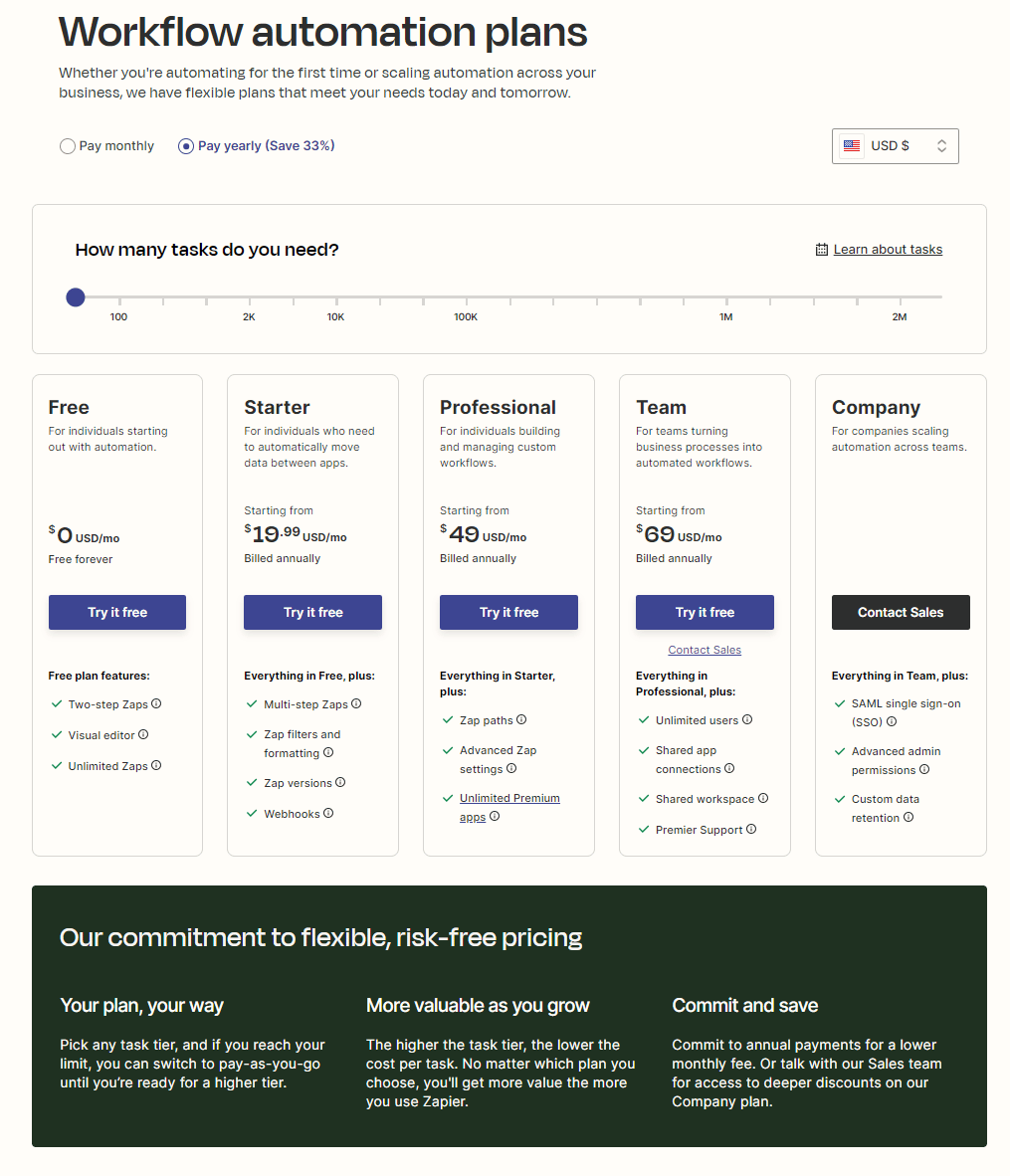

Zapier makes a good case in point. The automation company recently rolled out big changes to their pricing model, but kept pricing as a hybrid of subscription packages and usage-based pricing. Customers can now build as many zaps as they want on the free plan (this previously had limits) and then need to choose a paid subscription tier based on their product requirements and # of automated tasks. Those who hit task limits keep their subscription and pay-as-you-go for extra usage.

It’s no longer usage-based pricing vs. subscriptions

The real enemy of usage-based pricing isn't subscriptions. It's inflexible pricing models with significant upfront commitments where pricing is tied to software access rather than actual consumption or value.

There are (at least) seven flavors of hybrid to consider for your pricing.

📈 Usage-based expansion

GitHub charges on a per-user and subscription basis. They bake in usage of newer products like Actions, Packages and Codespaces “for free” within each subscription package. Customers then pay more as they use more.

💵 Usage-based subscriptions

Clay offers self-service packages ranging from $0 to $800 per month. Customers move up packages based on usage (# of credits), features, integrations or services/support requirements.

💳 Transaction-based revenue + subscriptions

Shopify charges on a subscription basis with a Good/Better/Best package lineup. But "subscription solutions" account for less than 30% of Shopify’s revenue. The rest is a combination of payments, FinTech and marketplace revenue. All of these grow as merchants are more successful.

🌱 Success-based pricing

Intercom made a splash with pricing for their AI support chatbot (Fin). The product is priced at $0.99 per successful resolution — directly aligning the price paid with the value received. Intercom counts a resolution as either (a) the customer confirms the answer is satisfactory or (b) the customer exits the conversation without escalating to a human. The AI chatbot is an add-on to the company’s core subscription offerings, which are priced on a per-seat basis.

🧪 Usage-based pricing for specific segments

Autodesk introduced Flex, a pay-as-you-go offering for occasional product use, in 2021. This was designed to get folks to try out the broad suite of Autodesk products with minimal commitment. Tokens grant access to a given product for 24 hours at a time with different products having different token rates.

👩🏽💻 "Active" user subscriptions

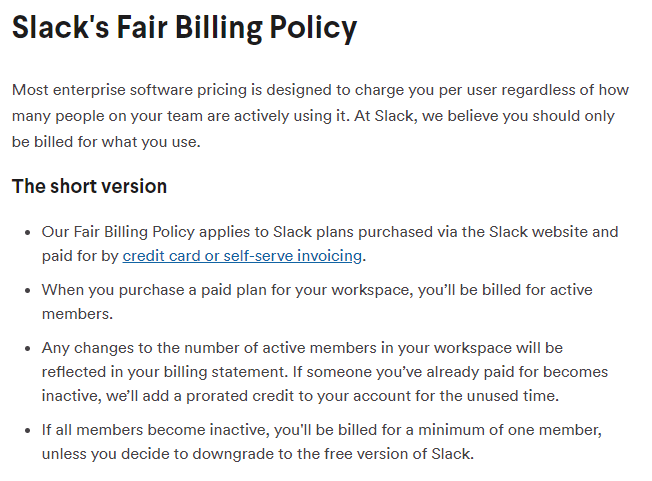

Slack charges for "active" users on a subscription basis. Customers don't need to worry about over-buying for folks who never log-in; they can grant everyone access and are only charged for those who actively use Slack. This is as part of Slack’s Fair Billing Policy (note: it is specifically for self-serve plans).

💳 Credits-based enterprise license agreements (ELAs)

Imagine you're selling a complex multi-product deal where each product is used by different folks in an org. In such cases, some SaaS companies adopt a "retainer" style model where customers commit to a level of spend, then draw down that spend flexibly based on actual licenses allocated to different products.

Common pitfalls of usage-based pricing

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library