My friends at AirOps just released a 🔥 playbook about how to take control of your AI search visibility with examples from Carta, Ramp, and Webflow.

Key insights from my perspective: (1) 70% of AI-cited pages were updated within the past year, (2) 85% of brand mentions in AI search come from third-party sources versus your own, and (3) content less than three months old is 3x more likely to be referenced.

Check out the playbook. Then go deeper with AirOps and growth expert Kevin Indig in their upcoming webinar on December 11th.

It’s been about 60 days since I left VC to become a full-time solopreneur. It feels like it’s been six months.

If I had to describe the transition in one word it would probably be overstimulated. I see so much opportunity yet everything falls to me. Getting summoned to three weeks of federal jury duty in January certainly doesn’t help. I’m resolving to make 2026 the year of focus and, hopefully, some delegating.

The upside is that this is a path I can see myself on indefinitely. I’ve been blown away by the support from readers and the opportunities that have come up.

The newsletter cracked the Business Bestsellers on Substack (#46), only two months after introducing the paid tier! It’s now doing >$75k in annualized revenue from subscribers. (Ads are a bigger revenue source, although I’d like the two to be equal by the end of next year.)

I’m working on more premium offers to make paid subscriptions a no-brainer without alienating free readers. What’s on my mind for 2026: subscriber-only perks on top GTM tools (coming in January 👀), special in-depth reports, and ways to bring the community together. I’m very open to ideas!

I was nervous that free subscribers would stall out. The opposite seemed to happen. Growth Unhinged now reaches over 81,600 readers (33% y/y growth).

My dog has never been happier or more demanding. I’ve created a monster. When I head out for a cold brew, he expects to make a stop at the dog bakery. Next thing he’ll be asking for avocado toast in the morning.

One area where I’ve been spending time is my new-ish podcast, Mostly Growth, with CJ Gustafson. It’s the mostly serious podcast for anyone who cares about startup growth. Somehow we’re already 20 (!) episodes in.

We recently invited guests on the pod and the first four are growth powerhouses: Brian Balfour, Emily Kramer, Leah Tharin, and Dave Kellogg. Today I’m sharing my biggest learnings from those conversations:

Why your marketing isn’t working

The PMF treadmill (and PMF collapse)

Who will buy all the SaaS companies

OpenAI’s path to $500B

Potentially reliable things we read at 2am

What we tried this month

Why your marketing isn’t working

is perhaps my favorite B2B marketing writer. I don’t miss an edition of her iconic MKT1 Newsletter.

She has two frameworks that, in my opinion, get to the heart of why your marketing (probably) isn’t working. They’re called Fuel & Engine and RAM.

Fuel & Engine.

Every marketing team needs a mix of “fuel” (think: great content) and an “engine” to distribute that fuel (think: channels, automation). If you write the world’s best eBook but don’t send it to anybody, you’ve got an engine problem. Teams must constantly build toward balance.

RAM = Random Acts of Marketing.

Emily describes this as “check-the-box-style marketing work, often copying tactics from other companies”. I find that marketing is particularly vulnerable to entropy: it decays into disorder, inefficiency, and busy-ness.

Emily recommends a traffic light system to prioritize where to spend your time: 50% green (double down on what’s working), 40% yellow (iterate on projects that have potential), and 10% or less on everything else.

Start here to diagnose the root cause of ineffective marketing.

🎧 Listen on Apple Podcasts | 🎧 Listen on Spotify

The PMF treadmill (and PMF collapse)

Product-market fit (PMF) used to be seen as a destination. Now it’s more like a treadmill where the speed keeps getting turned up, according to Reforge CEO . And it’s causing even mature $100M+ ARR businesses to see their PMF evaporate seemingly overnight.

What’s changing with product-market fit:

PMF isn’t enough. It’s one of “Four Fits” to build a successful business. The other fits: Product Channel fit, Channel Model fit, and Model Market fit. AI changes each of these all at once.

PMF is a threshold. That threshold keeps going up over time as a product category matures. Part of why mature categories like enterprise CRM are so hard to break into is because the PMF threshold is so high and requires dozens of table stakes features.

The PMF threshold could change overnight. Customer expectations used to rise linearly. New tech shifts with AI mean customer expectations can spike exponentially. You need to go faster just to stay in the same place (and even that might not be enough). See: stock images, online homework help.

Product spend might look more like COGS. If you look at PMF as a treadmill, product investments aren’t necessarily R&D. They’re necessary to keep serving customers and avoid PMF collapse.

Product adoption becomes the bottleneck. As companies ramp up product velocity to stay on the PMF treadmill, product delivery starts to exceed product adoption. Companies are releasing features faster than customers can absorb them. This is Brian’s #1 priority at Reforge, which has increasingly become an AI product company (although many know it for online courses).

🎧 Listen on Apple Podcasts | 🎧 Listen on Spotify

Who will buy all the SaaS companies

Jason Lemkin recently wrote a provocative piece called “Who Will Buy the SaaS Companies?” His answer, to paraphrase, was perhaps nobody. OnlyCFO came to a similar conclusion referencing former ZIRP darlings between $20-$50M ARR with ~20% growth who can’t attract a single buyer.

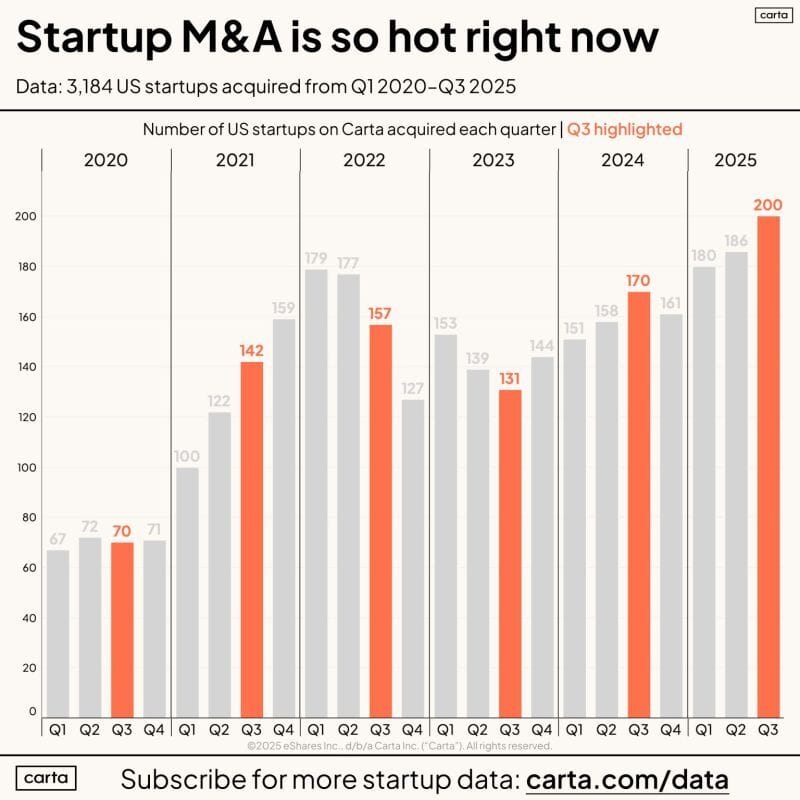

Then I saw Peter Walker share the most recent data from Carta. The headline: “Startup M&A is so hot right now.” Deal volume in Q3 was the highest of the past six years, even above Q1 2022. Anyone else confused?!?

CJ and I discussed the exit environment with SaaS legend Dave Kellogg. What we’re collectively seeing:

M&A is hot and there are buyers at the table. Big Tech companies increasingly need an AI story and are willing to pay for it. A more lenient regularly environment could be playing a role as well.

Exit count is up, but it’s not clear if the $$ of exits are up. Peter Walker shared that ~75-80% of the exits are Seed/Series A companies. Many of these look more like tuck-ins or acqui-hires.

AI companies are (by far) the hottest targets. Although there are two types of AI companies being acquired. Some are AI-native (see: Salesforce buying Doti AI and Convergence AI, Meta buying Scale AI). Others aren’t necessarily AI-native, but they benefit from the AI boom by counting AI darlings as customers (see: OpenAI buying Statsig, Stripe buying Metronome).

There’s noticeably less interest in “good-not-great” SaaS companies. The best liquidity path for these businesses is probably private equity (PE). Yet PE might be unwilling to pay anywhere near the price of the last VC round. And PE can afford to be highly selective, looking for profitable market leaders who they can make AI-powered.

It’s even more critical to know your target buyer and position the business to be attractive for them. If that’s PE, buyers want to see (a) profitability, (b) market leadership — likely in a specific vertical, (c) stickiness, and (d) a SaaS plus AI story. If that’s BigTech, buyers want to see growth (ideally 30%+) plus Rule of 40 plus a clear fit with their 3-5 year roadmap.

🎧 Listen on Apple Podcasts | 🎧 Listen on Spotify

OpenAI’s path to $500B

If you’re OpenAI trying to get to, say, $500B in revenue in five years, what do you do?

Why $500B? It’s a bit arbitrary, but a $500B revenue target in five years implies a scale that could (hopefully) self-fund OpenAI’s ongoing innovation and justify a near-term valuation around $1T. And JP Morgan says big tech firms will need AI revenues to exceed $650B by 2030 (up from $50B today) to make their infrastructure investments worthwhile. OpenAI would conceivably want to be the dominant player here.

OpenAI reportedly did $5B ARR in 2024 and is on track for $20B ARR in 2025. ~80% of the revenue is estimated to be from ChatGPT and ~20% from the B2B API business (Antropic’s is split the opposite way).

If OpenAI doubles down on consumer subscriptions, what’s the upside? The biggest B2C subscription businesses we could think of were Netflix (~$40B run-rate) and Amazon Prime (similar ballpark). Even if OpenAI were to become the biggest consumer subscription business, that’s still ~10-20% of the way to $500B.

What if OpenAI doubles down on enterprise? Salesforce, likely the biggest pure-play B2B SaaS company, does about ~$40B in revenue. SAP does a similar amount. There’s money here, but there will be intense competition from Anthropic and others. It might get them another ~10% of the way to $500B.

How about advertising? This is a massive space. CJ estimated Google’s ad revenue to be ~$250B. Meta’s is ~$150B. It feels inevitable for OpenAI to prioritize this revenue stream given the TAM as well as the costs required to support free users. (Although what looks like early tests haven’t had the best response…)

Could OpenAI go even further, tapping into transactions via a marketplace model? Amazon reportedly takes an ~8-15% transaction fee on purchases. Stripe takes ~3%. If ChatGPT is telling consumers what to buy, I suspect they’d increasingly want to split some of the upside with brands.

The TL;DR: There is a path to hundreds of billions in annual revenue. But it’ll need to be a layer-cake and I suspect it’ll increasingly come from advertising and transaction fees.

🎧 Listen on Apple Podcasts | 🎧 Listen on Spotify

Potentially reliable things we read at 2am

When the AI agent isn’t actually AI. Fireflies, the AI notetaking app valued at $1B+, recently went viral for sharing what happened behind the scenes. It wasn’t really AI back in 2017; it was two guys surviving on pizza.

How to win The Traitors. I’m addicted to The Traitors, the reality TV show akin to Mafia or Secret Hitler. The latest UK Celebrity season has been fantastic. The Economist wrote about the game theory of The Traitors, highlighting the strategy of “rational herding”. The money quote: “For traitors this suggests an appealing strategy. Do not try to lead the discussion about who to banish, which might draw too much attention. Do enthusiastically agree with someone else’s mistake.”

What we tried this month

SuperMe, my AI avatar. Kyle AI is trained on 707k of my insights. What could go wrong?

Boardy, an AI Superconnector helping 100+ founders raise their round by EOY. It’s product onboarding: a surprisingly intimate AI phone call.

Tolan, an alien best friend. Brian Balfour was shocked at how emotionally attached he became to it.

Wispr Flow, Dave Kellogg’s favorite voice dictation app. He marveled at how well it picked up SaaS jargon.

Gamma, the AI-native PowerPoint. I liked that they didn’t push you into a prompt bar UX. They gave three options for getting started: paste in text, generate from prompt, or import a file/URL.

Irish goodbye-ing a networking happy hour. Zero regrets.

Samin Nosrat’s buttermilk-brined roast chicken. I made it instead of turkey on Thanksgiving and it was excellent.