I started the annual SaaS benchmarks report at OpenView back in 2017 (!) because there frankly wasn’t useful metrics data for startups. We didn’t have an objective view into what metrics were “good” and “great” — or what was happening in the industry. Over these past eight cycles we’ve navigated ZIRP-fueled highs, SaaS slowdowns and now a once-in-a-generation period of tech innovation.

Fast forward to 2024. In partnership with my friends at High Alpha, Paddle and OpenView, we’re releasing the 8th annual benchmarks report based on data from more than 4,000 companies in aggregate and 800+ from this year’s survey.

You can check out the full report here. I’ll unpack the data that stood out to me — and what to learn from it.

How do you compare? Benchmarks across the big SaaS metrics.

Early stage SaaS is back and stronger than ever. Everyone else, not so much.

Leaner teams and faster growth? How to build a high ARR per employee business.

Trouble on the horizon(tal). It’s really hard to be a horizontal SaaS app right now.

Time for AI monetization. Is there appetite for next-gen pricing models?

1. How do you compare? Benchmarks across the big SaaS metrics.

The biggest theme for 2024 is stabilization. After big swings up (and then down), 2024 looked a lot like 2023.

Just look at median growth rates for 2024 compared with 2023:

<$1M ARR: From 90% (2023) to 100% (2024)

$1-5M ARR: From 58% (2023) to 50% (2024)

$5-20M ARR: From 35% (2023) to 30% (2024)

$20-50M ARR: From 24% (2023) to 30% (2024)

>$50M ARR: From 25% (2023) to 15% (2024)

The downside: things have stabilized at a much lower pace than the boom period from H2 2020 to H1 2022. We see this in the 2024 SaaS benchmarks data alongside public SaaS growth, VC funding activity as well as real-time data from the ProfitWell by Paddle B2B SaaS index.

On the public SaaS side, median year-on-year growth rates have come down from 30-40% in 2021-2022 to 15% in 2024. This feels particularly anemic considering that median net revenue retention (NRR) still hovers around 110%.

The TL;DR: folks are working harder and harder simply to keep their head above water, let alone grow into the heady valuations of only a couple years ago. But there are exceptions…

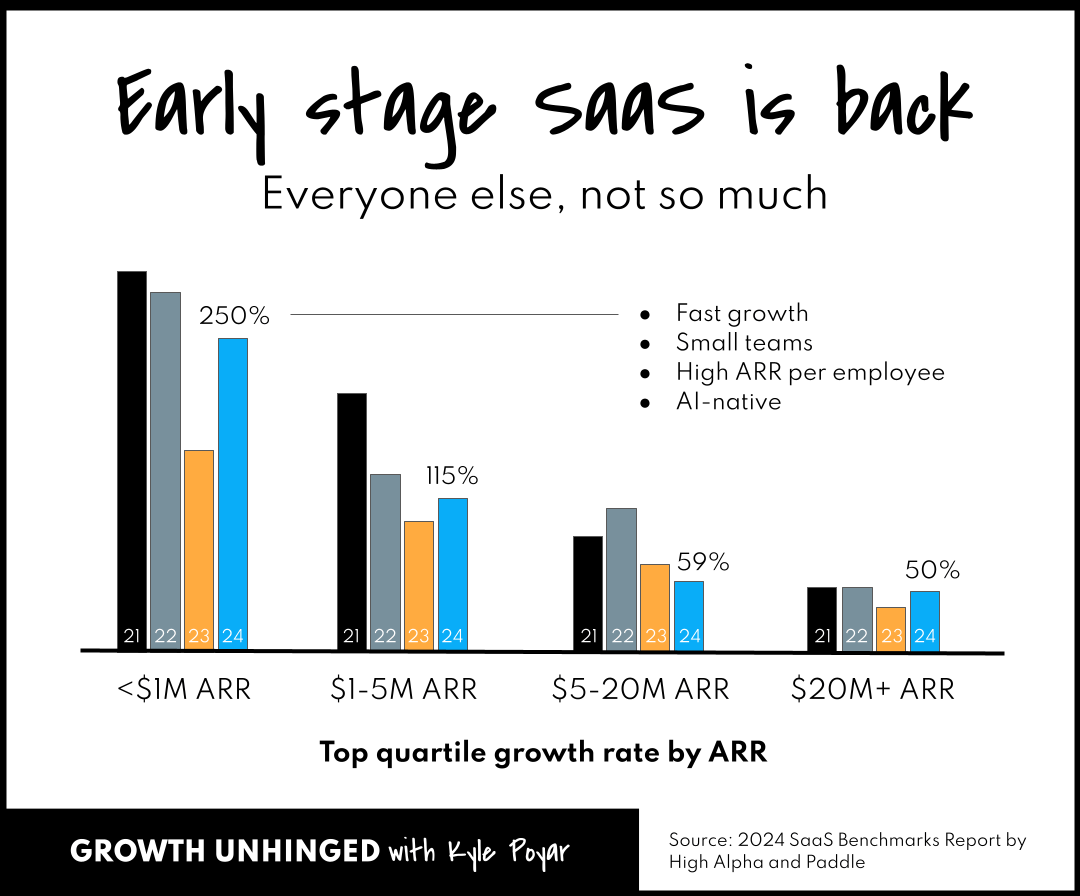

2. Early stage SaaS is back and stronger than ever. Everyone else, not so much.

The bright light in this year’s report: early stage SaaS and AI companies with less than $1M in ARR. Within this segment of businesses:

Top quartile growth has skyrocketed from 150% (2023) to 250% (2024).

They’re embracing AI tools themselves to grow while maintaining a lean team. The median headcount for these businesses has reduced from 12 (2023) to just 7 (2024).

They’re building stronger businesses, spending less on sales & marketing (lower CAC payback) while seeing better retention rates.

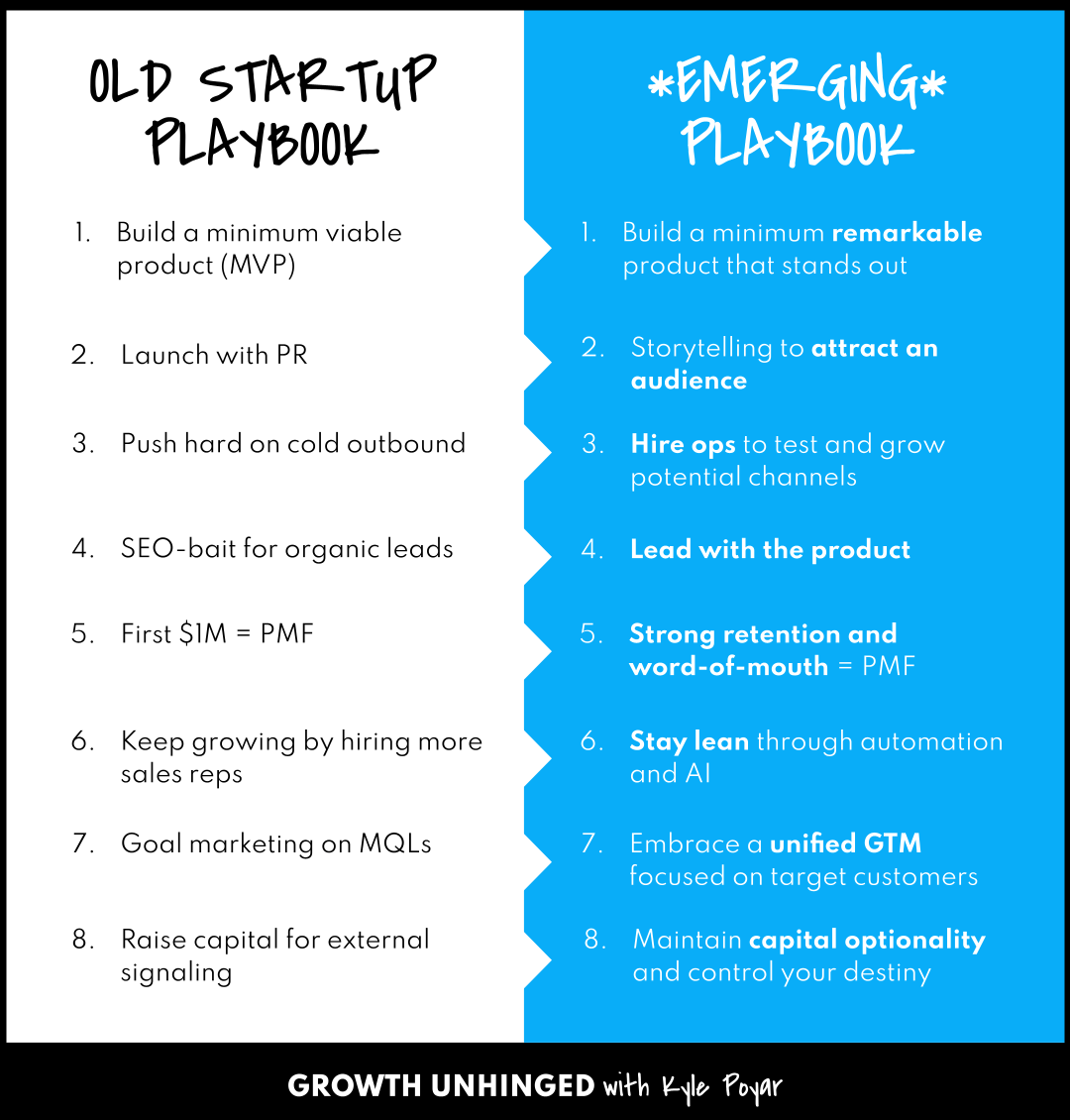

These next generation companies are ditching conventional wisdom and increasingly embracing an emerging startup playbook. They’re waiting to launch until they have a minimum remarkable product that stands out. They’re hiring ops folks to test and grow potential channels before doubling down on the ones that work. And they’re staying leaner for longer through automation and AI (it’s no wonder the GTM engineer seems to be the next hot GTM role).

Related: How to build your GTM strategy from scratch, How Jam went from seven failures to 10x growth

3. Leaner teams and faster growth? How to build a high ARR per employee business.

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library