👋 Hi, it’s Kyle Poyar and welcome to Growth Unhinged, my weekly newsletter exploring the hidden playbooks behind the fastest-growing startups.

In the last eight years I've surveyed 4,000+ private SaaS companies to figure out what's going on in the industry. Never have I seen benchmarks go out of date so quickly.

Let's separate hype from reality and find out what's really going on today. Take the 9th annual SaaS benchmarks survey here.

This report is super special to me. I'm so excited to continue the journey with my friends at High Alpha. The full report will drop in the Fall and all participants will get early access to the data (I’ll also share it here).

THANK YOU for your support. Now, on with the newsletter.

Let’s rewind the clock to 2022. The Oscars slap happened. Elon bought Twitter. Wordle became a thing.

Back then the typical <$1M ARR software startup had 13 people. “T2D3” was still the name of the game. Hiring a big team was a flex; in fact, the highest quartile of <$1M ARR SaaS companies had 38 (!) people.

Well, software startups have changed. As of last year, the typical <$1M ARR software startup had just 7 people. Expectations around ARR per employee went through the roof. AI agent workflows have become the thirst trap of LinkedIn (and perhaps this newsletter?). The new flex is reaching the top of the Lean AI leaderboard.

I thought now is a good time to shed preconceived notions and investigate the new SaaS org chart, by the numbers. The data comes from the most recent SaaS benchmarks report, which covered 800+ software companies including both VC-backed and bootstrapped companies.

The widening gap between early-stage startups and everyone else

Zooming out, there’s an increasing divergence between early-stage startups and everyone else.

Software companies used to get way more efficient as they scaled with a $50M+ ARR company typically making 2-3x the ARR per FTE of a $1-5M ARR startup. This was part of the magic of SaaS! But it’s no longer consistent with what’s happening.

More mature SaaS companies are facing dual crises of team bloat paired with decelerating growth.

Median ARR per employee was down slightly (-9% year-on-year) among businesses with $5-20M ARR.

It dipped even further (-17% year-on-year) for those with $20-50M ARR.

It fell materially for companies with >$50M ARR (-34% year-on-year).

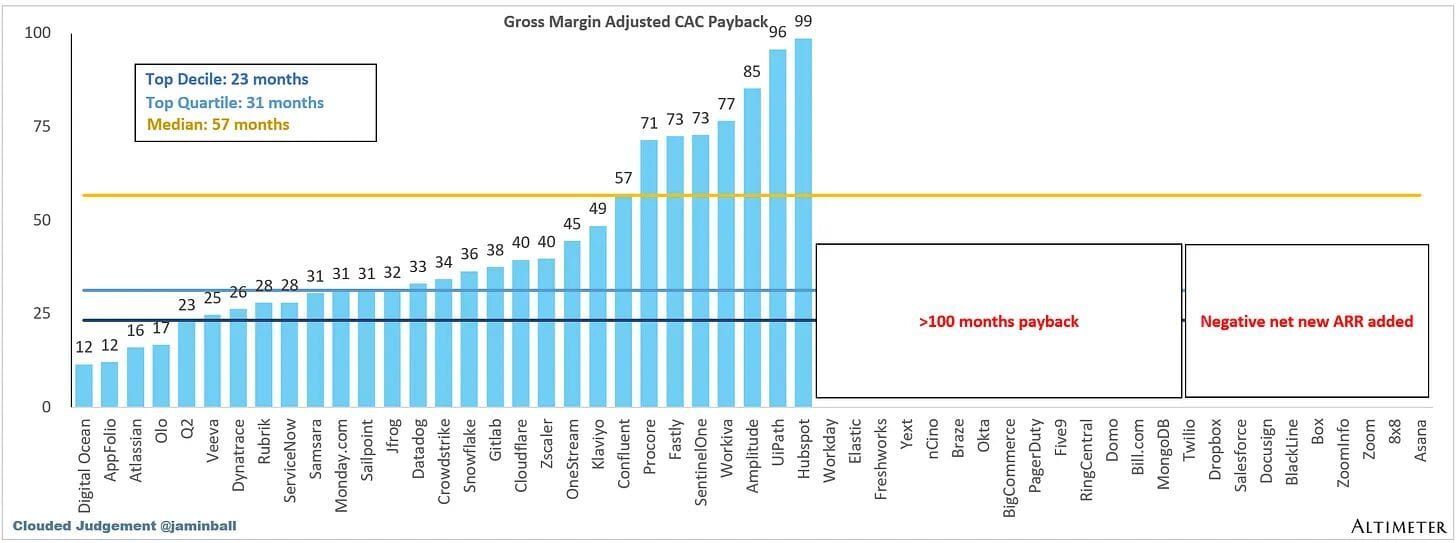

Looking at public software companies, there’s a worrying level of inefficiency, too. Public SaaS companies ended Q1 2025 with an average gross margin-adjusted CAC payback period of 57 months based on estimated data from Clouded Judgement1. Said differently, it takes the best companies nearly five years to recover their sales and marketing spending.

This isn’t some extreme outlier quarter. The average CAC payback period over the past twelve quarters is now 41 months. CAC payback periods haven’t been healthy since Britney Spears’s conservatorship ended in 2021!

Public companies can afford for their GTM to be inefficient in the short-term. They have plenty of profitable legacy customers who can subsidize sales and marketing. But the subsidies can’t go on forever. And a reckoning could be on the horizon.

Early-stage startups have gone in the opposite direction. Early-stage teams are much smaller than in previous years and seeing far higher ARR per employee.

Subscribe to Kyle Poyar's Growth Unhinged to read the rest.

Become a paying subscriber of Growth Unhinged to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Full archive

- Subscriber-only bonus posts

- Full Growth Unhinged resources library