Your guide to the 2024 SaaS benchmarks

We're dropping new data from 800+ SaaS and AI companies

I started the annual SaaS benchmarks report at OpenView back in 2017 (!) because there frankly wasn’t useful metrics data for startups. We didn’t have an objective view into what metrics were “good” and “great” — or what was happening in the industry. Over these past eight cycles we’ve navigated ZIRP-fueled highs, SaaS slowdowns and now a once-in-a-generation period of tech innovation.

Fast forward to 2024. In partnership with my friends at High Alpha, Paddle and OpenView, we’re releasing the 8th annual benchmarks report based on data from more than 4,000 companies in aggregate and 800+ from this year’s survey.

You can check out the full report here. I’ll unpack the data that stood out to me — and what to learn from it.

How do you compare? Benchmarks across the big SaaS metrics.

Early stage SaaS is back and stronger than ever. Everyone else, not so much.

Leaner teams and faster growth? How to build a high ARR per employee business.

Trouble on the horizon(tal). It’s really hard to be a horizontal SaaS app right now.

Time for AI monetization. Is there appetite for next-gen pricing models?

1. How do you compare? Benchmarks across the big SaaS metrics.

The biggest theme for 2024 is stabilization. After big swings up (and then down), 2024 looked a lot like 2023.

Just look at median growth rates for 2024 compared with 2023:

<$1M ARR: From 90% (2023) to 100% (2024)

$1-5M ARR: From 58% (2023) to 50% (2024)

$5-20M ARR: From 35% (2023) to 30% (2024)

$20-50M ARR: From 24% (2023) to 30% (2024)

>$50M ARR: From 25% (2023) to 15% (2024)

The downside: things have stabilized at a much lower pace than the boom period from H2 2020 to H1 2022. We see this in the 2024 SaaS benchmarks data alongside public SaaS growth, VC funding activity as well as real-time data from the ProfitWell by Paddle B2B SaaS index.

On the public SaaS side, median year-on-year growth rates have come down from 30-40% in 2021-2022 to 15% in 2024. This feels particularly anemic considering that median net revenue retention (NRR) still hovers around 110%.

The TL;DR: folks are working harder and harder simply to keep their head above water, let alone grow into the heady valuations of only a couple years ago. But there are exceptions…

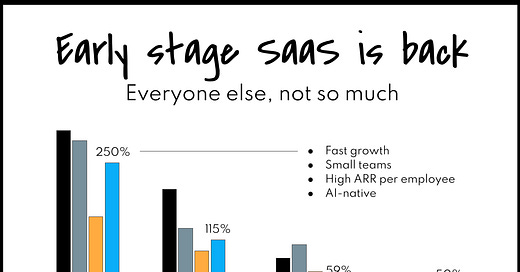

2. Early stage SaaS is back and stronger than ever. Everyone else, not so much.

The bright light in this year’s report: early stage SaaS and AI companies with less than $1M in ARR. Within this segment of businesses:

Top quartile growth has skyrocketed from 150% (2023) to 250% (2024).

They’re embracing AI tools themselves to grow while maintaining a lean team. The median headcount for these businesses has reduced from 12 (2023) to just 7 (2024).

They’re building stronger businesses, spending less on sales & marketing (lower CAC payback) while seeing better retention rates.

These next generation companies are ditching conventional wisdom and increasingly embracing an emerging startup playbook. They’re waiting to launch until they have a minimum remarkable product that stands out. They’re hiring ops folks to test and grow potential channels before doubling down on the ones that work. And they’re staying leaner for longer through automation and AI (it’s no wonder the GTM engineer seems to be the next hot GTM role).

Related: How to build your GTM strategy from scratch, How Jam went from seven failures to 10x growth

3. Leaner teams and faster growth? How to build a high ARR per employee business.

Earlier this year I wrote about my love for annual recurring revenue (ARR) per full-time employee (FTE) as in increasingly important metric. It’s a metric you can’t hide from. And you don’t need to be a CFO to calculate it.

Comparing this year to last year, “good” and “great” ARR per FTE is up materially among SaaS companies with less than $5M ARR. On the flip side, it has stagnated or declined among larger, later stage businesses. Here’s how “good” ARR per FTE has trended:

<$1M ARR: From $40k (2023) to $70k (2024) ⬆️

$1-5M ARR: From $90k (2023) to $120k (2024) ⬆️

$5-20M ARR: From $150k (2023) to $150k (2024)

$20-50M ARR: From $200k (2023) to $175k (2024)

>$50M ARR: From $250k (2023) to $175k (2024) ⬇️

On the early stage side, I’m seeing founders embrace founder-led sales (#foundermode) for far longer than they had previously. And when they do hire, they might bring in a chief-of-staff, one or two BDRs, one or two AEs and a fractional leader rather than a full team. Many are getting highly specific about their ideal customer profile, embracing a unified GTM toward that ICP and automating their outbound.

On the later stage side, many have begun hiring again after an extended period of layoffs and hiring freezes. But they’re often hiring in lower cost geographies to keep burn down even as headcount has gone up.

Related: Your guide to ARR per FTE

4. Trouble on the horizon(tal). It’s really hard to be a horizontal SaaS app right now.

Not everyone has been impacted by the SaaS slowdown equally. In fact, AI-native SaaS and vertical SaaS businesses are still performing quite well.

This is the case at an aggregate level (as shown in the chart above) as well as when drilling down into growth rates by company size. It’s no wonder that seemingly every venture fund has a vertical AI market map (see Redpoint, Bessemer, Lightspeed).

My biggest takeaway isn’t to go out and build a vertical AI agent (although you certainly could!). It’s to go-to-market as if you’re vertical even if you’re horizontal.

We’re fortunate to have so much better data available to figure out exactly who’s in our ideal customer profile (ICP) at an account and customer level. And we can go far deeper than the classic industry, geo, and company size parameters to identify good-fit customers based on their existing technology stacks, hiring signals, automated account research, and many other factors.

Then we can take an account-centric view to measuring (a) how many accounts are in our ICP, (b) where those accounts are in their buying journey with us, and (c) which activities are most effective at influencing accounts along that journey. Think ABX meets orchestration.

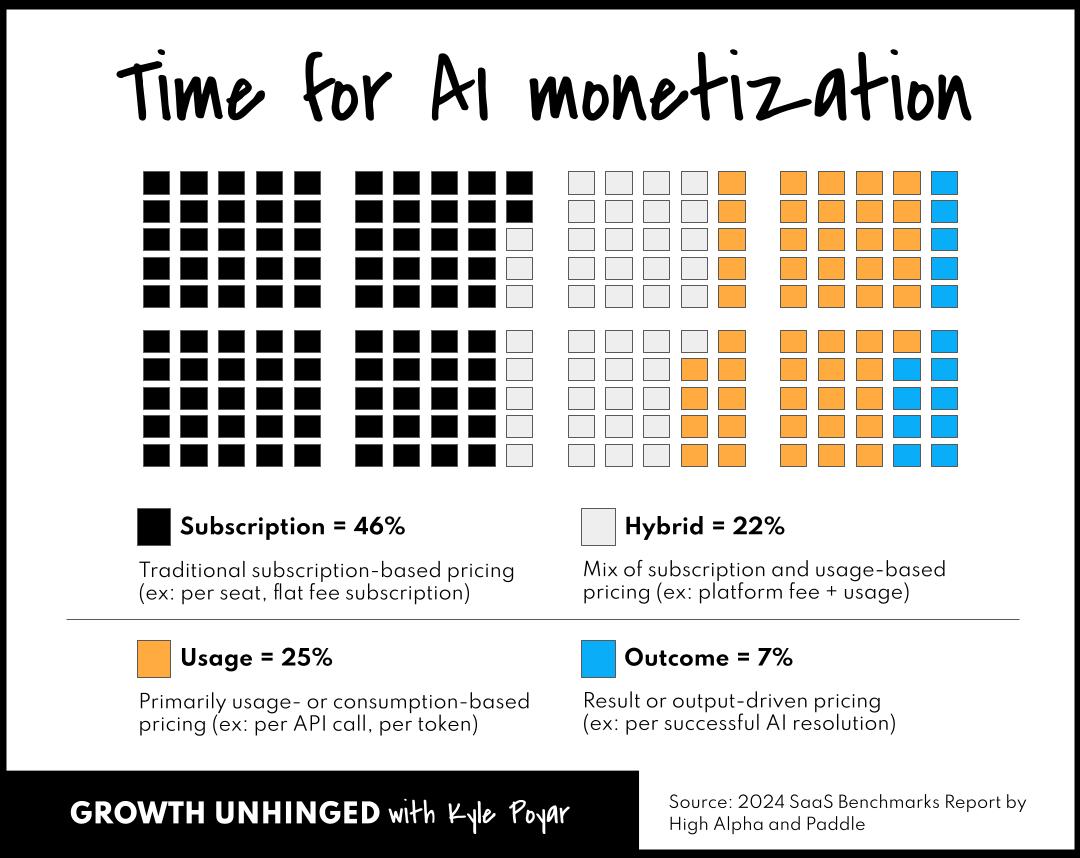

5. Time for AI monetization. Is there appetite for next-gen pricing models?

The interest in next generation pricing models has been wild. Intercom became a first-mover charging $0.99 per successful AI resolution. Salesforce recently announced it’s going all-in on Agentforce (and charging $2 per conversation).

But interest doesn’t always translate into adoption. When looking at how SaaS companies are monetizing AI products, 46% still have traditional subscription-based pricing (ex: per seat, flat fee subscriptions). This is quite high although it’s down somewhat compared to how folks monetize SaaS products — 59% of SaaS products have traditional subscription pricing. Maintaining the status quo makes sense for now considering the time, expense and change management associated with pivoting pricing models. It also makes it easier to sell AI capabilities as an “add-on” the an existing software subscription.

Meanwhile, slightly over half (54%) of AI products are monetized differently. This includes usage-based pricing (25%), hybrid pricing (22%) or shifting all the way to outcome or results-based pricing (7%). It’s worth underscoring that there are at least seven different flavors of usage or results-based pricing including pay-as-you-go (PAYG), three-part tariffs, usage-based subscriptions and adaptive flat rates. I suspect most folks will offer multiple options as they seek to balance lands, expands and tough procurement convos. (The downside: complexity!)

Related: From selling access to selling work (and what it means for you)

What else you should know

📚 To read. Check out the full 2024 SaaS benchmarks. Then continue the conversation on LinkedIn.

🎧 To listen. I joined the Run the Numbers pod by

to talk SaaS metrics in the age of AI and I spilled some ProducTea with on why we should be rethinking pipeline responsibility.📺 To watch. CityNerd. Perhaps my favorite YouTube channel? Watch it for weekly content on cities and transportation. Bonus points for the analytical bent and (extremely) dry humor.

Interesting to see the inclusion of strong retention as an agenda point in the emerging playbook. This is an area that sometimes don't get enough attention before it becomes a problem. If you're an early-stage company, it makes a lot of sense to think about this from the start and a great opportunity to shape this proactively and not only reactively.

Great article, Kyle. I really enjoyed reading it.

This was awesome, thanks Kyle!