Over the past year I’ve unpacked the zero to $1 million journeys of more than a dozen breakthrough startups including Attio, Copy.ai, lemlist and Pinecone. And I’ve advised countless others during this messy period between having a product to sell and a repeatable go-to-market machine.

Many of these startups have seen breakout growth. Copy.ai started with four MVPs, then struck gold and scaled to 10 million users in only four years. Jam went from seven failures to 10x usage growth. Pinecone saw signups explode to over 10,000 per day.

Not one of these journeys was preordained. And none followed what I’d consider to be the “conventional” startup playbook popularized over the past decade or so.

The conventional approach tends to look something like this:

Build a minimum viable product (MVP)—you should be embarrassed otherwise you’ve shipped too late.

Launch with a big PR splash—open your waitlist all at once to capitalize on the lightning strike.

Push hard on cold outbound to prove you can spend money to make money.

Write SEO-bait content for inbound leads—volume is what matters even if it is uninspired.

Get to $1M in ARR to show product-market fit (PMF) and raise your Series A.

Keep growing by hiring more reps—growth is an equation based on the number of ramped reps, quotas and average attainment.

Goal marketing on qualified leads (MQLs) to feed the army of sales reps.

Raise more money for external signaling—fundraises generate PR, close candidates and prove viability to prospects.

Each of these components makes intuitive sense. And collectively this playbook has served many startups quite well.

But the startups I’ve been spending time with lately — and in particular the startups that have gotten off the ground in a post-ZIRP, AI-first environment — have followed a different path. I’ll unpack what these next generation startups did instead, which collectively looks like an emerging startup playbook. This is a work-in-progress; please chime in with your reactions in the comments or on LinkedIn.

The *emerging* startup playbook

1. Build a minimum remarkable product that stands out.

People used to tell founders that they should be embarrassed by their initial product; otherwise, they’ve shipped too late.

That was fantastic advice when the predominant alternative was pen-and-paper or Excel. Now the alternative is mostly other modern software products.

It’s increasingly easy to build software and increasingly hard to distribute it. It’s especially hard to distribute a product that isn’t ready for primetime. Once you lose someone’s trust, it’s nearly impossible to win them back – let alone ask them to share your product with a friend.

Jam co-founder Dani Grant saw this first-hand. It took Jam 18 months and seven failed launches before the eighth finally worked. What changed on attempt number eight? Waiting until the product was bulletproof.

“People say if you're not embarrassed by your v1, you've shipped too late. People told us to ‘just ship’ because you’ll know you have PMF when people are even willing to use a broken product.

This is outdated advice. Today, quality is non-negotiable. We didn't ship until the product was bug-free. This made a huge difference in early usage.”

- Dani Grant, co-founder and CEO of Jam

There’s still room for minimum viable product (MVP) frameworks, it’s just that the bar for “viable” is much higher than before. There needs to be something remarkable about the initial product, which sparks interest, word-of-mouth and ongoing usage even if the product isn’t at full feature-parity yet.

2. Embrace storytelling to attract an audience.

Many startup founders stay in ‘stealth mode’ and steadily build up a waitlist until they’re ready to launch. Then the launch becomes a ‘lightning strike’ moment with as much fanfare as possible. Folks will open their waitlist all at once, work with PR to offer exclusives to top publications and drum up interest in early adopter communities like Product Hunt

Launches are energizing, catalyzing moments. But PR and big launch events can be expensive and reach the wrong audience–usually early-adopters and tire-kickers. They can easily backfire, wasting precious leads and leaving a startup scrambling when the sugar-high wears only weeks later. And many early-stage products aren’t ready for that level of overnight attention; sales and customer support aren’t appropriately sized to manage the demand, either.

An alternative would be to steadily build an audience interested in your product and to ungate the waitlist in batches. Building an audience is increasingly achievable through social media along with owned channels like newsletters. Unlike PR, these channels are person-centric rather than brand-centric; they require personality and authenticity in order to break through. Put differently, these channels reward founder storytelling to build an audience.

Adam Schoenfeld started Keyplay in March 2022 to help modern B2B companies succeed with ICP marketing. But six months before that he started with content and community to build an audience. Specifically, he published free data-rich resources for go-to-market leaders via LinkedIn, which he then converted into newsletter subscribers. This audience accelerated Keyplay’s growth by bringing signals on what to build first, instant credibility for Keyplay and a built-in distribution advantage.

“Our eight pre-launch customers came without a single outbound call or investor referral. We didn’t even have a website for Keyplay. 100% were curious community members who engaged.”

- Adam Schoenfeld, co-founder and CEO of Keyplay

Small decisions and optimizations helped Adam rapidly build an audience, growing his list from zero to 14,000 in less than 18 months without paid ad spend. He posted on LinkedIn multiple times a week with insightful, zero-click B2B content (zero-click as in readers did not need to click out of the platform in order to get value). He’d then send a B2B SaaS analysis newsletter once a week. Along the way, he provided assets for all Keyplay employees to optimize their LinkedIn profiles and amplify their collective reach.

3. Hire ops to test and grow potential channels.

Cold outbound became a part of the GTM playbook at nearly every enterprise software company. It might start with founders running their own outbound plays to find design partners. Steadily larger and larger teams would get built to turn outbound into a coin operated machine.

This was extremely effective – so much so that buyers became inundated with emails, cold calls and LinkedIn messages (and then stopped replying). The overall volume of outbound has ballooned; it’s harder and harder to make manual BDR/SDR teams economical, especially if a startup hasn’t fully honed its ideal customer profile (ICP) and messaging.

The flipside is that there’s an exploding number of potential channels to both generate and capture demand. A small subset of these include: organic social, paid social, automated outbound, AI SDRs, SEO, editorial content, lead magnets, influencer campaigns, field marketing, community marketing… the list goes on. There’s also more and better GTM technology to understand who’s in the target audience, collect signals about their buying intent and then reach them with a personalized message in an automated way.

The next generation of startups takes a rigorous approach to identifying potential channels, testing them and then scaling the handful that work best. Rows, the next generation spreadsheet company, ran 10 experiments across four channels in eight short weeks before scaling the channels that worked best. This requires an operational skill set usually in the form of a generalist (think: chief of staff) who is intellectually curious, analytical and fast-moving.

4. Lead with the product.

When startups wanted to supplement their lead generation beyond outbound, they’d typically turn to search engine optimization (SEO). The SEO playbook usually included creating a list of potential keywords, prioritizing the relevant ones that had the most volume and then writing lots of SEO-bait content to rank for those terms.

We’ve all stumbled across this highly generic and, frankly, unusable content. And AI is poised to create far more of it. (I sometimes wonder if the primary audience for SEO-content is now other AI bots rather than in-market buyers.)

A fresher approach is to create valuable experiences that draw people in. It comes down to leading with the product as its own marketing through lead magnets, mind-blowing videos, interactive demos or free products.

Copy.ai – the AI platform for go-to-market teams – took the approach of creating free lead magnets, inspired by HubSpot’s blog title generator and Shopify’s business name generator tools. They built more than 30 of these, which attracted a substantial number of users. Copy.ai uses AI to generate the tools themselves along with descriptions of the tools, landing pages to promote them and examples of inputs and outputs. The company has scaled from zero to 10,000,000 users in only four years.

Rows, meanwhile, captured lightning in a bottle by removing their homepage altogether. They let users immediately try the product – no signup required (users create an account later when they wish to save their progress). The project was a resounding success. Leading with the product nearly tripled Rows’ conversion rate from visitor to signup (from 11% to 27%) and quintupled the number of new activated users.

5. Strong retention and word-of-mouth = PMF.

$1 million ARR has long been a major milestone in enterprise software. Whether in fundraising conversations or popular blog posts, $1 million comes up as a near-mystical number that signals product-market fit and readiness to raise a Series A.

It’s not a terrible rule-of-thumb. The $1 million ARR milestone indicates customers are willing to pay for the product and that there’s some level of repeatability in finding, winning and serving these customers. It might have been particularly meaningful at a time when go-to-market was dominated by cold outbound plus inside sales.

But $1 million ARR was never a great indicator of product-market fit, and is even less useful today. Why? A software company could get to $1 million ARR with one big enterprise deal or with thousands of small, self-serve customers. Customer cohorts could go through numerous renewal cycles or none at all. And the use cases could be extremely consistent across customers or barely related.

The founders I’ve talked to look at retention and word-of-mouth as stronger indicators of product-market fit. These signal that customers are seeing repeatable value and that the value is so strong that they’re telling others about it.

Attio, the up-and-coming CRM, spent nearly five years building and iterating before gaining conviction that they had product-market fit. Co-founders Nick and Alex paid special attention to the ratio between daily active users (DAUs) to monthly active users (MAU). This helped Attio understand the product’s stickiness and how many people actually wanted to use it.

“If a user hates a tool, they’ll cram their usage into one short burst, whereas if they love a product, they’ll engage in small bursts throughout the day.”

- Alexander Christie, co-founder and CTO of Attio

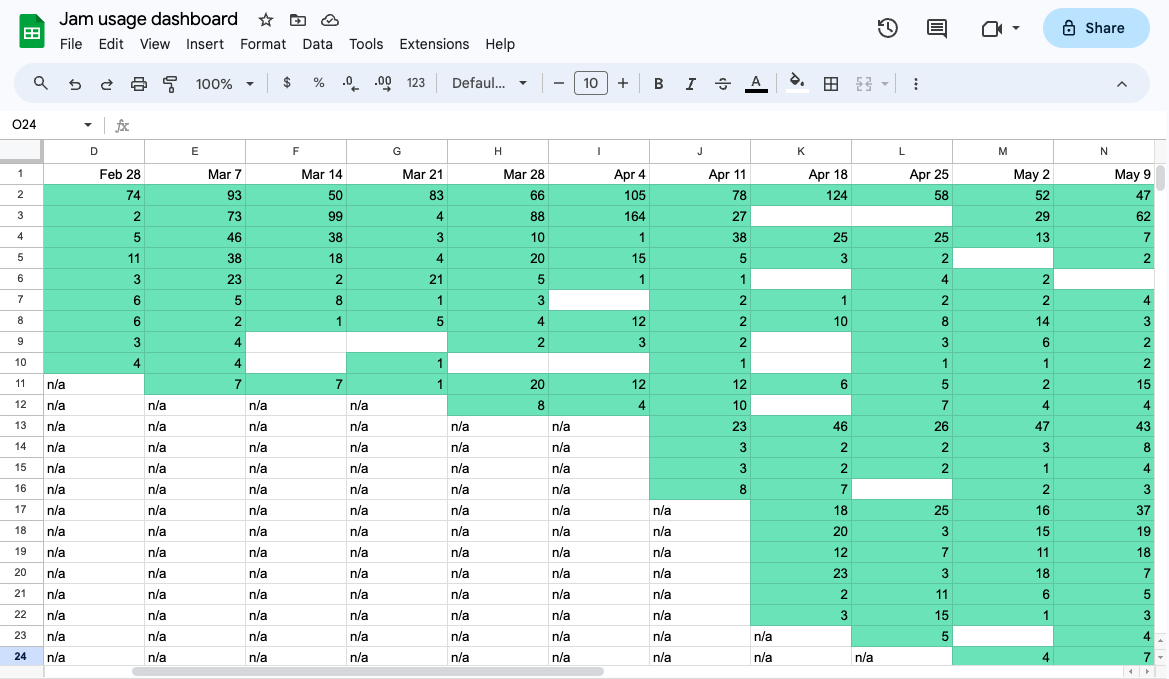

Jam, the bug reporting tool, tracked one north star metric in the early days: retention. Dani wanted to see customers continue to use Jam week after week.

“You can't fake retention. If a product is not useful, you don't retain. Our team tracked usage in a simple Google Sheet and watched for streaks week over week. Only once retention was healthy did we open up Jam to the public.

When we were 19 weeks in, two of the original five pilots had 19 week sprints. Finally, 20 weeks after the pilots and more than six months after starting work on v8, we were ready to launch.”

- Dani Grant, co-founder and CEO of Jam

6. Stay lean through automation and AI.

In a previous era, growing beyond $1 million ARR became more-or-less an equation in a spreadsheet. If you didn’t grow as fast as you hoped, it was usually because you hadn’t hired enough people quickly enough.

The spreadsheet-based approach to scaling has started to fade as go-to-market becomes more complicated and as startups embrace more efficient growth. An increasingly important metric in the minds of both founders and investors is annual recurring revenue (ARR) per full-time employee (FTE); and there’s a much higher bar for efficiency than before.

HeyGen co-founder and CEO Joshua Xu underscored this point; the company scaled quickly to a reported $35M in ARR (and profitable) with an extremely lean team. Even though HeyGen certainly has the capital to hire (they raised a $60M Series A in June 2024), Joshua told me the following:

"More people isn't always better. A lean team that can move fast is more important."

- Joshua Xu, co-founder and CEO of HeyGen

At the same time automation and AI give software companies the tools to do more with less. They might not need as many SDRs per account executive if they can automate the SDR function or replace SDRs with AI. They might not need as many marketers if they leverage AI for content creation, personalization and SEO. And there might be less reliance on account executives to sell small deals when customers might happily buy via self-service.

Paris-based CRM provider folk recently celebrated 2,000 paying customers, over 100,000 users and 5x year-on-year revenue growth – all with a lean team of 25 people. There’s only one growth person, marketer and SDR on the team. Co-founder and CEO Simo Lemhandez believes that early decisions on team structure have a big impact on a company’s future; the unit economics essentially get ingrained as a company scales. That’s influenced him to keep folk extremely lean with a high ARR per FTE.

“We try to be slightly stretched so that we either automate stuff or solve it in a product-first way rather than thinking that hiring a new person will always solve the problem. There’s a strong constraint we impose on ourselves not to hire too fast and to not consider hiring as the only solution to solving a problem.”

- Simo Lemhandez, co-founder and CEO of folk

7. Embrace a unified GTM focused on your ideal customers (ICP).

Software businesses have been stuck with a mental model where marketing generates leads (MQLs) and then sales closes them. As we tied growth to a hiring plan, marketing became responsible for feeding new sales reps with more and more MQLs.

In my view, this MQL paradigm is fundamentally broken, and not just because the very definition of a marketing qualified lead is highly subjective and arbitrary. Measuring MQLs makes it nearly impossible to know whether our efforts are influencing the right people at the right accounts. It sets up attribution fights and blame games between marketing and sales. It encourages spray-and-pray demand generation tactics — with the logic that we can disqualify or filter out anyone who’s a bad fit. And it creates a leaky lead bucket with significant wasted effort and spend.

As ClickUp COO Gaurav Agarwal told me, revenue needs to be treated like a repeatable machine. The focus should be on understanding the incrementality of what you’re doing rather than attribution.

“Revenue machines in B2B are changing very fast and are becoming more holistic than ever before. Especially in a PLG environment, there is no single revenue owner!”

- Gaurav Agarwal, COO of ClickUp

Why not focus your efforts on reaching the accounts you care about where your product works the best, you have the best chance of winning and where customers are most likely to renew and expand? And why not embrace a view that every team plays a role in generating pipeline?

If you’re ever going to find out what works, you need a unified view of go-to-market (GTM) effectiveness: (a) how many accounts are in your ICP?, (b) where are those accounts in their buying journey? and (c) which activities work best to influence accounts along that journey?

If you look at GTM effectiveness this way, it doesn't matter whether you invest more in PLG, automated outbound, SEO, paid ads, BDRs/SDRs, or something else entirely. What matters is that you reach the right people and turn them into customers.

8. Maintain capital optionality and control your destiny.

To pull off the prior startup playbook, you’d need capital – the more, the better. Large fundraises not only provided the cash to hire armies of sales reps and xDRs, they provided powerful external signaling. Fundraises attracted press attention, which then attracted candidates and signaled viability to potential prospects. There were competitive dynamics at play, too, which big fundraises effectively taking the oxygen out of the room as smart VCs anointed a category leader.

This was fantastic – until it wasn’t. As interest rates rose and the capital markets froze, many found themselves with giant preference stacks and valuations that would be impossible to grow back into.

If you’ve read this far, you’ve probably noticed the emerging startup playbook is far less reliant on outside capital. Software companies attract their own audiences, grow efficiently through automation and AI, and scale up as they’ve observed strong evidence of product-market fit.

Outside capital becomes optional and at the founder’s discretion depending on their specific ambitions and perspective on the market. Founders may choose to bootstrap (see: lemlist bootstrapping to $28M ARR) or raise right-sized rounds that provide the fuel to go after an opportunity they see in the market. Or they might choose to go big to capitalize on the opportunity in front of them (see: HeyGen raising a $60M Series A while profitable). In either case, it’s about embracing optionality and having a path back to profitability if and when desired.

The TL;DR:

Altogether, there are eight traits that I’m observing in the next batch of breakthrough software startups:

Build a minimum remarkable product that stands out

Embrace storytelling to attract an audience

Hire ops to test and grow potential channels

Lead with the product

Strong retention and word-of-mouth = PMF

Stay lean through automation and AI

Embrace a unified GTM focused on target customers

Maintain capital optionality and control your destiny

Think of these as emerging best practices rather than a how-to guide. Some may not work for your specific business; you may also find yourself creating entirely new practices that better reflect the nuances of your product, market and team.

Regardless of where you land, it’s clear that we need to move past the dated (and expensive) approach of the recent past and craft a better future.

PS - If you’re building a startup following these principles, I’d love to hear from you. Simply hit reply or connect on LinkedIn.

Special thank you to Adam Schoenfeld (Keyplay), Alexander Christie (Attio), Dani Grant (Jam), Guarav Agarwal (ClickUp), Henrique Cruz (Rows), Joshua Xu (HeyGen) and Simo Lemhandez (folk) for sharing your insights!

I feel like branding and brand story is so important right now.

Love to see WoM (word of mouth) being a clear indicator of PMF. Not a complicated and basic approach.

Fortunately, It is become essential KPI to measure in several cases and a traction engine.

A real and basic network effect example.